10 best tax practice management software for accounting firms

Here are the top rated tax practice management tools to keep your accounting firm on track.

The right tools can be the difference between a smooth tax season and an exhausting one.

Take US-based firm, BNA, for example. With the right tech stack, they’re able to deliver tax returns in three days.

But what is the right tech stack? Or at least, what should be at the core of it?

A practice management tool. A platform like Karbon that centralizes your firm’s work, client communication, internal collaboration, work templates, documents, reporting, and billing and payments. This tool will ensure you have visibility over your tax season so you can focus on managing your firm’s production flow and delivering exceptional client service.

Here are some tips for choosing the right tax practice management software, followed by ten of the best solutions that are designed to help your firm.

What is tax practice management software?

Tax practice management software is used by tax accountants to manage and streamline each part of their firm’s operations, including features like client communication, internal collaboration, document management, workflow management, reporting, billing and payments, and insights.

The best tax practice management tools work within the context of your entire firm, giving you visibility over your team’s workflow and confidence in meeting deadlines.

Choosing the right tax management software

Two key factors should guide your decision to bring on a new tax practice management tool:

Your firm’s size. Small, mid-sized, and large firms have distinct needs. Smaller firms will likely prioritize affordability and ease of use, while larger firms need things like scalability, advanced reporting, and integration capabilities.

Your growth stage. Consider where your firm is in its growth journey. Startups might focus on core tax functionality, while established firms might need comprehensive practice management tools for increased efficiency.

But regardless of your size and growth stage, there are a few features of great tax management software that you shouldn’t compromise on:

Control of all systems and processes. A tax practice management tool should feel like your firm’s ultimate command center and provide control over data, workflows, and communication.

Document management hub. This hub should include document storage and security, allowing for easy categorization, retrieval, and collaboration on all important documents.

Standardizing processes with templates. Your tax practice management tool should enable you to create and apply templates for common tax processes to reduce repetitive work, automate and standardize your firm’s procedures, and reduce the client chase.

Individual task delegation and tracking. It should be easy to assign tasks to team members, giving you complete transparency into what’s on your team members’ plates and what’s expected of them. Tax tools should allow you to delegate individual tasks, set deadlines, and track progress.

Activity timeline. Software with activity timelines streamline and simplify project management. With a chronological overview of all tasks and interactions related to a particular tax project or client, it keeps everyone on the same page and helps you maintain a clear audit trail.

Time and resource estimates. Tax software should support the creation of detailed estimates to help you track time, manage resources, understand profitability, and accurately price your services.

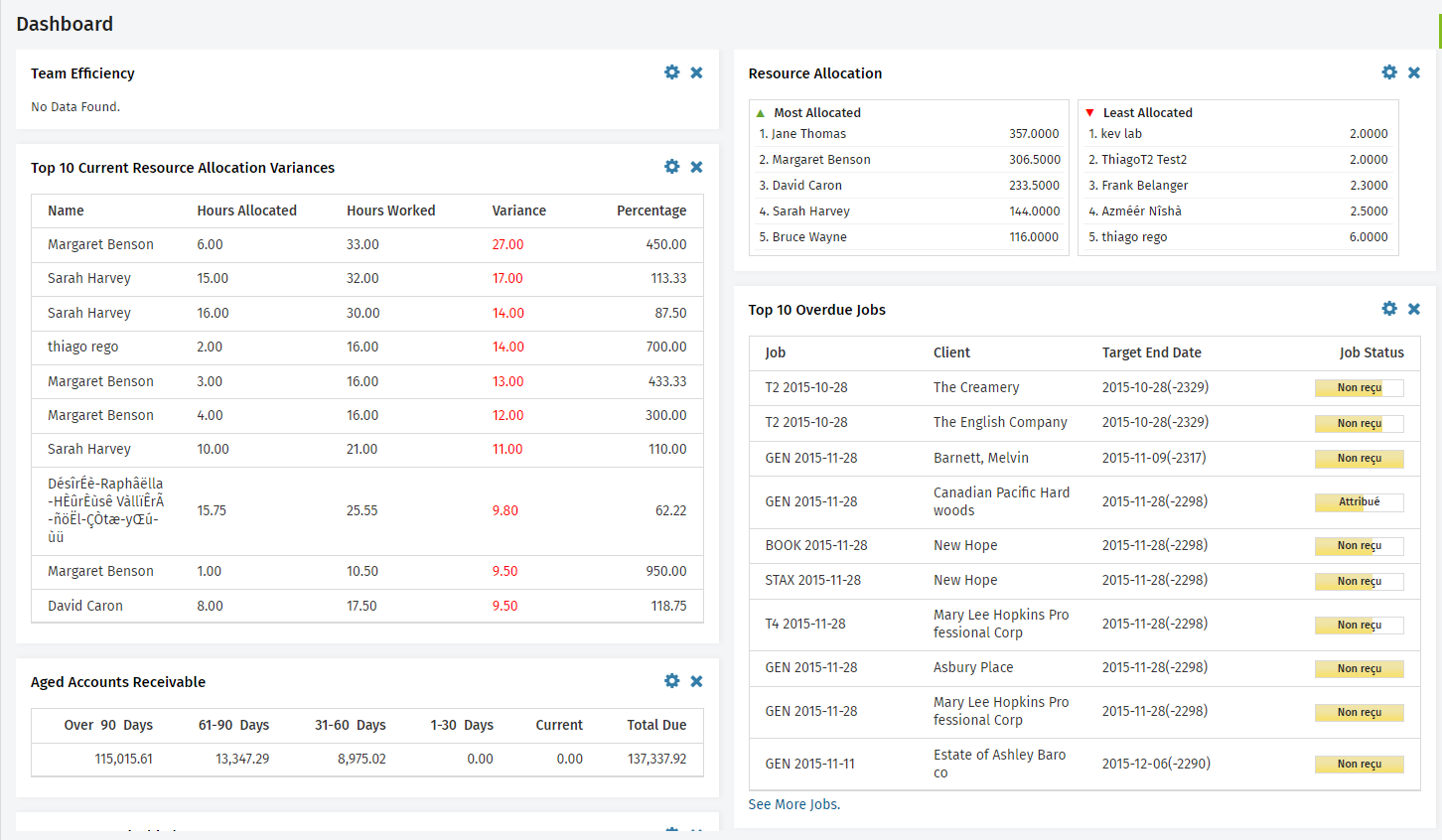

Big picture visibility. To achieve practice excellence, you need a bird's-eye view of your firm's operations and profitability. Look for software with comprehensive dashboards and reports that allow you to monitor progress, identify bottlenecks, and make informed decisions.

Curious to learn how your team’s practice stacks up against other firms? Take Karbon’s Practice Excellence Assessment, see opportunities for improvement, and receive a tailored list of resources to help your firm grow.

10 best tax practice management software solutions

1. Karbon

Karbon is the #1 ranked practice management platform for accounting and bookkeeping firms. It’s the category leader on G2 and features prominently among Deloitte Technology’s 500 Fastest Companies.

Karbon offers integrated tax management tools, enabling intuitive communication and seamless accounting workflows so you have insights into everything—who is doing what, when, why, and how.

