The 10 best accounting workflow software tools

Accounting workflow automation has the potential to completely transform how your accounting firm operates.

Get more work done with fewer (or the same) resources. This can help you navigate the current accounting labor shortage, streamline your workflows, provide a better service to your clients, and boost your firm’s profitability.

According to the 2022 Practice Excellence Report, an analysis of over 1,000 accounting firms across the globe, the highest performing firms are those that use workflow automation. These firms are working smarter, not harder and delivering high-quality work.

For example, Tabatha Morrison, owner of Canadian firm Tabworks, is doing just that. By finding and implementing the right accounting workflow software solution for her firm, she reduced her client onboarding time by 80% and now delivers work within 5 days of an initial client inquiry.

And the team at BNA, on average, are now able to complete tax returns in 3 days. Can you imagine tax season with results like that? Owners Bernie and Jason are now able to focus their time on attracting new clients, producing high-value client work, helping their small business clients, and working on their own firm’s needs (such as hiring and ensuring cash flow).

Accounting firms in need of workflow or accounting project management software are often impacted by:

Client work and tasks falling through the cracks

Missed deadlines

The inability to scale operations

Processes that are inefficient and not standardized from employee-to-employee and/or client-to-client

The inability to visualize capacity and bottlenecks

An overwhelming sense of chaos

To overcome these challenges, you need the right accounting workflow solution for your firm. Here’s what you need to know when considering your accounting workflow management software options.

Recommended reading: Accounting automation guide

What to consider when selecting an accounting workflow solution

There are two main considerations involved in selecting the right accounting workflow solution:

How does it benefit your firm overall?

How does it benefit your team members?

How accounting workflow management benefits your accounting firm

Increase visibility across capacity and work bottlenecks

Provide insights on productivity

Improve and centralize collaboration

How accounting workflow management benefits your staff

Increase efficiency and productivity, particularly across repetitive tasks

Simplify day-to-day operations

Know exactly what has to get done and when

Accounting workflow features that benefit accounting firms

Kanban board: A high-level overview of upcoming and current work so you can understand staff capacity and predict workflow bottlenecks

Centralized communication: Remove information silos and increase visibility over client and internal communication, fostering an agile team

Cloud-native: Improve employee satisfaction and widen your hiring pool by deploying a remote or hybrid work culture

Business analytics and reporting: Measure and understand productivity and profitability metrics so you can make critical and informed business decisions

Time and budget tracking: Estimate and track time to understand profitability and allocate resources

Accounting workflow features that benefit accounting firm staff

Automation: Work smarter, not harder by automating low-value administrative tasks so you can spend time producing high-quality, revenue-driving work

Templates: Standardize recurring work and never start from scratch with customizable workflow templates

App integrations: Reduce the need to double-up and cross-check several systems and expedite workflows

Accounting client portal: Collaborate with clients in one streamlined workflow using tasks and document sharing

Work scheduler: Set recurring work to automatically repeat on schedules

The best software for automating accounting workflows

Karbon

Karbon is an accounting practice management software with advanced workflow automation capabilities.

Accounting firms use Karbon to automate low-value workflow tasks so they can focus on high-value client service.

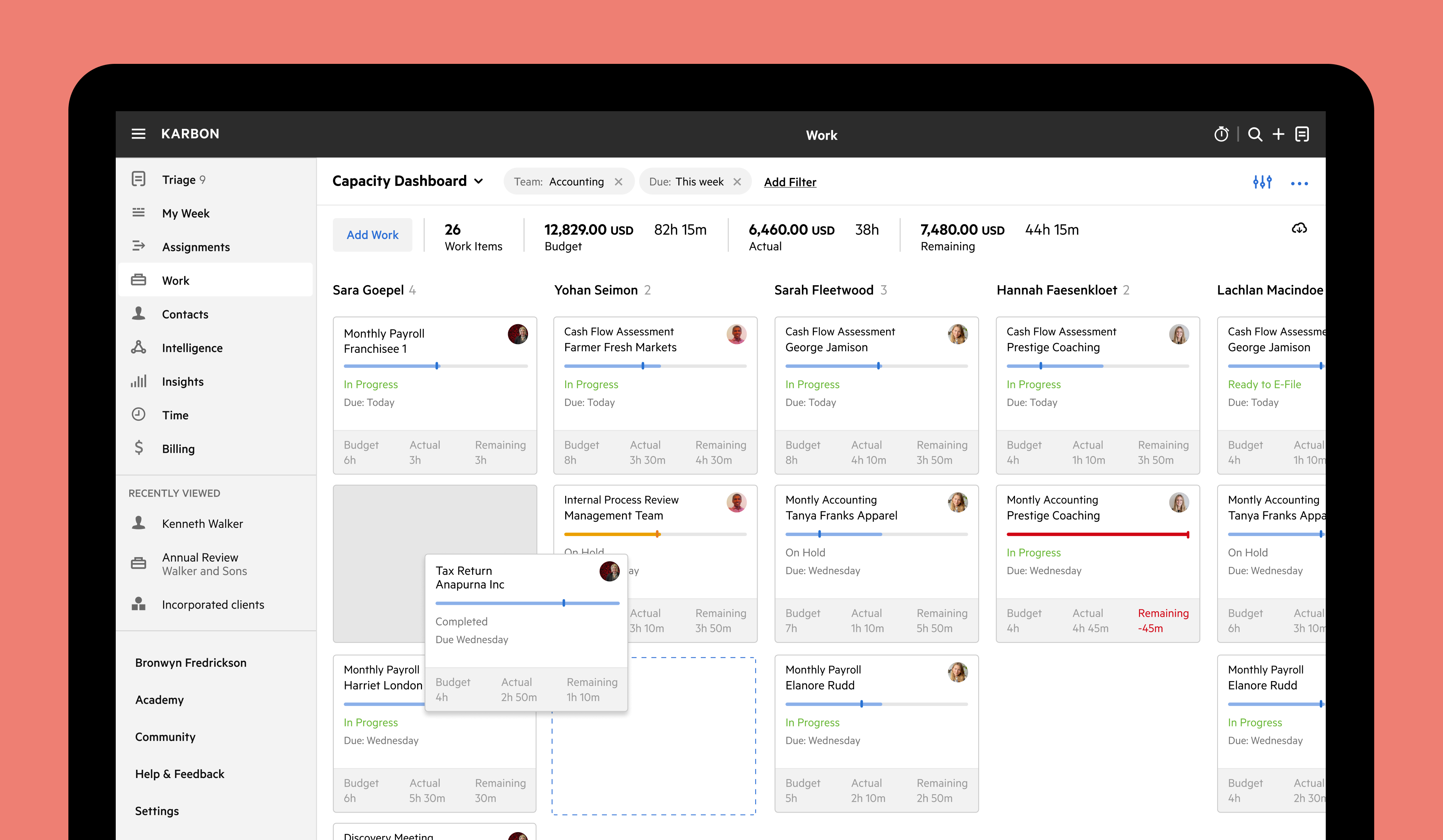

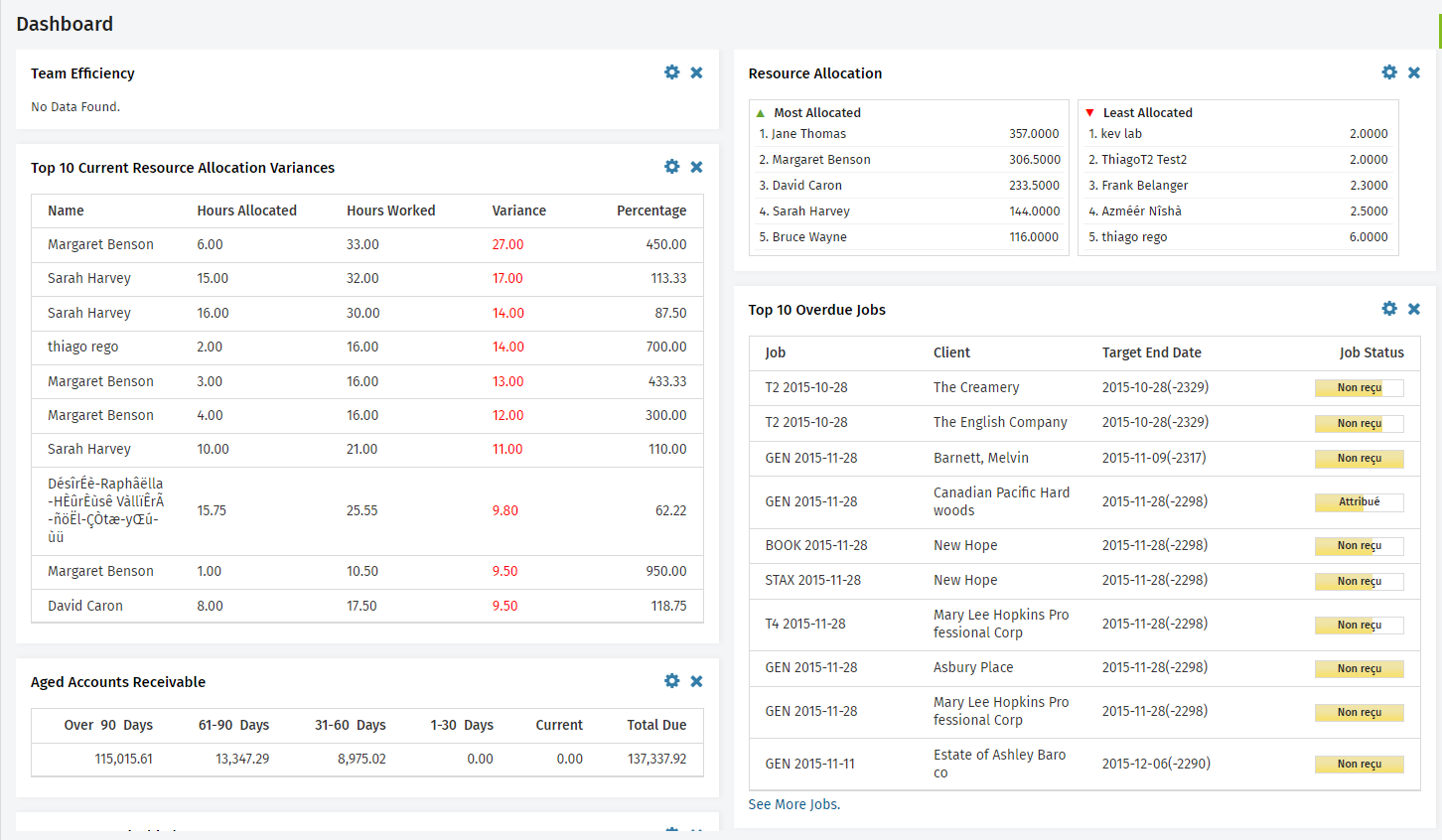

Karbon’s capacity management dashboard

Who is Karbon best suited for?

Karbon is geared towards accounting firms, CPA firms, tax professionals and bookkeeping firms with 5+ team members that need a comprehensive workflow management solution that will grow with their firm.

What do Karbon customers say?

“Karbon is so well-thought-out and robust, but still simple to use. It would take at least three different systems to replace what Karbon gives us today, if we could even do it all.”

— Jason Ackerman, BNA

Karbon pricing

Karbon has three pricing plans: Team, Business, and Enterprise.

Annually:

Team: $59 USD/month, per user

Business: $89 USD/month, per user

Enterprise: Custom pricing

Monthly:

Team: $79 USD/ month, per user

Business: $99 USD/month, per user

Enterprise: Custom pricing

Firms under 50 users can choose either a Team or Business plan and the total cost is simply the number of users multiplied by the subscription per month (paid monthly or annually).

Features

Workflow automation

Direct email integration (Gmail, Microsoft Outlook and Microsoft Exchange)

Built-in CRM

Automatic client reminders and client tasks

Collaborate in context with @mentions and notifications

Template library with 250+ accounting-specific workflow templates

Kanban board work view (sortable by due dates, status, employee capacity, and more)

Time and budget tracking (including timesheets)

Document management integration (Dropbox, OneDrive and SuiteFiles)

GPT-powered Karbon AI (currently in beta)

Engaged user community with 3,000+ members

Real-time integrations that make sense for you (i.e. other leading accounting software, including Xero Practice Manager)

Business intelligence and reporting

Reviews

Pros

The only accounting workflow solution with a true email integration that deeply embeds email into your workflow

Constant innovation and frequent product releases

Open API so you can integrate apps, build custom solutions, and optimize workflows

Work smarter, not harder with automated workflows and client reminders

Unite your team and collaborate with a single source of truth for all communication and client information

CRM capabilities allow you to track your firm’s relationship with every client and deliver the service you promise

Reveal insights to guide critical firm decisions and improve efficiency with Karbon Practice Intelligence

Built by a team of accounting professionals and those with experience in the accounting space

Highly customizable to match your practice’s workflow

By centralizing firm and client data, your client experience and client relationships are enhanced

Cons

May require more time to be set up effectively than basic alternatives, because it is a robust solution

Functionality is geared towards teams, so may not be suitable for sole practitioners or teams of 2-3 staff

Why Karbon?