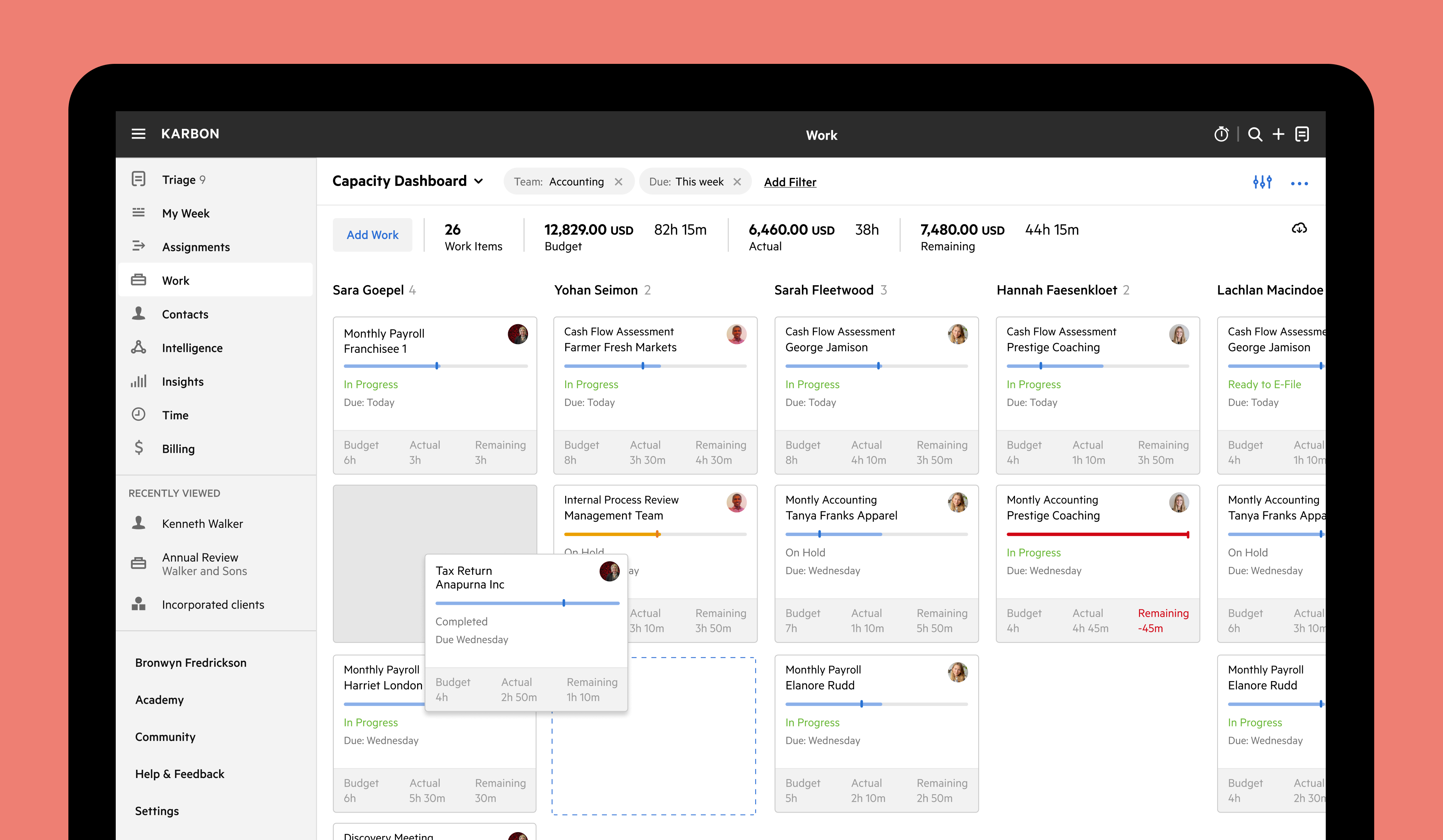

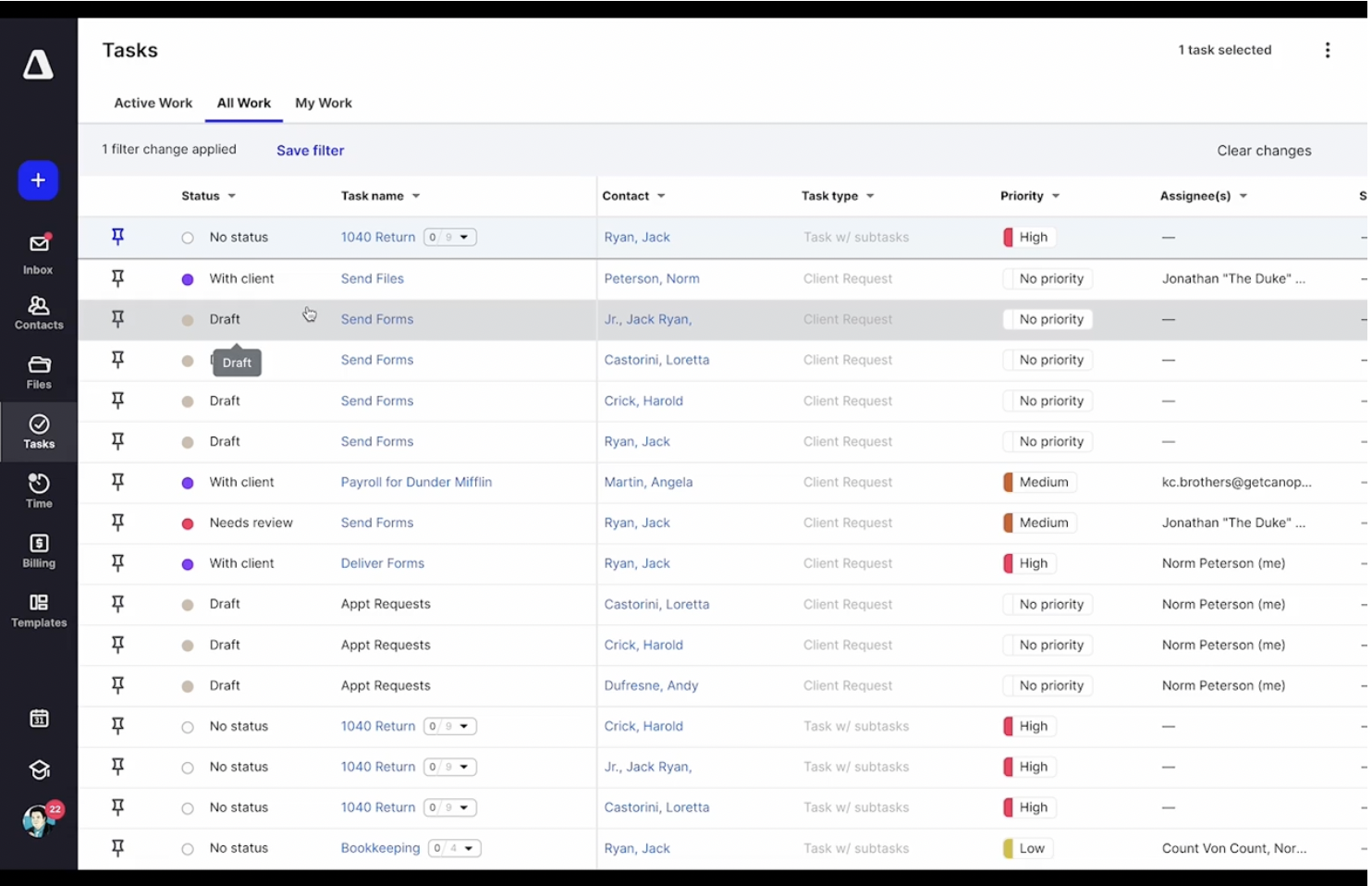

A capacity dashboard view in Karbon using the Kanban view functionality

Key features

Accounting task management and tracking for individuals and teams

Template library with 250+ workflow and tax management templates

Cloud-based document management

Project management and workflow automation

Activity timeline views

Time, budget and resource tracking (including timesheets)

Direct email integration (Gmail, Microsoft Outlook and Microsoft Exchange)

Built-in CRM

Automatic client reminders and client tasks

In-context collaboration with @mentions and notifications

Secure GPT-powered Karbon AI

Real-time integrations that make sense for you (i.e. other leading accounting software, including QuickBooks Online Accountant and Xero Practice Manager), plus an open API so you can build your own custom integrations

Practice intelligence for improving performance across the board

Ratings

Reviews

“Karbon has all that I need as a firm owner… I am assured that nothing falls through the cracks. I don't have to remember all the deadlines for filing tax-related responsibilities because I can see everything.”

— G2 reviewer

“Karbon allows me to set up templates for workflows across individual tax returns, business tax returns, quarterly tax reports, and more. [It] contains all the steps that I need to accomplish the project and mark the status of each step.”

— Chester R, G2 reviewer

Pros

Constant innovation and frequent product releases

Easily customizable to match your practice’s workflow

Open API so you can integrate apps, build custom solutions, and optimize workflows

CRM capabilities track your firm’s relationship with every client and deliver the service you promise

It’s the only accounting practice management tool where you can @mention colleagues and comment on emails, turn emails into tasks, and assign them to colleagues, clients, and jobs

Karbon Practice Intelligence guides critical firm decisions and improves efficiency

Built by a team of passionate industry experts

Engaged user community with 3,000+ members

Offers a free trial

Cons

May require more time for set up and onboarding because it is a robust solution

Functionality is geared toward teams, so may not be suitable for teams of one or two

What kinds of firms use Karbon?

Though ideal for medium-sized firms, Karbon can also suit firms ranging from 2-250+ employees. Karbon blends deep functionality with an intuitive interface for clarity, communication, and insight.

Pricing

Karbon has three pricing plans: Team, Business, and Enterprise.

Paid annually:

Team: $59 USD/month per user

Business: $89 USD/month per user

Enterprise: Custom pricing

Paid monthly:

Team: $79 USD/month per user

Business: $109 USD/month per user

Enterprise: Custom pricing

Book a free demo to learn more about Karbon and how it can help you scale your tax services.

2. Drake Tax

Drake Tax is a tax solution that specializes in helping accounting professionals analyze multiple tax years, estimate refund amounts, and create password-protected PDFs for returns. It’s a helpful tax tool—but keep in mind that it doesn't offer many holistic practice management features.

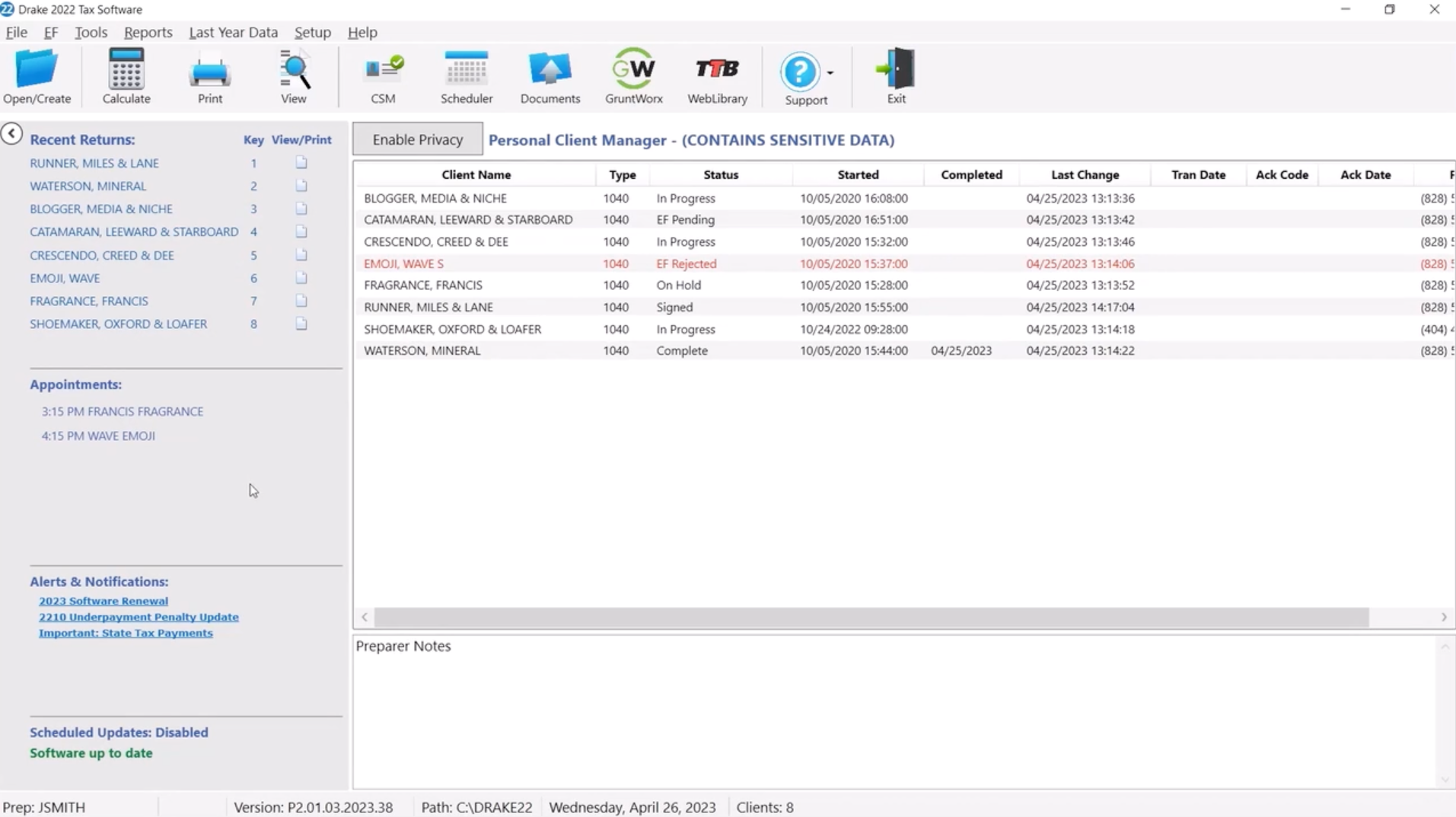

Drake Tax home screen dashboard

Key features

Payroll module with direct deposit, e-filing quarterly, and employment tax forms

Tax planner with year-to-year tax comparisons and scenario comparisons

Auto-calculations with notes and messages

Quick tax estimator

Document portals

Ratings

Reviews

“Drake is very straightforward compared to other tax softwares I have used. The best part is that if I ever have an issue or question their customer service responds right away!”

— Emily P, Capterra reviewer

“Drake Tax is very affordable tax software which is ideal for the small tax firms. The software is very robust and pretty straightforward to use.”

— JaCoby M, G2 reviewer

Pros

Integrates with TheTaxBook

Users frequently report good customer service

Clear and simple pricing

Offers a free trial

Cons

Lacks educational resources

Cloud access is not standard and comes with an additional cost

No holistic project management features

What kinds of firms use Drake Tax?