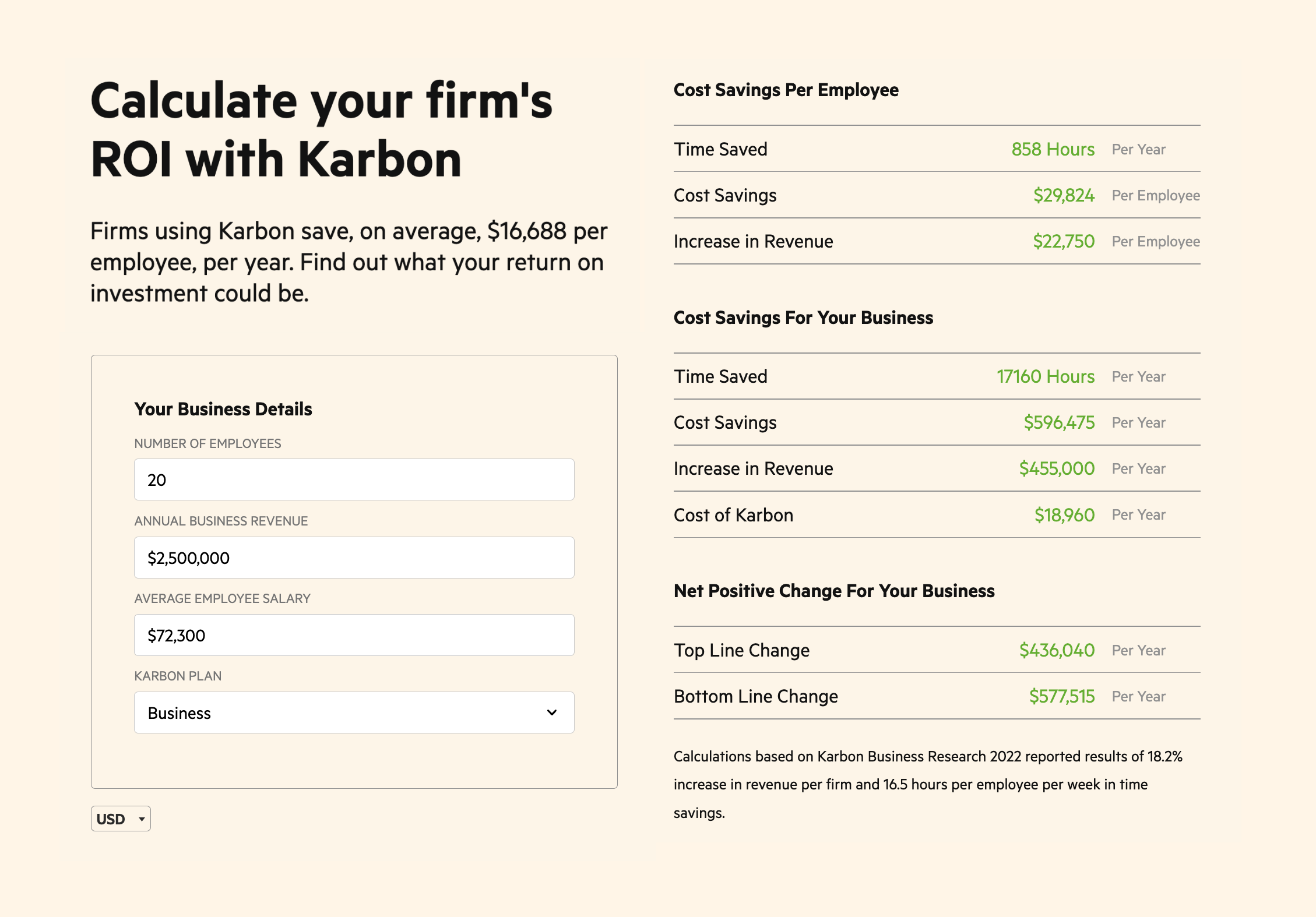

To better understand the benefits of using Karbon, you can calculate your firm’s ROI using Karbon’s ROI calculator.

For example, if your firm has 20 employees, you would:

Save 858 hours per year, per employee

Save $29,824 USD per employee

Increase revenue by $455,000 USD per year

Karbon’s ROI calculator

Learn how Karbon can give you the workflow management confidence you need. Book a demo.

Jetpack Workflow

Jetpack Workflow is a simplified automated workflow software. It focuses on delivering the most commonly requested features at a high level in a trimmed down package.