Drake Tax is used by small- to medium-sized businesses that are primarily looking to file their returns. Because the system doesn’t excel in handling more complex partnership rules and nuanced returns, it won’t be ideal for growing and enterprise-sized firms.

Pricing

Drake Tax offers 3 different pricing packages:

1040 plan: $1,695 USD one-time payment

Pro plan: $2,095 USD one-time payment

Pay-per-return: $355 USD each

Plus ($99 USD/month per user) for cloud access.

If you’re a firm that handles even a moderate amount of tax returns, you’ll find that their one-time payment plans give you much more value for your money.

3. Taxfiler

Taxfiler is a cloud-based tax solution that helps accountants with preparing accounts, filing tax returns, and meeting compliance norms. It was acquired by IRIS in 2018 and for new customers, it can be purchased only as part of IRIS Elements Tax. Its primary market is based in the UK.

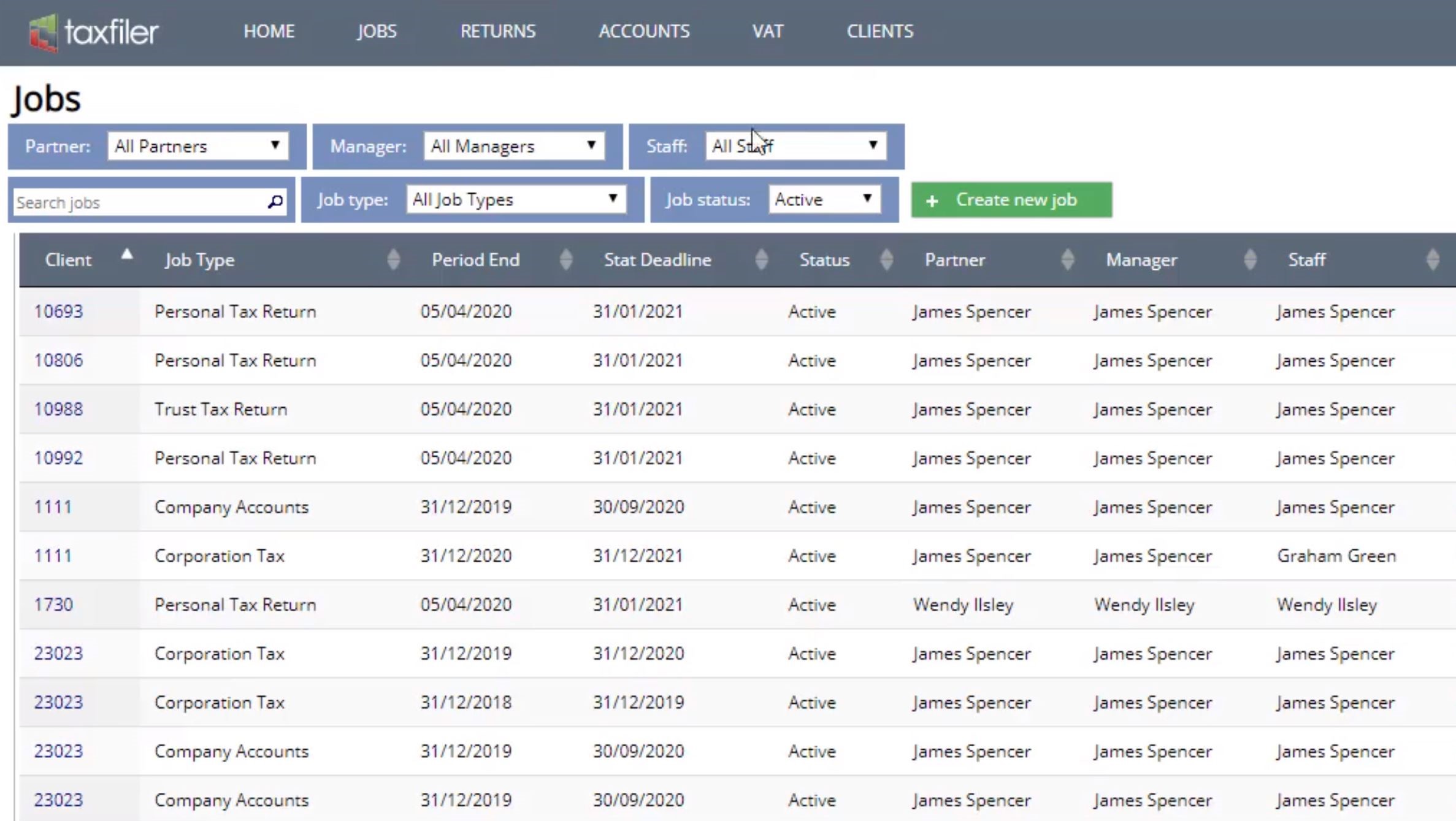

Jobs view in Taxfiler

Key features

Personal tax tool with built-in calculators to help with capital allowances, chargeable gains, and averaging

Accounts preparation for trial balance tax stage

Corporate tax

Partnership tax

Trust and estate tax

Ratings

4.5 stars on G2 (from 2 reviews)

4.8 stars on Capterra (from 5 reviews)

Reviews

“This software is brilliant for producing the vast majority of our accounts and tax returns and is very good value for money. Would like to see some more functionality added in the near future.”

— Sam L, Capterra reviewer

“Perfect software for small accounting practices, very good integrations with cloud bookkeeping software. [The format] won't suit larger businesses… but for micro businesses, it's perfectly suitable.”

— Rob L, G2 reviewer

Pros

Offers supplementary tax forms including participator loans, group relief, and charities

Cloud-based

Integrates with QuickBooks Online, Sage, and Xero FreeAgent

Simple, monthly pricing with no contracts

Cons

Must upgrade to IRIS Elements for additional features

It’s a stand-alone tool that doesn’t work within the context of your firm

Does not offer a free trial

What kinds of firms use Taxfiler?

Taxfiler is used by small firms that need basic functionality and value the IRIS Elements suite of products. Their pricing plan dramatically increases for larger firms and doesn’t offer tools for scale, making it a less viable option for enterprise teams.

Pricing

Taxfiler offers 4 pricing plans:

Start-up: £11/month (single-user and 10 clients maximum)

Solo: £24/month (single-user and 30 clients maximum)

Pro: £36/month per user (unlimited clients)

Team: £236/month (10 users and unlimited clients)

As part of IRIS Elements Tax, when you sign a 12 month contract, pricing is:

Tax Essentials: £9/month for up to 10 clients (increasing as you add more clients, capped at 100 clients), plus £10/month per user

Tax Professional: £55/month for up to 10 clients (increasing as you add more clients, capped at 100 clients), plus £10/month per user.

4. Financial Cents

Started in 2020, Financial Cents is a practice management solution for accounting firms, designed for small to mid-sized accounting firms.

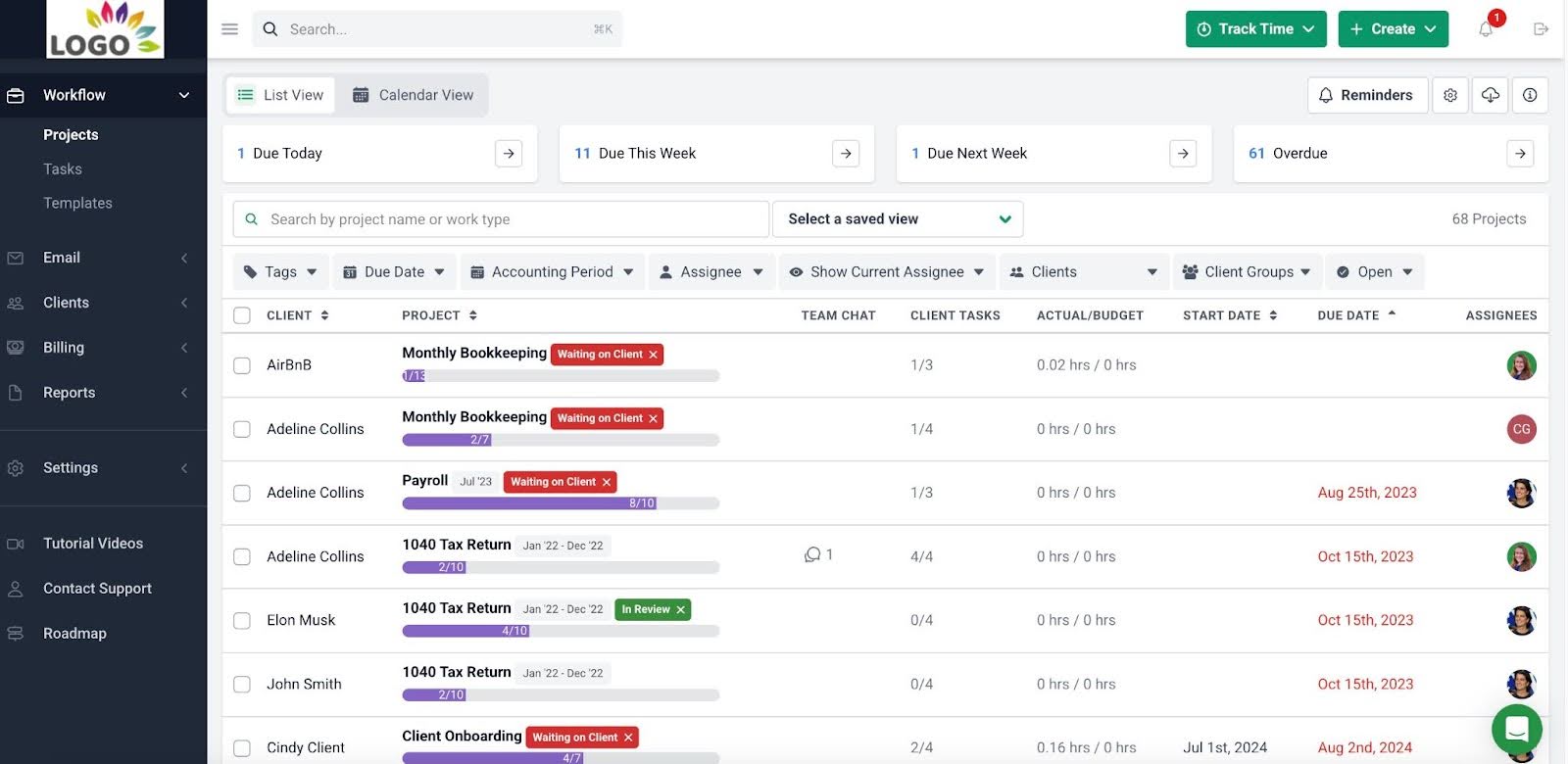

Financial Cents work dashboard view

Key features

Email integration

Workflow management

Time tracking and invoicing (through QuickBooks Online integration only)

Client management

Client requests and auto reminders

Capacity management

Client portal

Ratings

Reviews

“Financial Cents has allowed me to be more efficient, bill more accurately, and let go of wasted time chasing clients for information.”

— Jaclyn D, G2 reviewer

“It is straightforward and easy to use, with really helpful training videos and excellent customer service. There are small niggles…however I'm sure these will be addressed in time.”

— Helen H, Capterra reviewer

Pros

Quick to implement (however this might be a drawback for some firms looking for a more powerful solution)

Integrations with Quickbooks Online, Gmail, and Microsoft Outlook

Affordable pricing

Offers a 14-day free trial

Cons

Limited workflow automation for complex clients and projects

No First-in First-out queues to manage tax work production

No Kanban board work dashboards

Lacks deep and customizable reporting, insights, and business intelligence analysis capabilities

What kinds of firms use Financial Cents?

Financial Cents is best suited for small firms that are just getting started with tax management. Scaling firms will eventually outpace its functionality.

Pricing

Financial Cents has three pricing plans that can be billed either monthly or annually. The following are based on the monthly pricing plan:

Solo: $19 USD/month, per user

Team: $49 USD/month, per user

Scale: $69 USD/month, per user

With the Scale plan, firms receive additional add-on features like auto-follow-ups for client tasks, integrations with Zapier, and an open API.

Financial Cents also offers a free 14-day trial for all three plans.

Compare Karbon vs. Financial Cents.

5. Canopy

Canopy is a tax resolution tool at its core that offers client, document, billing, email, and staff management through a modular pricing plan that allows accounting firms to pick and choose which features to add on.

Keep in mind that this might mean paying more for add-ons that are core to accounting practice management.

Work and task view in Canopy

Key features

Task and project management

Client tasks and auto-reminders

Surveys for client data collection

Invoicing and payments

Time tracking

Document management

Budget planning and tracking

Basic analytics

Mobile app for both you and your clients

IRS integration

Ratings

Reviews

“We use [Canopy] for a tax law practice and it has worked great overall.”

— Catherine B, G2 reviewer

“Clients found the portals very user-friendly, and handing off work to different staff during the tax preparation process was a breeze. This was evident with our remote team, who found the dashboards ideal for managing their work in process.”

— David L, G2 reviewer

Pros

Tax resolution cases and integration with IRS (paid add-on)

Flexible document and file management functionality (paid add-on)

Time, billing and invoicing capabilities

Provides detailed overview information of each case

Offers case service assistance

Offers a free trial

Cons

Key product features are only available at additional costs (e.g. workflow management and document management)

Complicated and expensive pricing (pay per client, per add-on module, per user)

Limited workflow templates

Customized reporting is minimal

What kinds of firms use Canopy?

Canopy is best suited for tax professionals who value the Canopy tax resolution cases and integration with the IRS.

Pricing

Canopy has a modular pricing model that charges by the number of features you add on.

Their Standard and Pro pricing tiers include 250 free contacts and charges extra for these add-ons:

Document Management: starting at $40 USD/month, per user

Workflow: starting at $35 USD/month, per user

Time & Billing: starting at $25 USD/month, per user

Tax Resolution: starting at $50 USD/month, per user

Canopy also offers two other tiers for firms with fewer than four staff members:

Starter: $45 USD/month per user, plus $50 USD/month per user for their tax resolution feature.

Essentials: $45 USD/month per user, plus $50 USD/month per user for their tax resolution feature.

For a 10-user firm with 500 contacts and each of the add-ons on the Pro plan, you can expect to pay $1,085 USD/month, billed annually (plus an implementation fee).

Get a side-by-side comparison between Karbon and Canopy and find out which solution is right for your firm.

6. TaxDome

TaxDome markets itself as the ‘all-in-one platform for accounting, tax, and bookkeeping firms’. It offers a breadth of basic functionality.

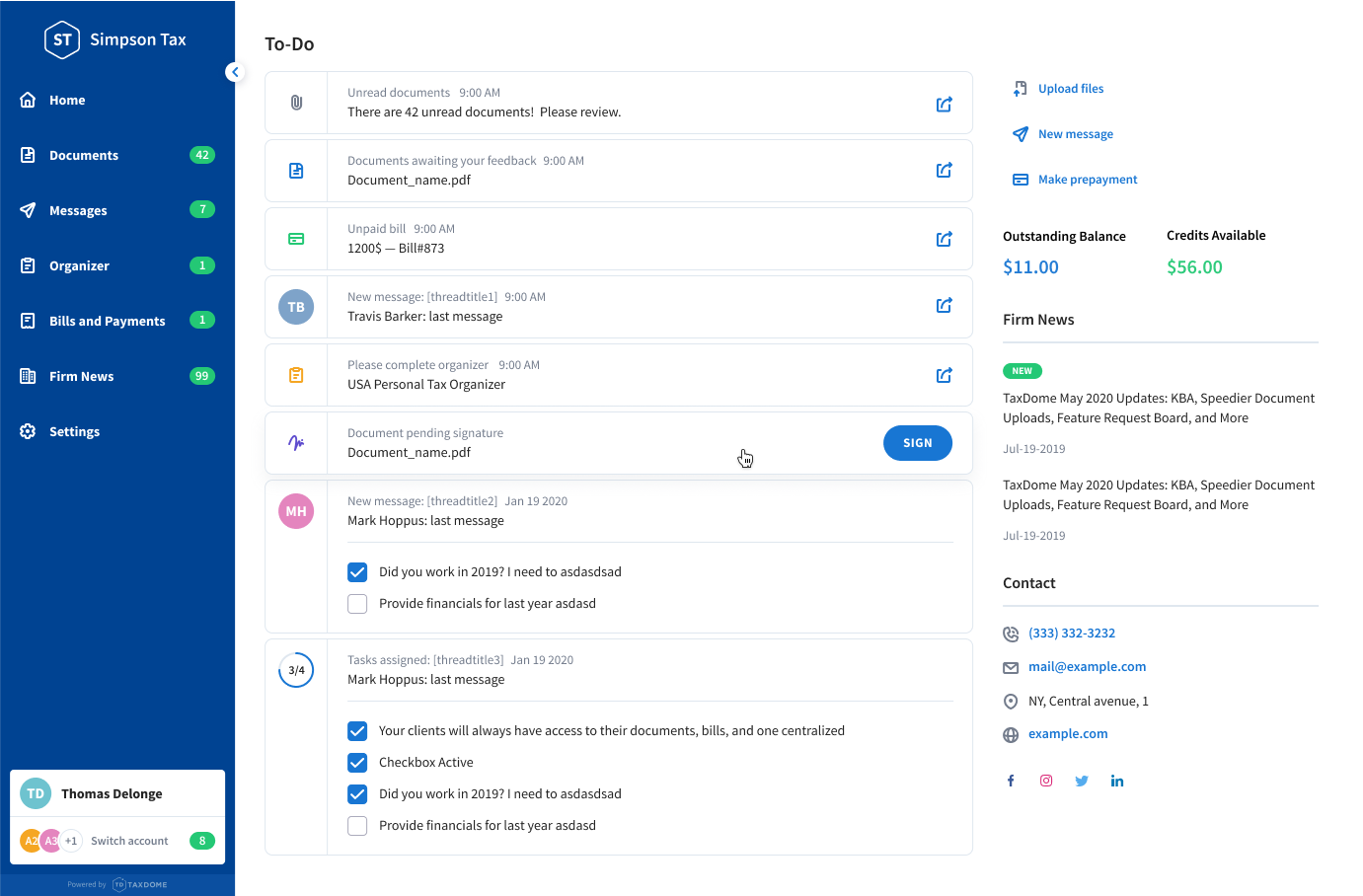

To-Do view in TaxDome

Key features

Workflow automation

CRM

Tax management

Document and financial report management

Client portal

eSignature capabilities

Invoicing and payment processing

Client-facing mobile app

Website creation service

Ratings

Reviews

“[With TaxDome]I am able to prepare so many more tax returns, as my admin time has been reduced to a bare minimum.”

— Alison G, G2 reviewer

“TaxDome has been instrumental in organizing our accounts and maintaining client information in a clean and efficient manner.”

— Margarita M, G2 reviewer

Pros

Robust and customizable client portal

Unlimited document storage with a PDF editor

Affordable pricing (however the primary user must sign up for an annual subscription)

Offers a free trial

Cons

TaxDome has a large array of features that feel generally underdeveloped, making it difficult to use them all well

No budget vs. actual reporting

No high-level visibility across your entire firm’s work (limited to each ‘pipeline’)

No built-in reporting and analytics or customizable business insights dashboards

What kinds of firms use TaxDome?

TaxDome is best suited for tax and CPA firms that are looking for functionality across a wide range of features, but don’t necessarily require much depth to each one.

Pricing

TaxDome offers three pricing tiers. Pricing depends on how many years you sign up for and payment is required upfront (only billed annually).

The pricing below is based on a one year subscription:

Solo: $800 USD/year per user

Pro: $1,000 USD/year per user

Business: $1,200 USD/year per user

For a 5-user firm on a 1-year contract on the Pro plan, the total price would be $5,000 per year.

Pricing and tiers change for those in other countries, including Australia and the UK.

Karbon vs. TaxDome: Which tax practice management solution is right for your firm?

7. Mango

Mango (formerly known as ImagineTime) is a cloud-based practice management solution that doubles as a tax management tool, and time and billing software.

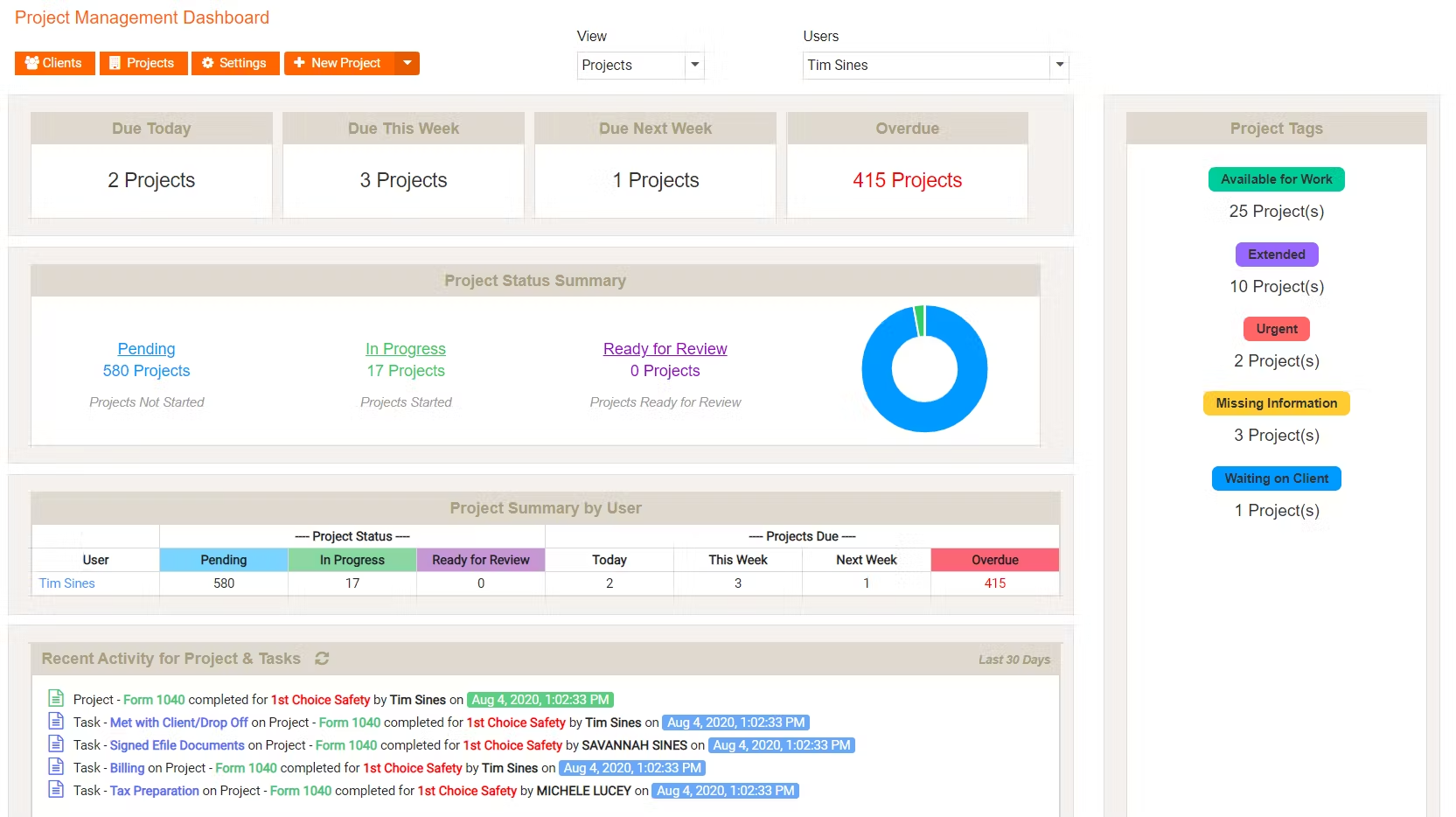

Project management dashboard in Mango

Key features

Time and expense tracking

Invoicing and reporting

Client portals

E-payments

Firm-wide scheduling

Due date management

Document management

Secure file sharing

Ratings

Reviews

“Mango Practice Management is newer in the market and provides a seamless experience with great features, like time management and good expense management.”

— Prashant M, G2 reviewer

“Overall, I feel this has been a great product for us… [It’s] very user friendly and easy to get around in.”

— Brenda R, Capterra reviewer

Pros

Offers a fully integrated payment system

Offers some practice management solutions like client portal, document management, and time and billing

Integrates with tools like QuickBooks, MailChimp, and Google Calendar

Affordable pricing for smaller firms

Cons

Some users report difficulty with integrations

Many reports of poor customer support

Does not auto-update client information through your workflow

What kinds of firms use Mango Practice Management?

Mango Practice Management is best suited for smaller accounting firms that don’t yet require robust customization features or onboarding support.

Pricing

Mango Practice Management has three simple pricing plans to serve a variety of accounting firms:

Basic: $35 USD/month per user

Plus: $55 USD/month per user

Pro: $69 USD/month per user

All plans include free implementation with import assistance, training, setup, and 200 eSignatures.

8. Jetpack Workflow

As its name suggests, Jetpack Workflow provides workflow management for accounting firms. So it’s important to note that Jetpack Workflow is not a practice management solution.

As a result, its offerings lean towards the more basic side.

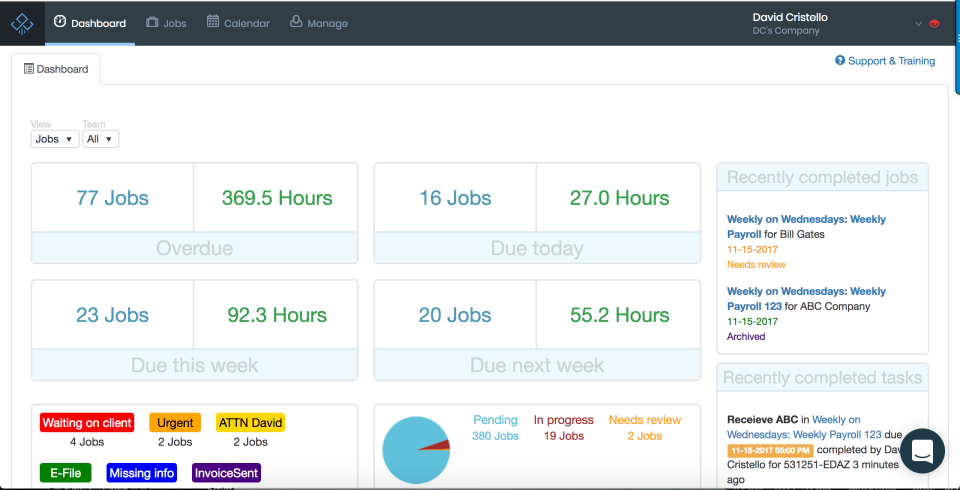

Dashboard view in Jetpack Workflow

Key features

Job and task management

Basic workflow automation

Job templates and template library

Time tracking and budgets

QuickBooks Online and Zapier integration

Work dashboard

Calendar view

Ratings

4.1 stars on G2 (from 11 reviews)

Reviews

“I love that it is flexible and customizable and easy to collaborate with a team to see what was done. [It’s a] good base product but needs to mature.”

— G2 reviewer

"Jetpack Workflow keeps track of all of my work tasks and administrative tasks in one place.”

— Mike C, Capterra reviewer

Pros

Affordable pricing for simple workflow management

Time tracking capabilities

Useful dashboard with a high-level overview of work

Cons

Limited email management capabilities, which means you have no single source of truth and will need to constantly switch between Jetpack Workflow and your inbox

Limited automation that doesn’t provide the complexity that most accounting processes require

No client portal means you’ll need to find a separate solution to securely streamline client communication and collaboration

What kinds of firms use Jetpack Workflow?

Jetpack Workflow is suited for smaller firms that want a basic solution that they don’t anticipate outgrowing.

Pricing

Jetpack workflow has two pricing plans: Organize and Scale.

The Organize plan costs $45 USD/month, per user on a monthly subscription ($36 USD/month on an annual plan).

The Scale plan costs $50 USD/month, per user on a monthly subscription ($39 USD/month on an annual contract).

Karbon or Jetpack Workflow? Get a side-by-side comparison so you can decide which is better for your firm.

9. OfficeTools

OfficeTools was originally built in the old era of server-based practice management technology.

To keep up with modern, cloud-based accounting firms, they now offer two versions of accounting practice management:

OfficeTools Cloud: Their answer to web-based technology

OfficeTools WorkSpace: Their original desktop-based software

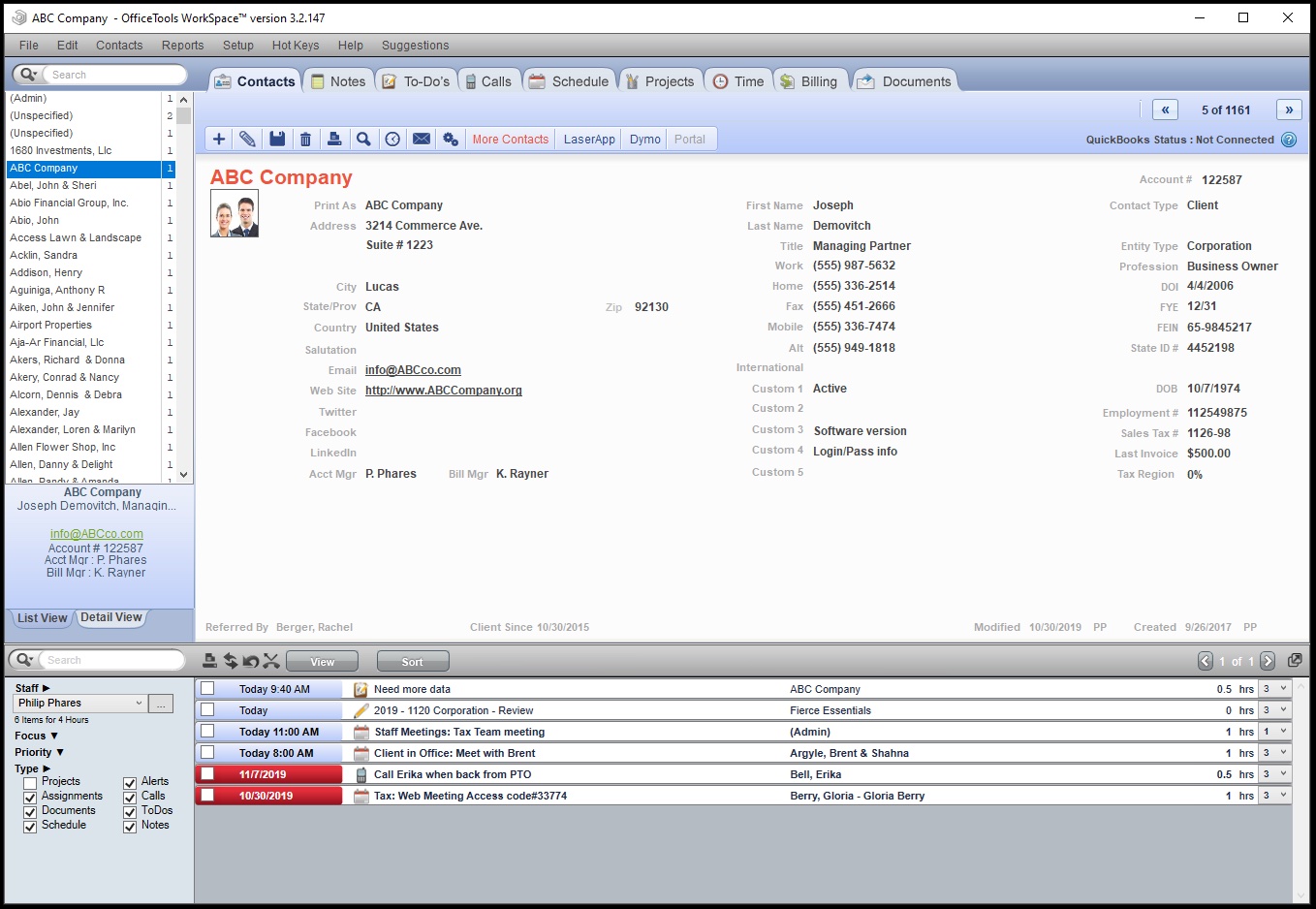

Client view in OfficeTools WorkSpace

Key features

Contact management

Workflow management

Billing and invoicing (with pre-built invoice templates)

Payments

Calendar integration

Client portal

Ratings

Reviews

“It takes care of our time and billing…but there is a lot of room for improvement.”

— G2 reviewer

“OfficeTools has all the vital functions you would expect: invoicing, billing, project management, file storage. [But it] is constantly freezing and giving error messages.”

— Capterra reviewer

Pros

The robust calendar integration means you can set your appointment availability and view calendars by department (only available in OfficeTools WorkSpace)

Flexible document and file management that organizes and tags documents

Track time, billing, invoicing, and payment collection

Intuitive client information import from Excel spreadsheets

Integration with QuickBooks and Lacerte Tax (only available in OfficeTools WorkSpace)

Cons

Long and difficult implementation process, with minimal support

Outdated and counterintuitive interface that requires workarounds to function as expected

Limited internal and external communication functionality

No customizable reporting

Setting up the customizable client portal isn’t straightforward

Users report having issues with the QuickBooks integration breaking

What kinds of firms use OfficeTools?

OfficeTools WorkSpace is primarily used by long-standing customers. Due to it being an outdated desktop software and not cloud-native, it’s rarely considered today as a solution for new customers.

OfficeTools Cloud, on the other hand, is suited for accounting firms that are willing to trade certain practice management features—like customizable reporting—for flexible document and file management capabilities.

OfficeTools pricing

OfficeTools Cloud pricing starts at $59 USD/month per user billed monthly ($49 USD annually), and OfficeTools WorkSpace requires custom pricing.

10. CCH iFirm Practice Manager (Wolters Kluwer)

CCH iFirm Practice Manager is a Wolters Kluwer product that makes up one part of a larger CCH app ecosystem.

CCH iFirm dashboard view

Key features

Time tracking and invoicing

Basic insights and reporting

Billing and payments

Workflow management

Ratings

2.5 stars on G2 (from 4 reviews)

2.8 stars on Capterra (from 4 reviews)

Reviews

“The service goes offline constantly, the support lines are jammed, and no one seems to know what to do.”

— Dean P, G2 reviewer

“We started using iFirm as one of the original users when it came out. [But] it is cumbersome to use properly.”

— Natalie, Capterra reviewer

Pros

Highly customizable dashboard with widgets

Deep integration with other CCH products, which is useful for firms within the ecosystem (however this can be seen as a drawback for firms that also want to integrate with apps outside of the ecosystem)

Cons

Limited work templates

No Kanban board view

No task dependency automators, so work statuses must be updated manually

No team collaboration tools like @mentions

Unreliable and clunky user experience

What kinds of firms use CCH iFirm Practice Manager?

CCH iFirm Practice Manager is best suited for firms that require their practice management tool to deeply integrate with the CCH ecosystem.

Pricing

CCH iFirm Practice Manager starts at $640 USD for one user (only available as an annual payment). You can add an additional single user for $165 USD per year, or a three-user bundle for a total of $385 USD.

This doesn’t include pricing for their client portal, which starts at $575 USD (annually) for a single user, and an additional $165 USD or $386 USD for a single user or a three-user bundle, respectively.

Alternatively, you can purchase both the practice management and client portal solutions together for $1,020 USD for a single user and an additional $165 USD for another user or $385 USD for a bundle of three additional users.

Each option requires an additional single payment of $124.50 USD for set up, and storage is available in 5GB increments for $32 USD as an add-on.

Comprehensive practice management for your tax firm

The #1 takeaway you should have from this guide is that tax practice management is too important to exist in isolation within your firm.

Accounting practice management software brings together client emails, tasks, key documents, performance analytics, financial milestones—every part of your firm's workflow—and unifies it with all tax-related work.

Growth-focused firms use it to power their tax practice by:

Creating a centralized repository for storing and organizing tax-related documents, including tax returns, supporting documentation, and client correspondence

Sending tax-related updates and answer client questions in unified client portals

Accurately record the time spent on tax-related tasks

Generate reports and analytics related to your tax practice

It’s exactly what Essina Business Financial Services did.

With Karbon as their practice management solution, they leveraged automation tools like auto-client reminders to keep back-and-forths across all of their client work timely, clear, and efficient.

Prior to using Karbon, the client chase was frustrating because I constantly needed to remind clients. Karbon’s automatic client tasks kick-start my projects without me needing to think about it. This means that when I am ready to start a job, I have everything I need.

Their team now saves over 2 hours each day by no longer having to chase down clients or perform manual administrative work and data entry.

You can, too.

If you’re curious how Karbon can take your tax management to the next level, book a demo or try Karbon for free today.