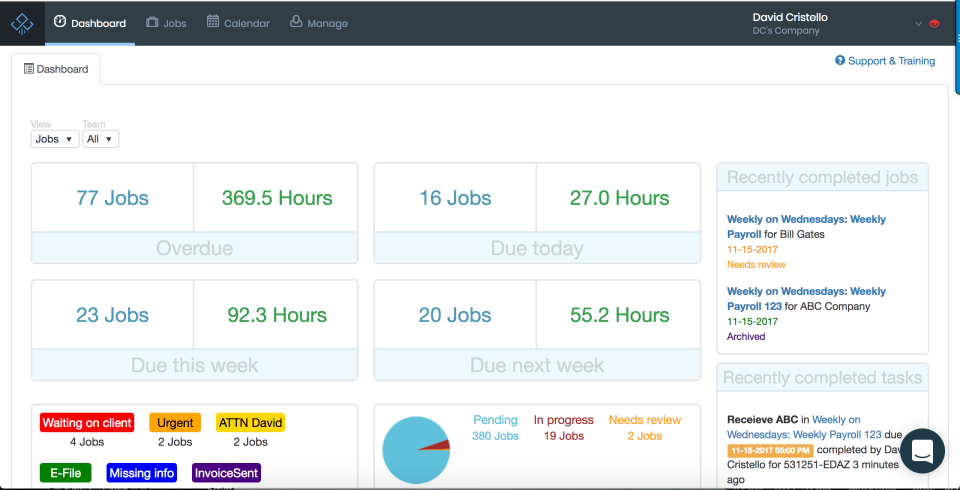

Jetpack Workflow dashboard view

Who is Jetpack Workflow best suited for?

Jetpack Workflow is best suited for small firms of no more than three staff that want a basic solution that they don’t anticipate outgrowing.

Jetpack workflow pricing

Jetpack workflow has two pricing plans: Organize and Scale.

The Organize plan costs $45 USD per month, per user on a monthly subscription ($36 USD annually).

The Scale plan costs $50 USD per month, per user on a monthly subscription ($39 USD annually).

Features

Job and task management

Basic workflow automation

Job templates and template library

Time tracking and budgets

QuickBooks Online and Zapier integration

Work dashboard

Calendar view

Reviews

Pros

Affordable pricing for simple workflow management

Time tracking capabilities

Useful dashboard with a high-level overview of work

Cons

Limited email management capabilities, which means you have no single source of truth and will need to constantly switch between Jetpack Workflow and your inbox

Limited automation that doesn’t provide the complexity that most accounting processes require

No client portal means you’ll need to find a separate solution to securely streamline client communication and collaboration

Get a side-by-side comparison between Karbon and Jetpack Workflow and find out which platform is right for your firm’s workflow needs.

Canopy

Canopy is an accounting practice management tool with workflow capabilities that started as a tax resolution tool. Canopy’s modular pricing means that accounting firms can pick and choose which features to add on.

But keep in mind that most add-on features are crucial to successfully running an accounting firm. This means you’ll likely want them all, which will end up significantly increasing how much you spend.

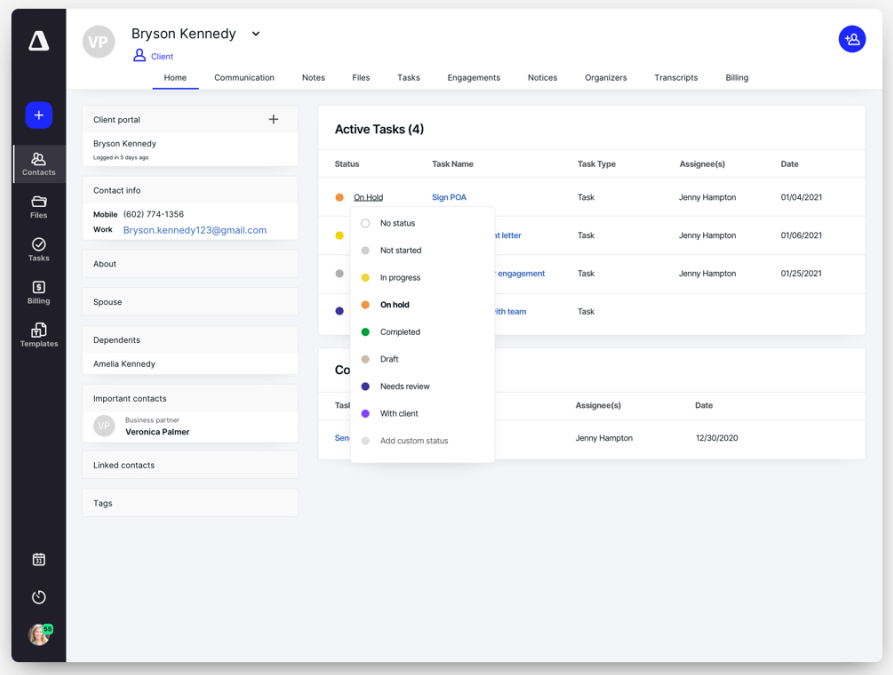

Client view in Canopy

Who is Canopy best suited for?

Canopy is best suited for accounting firms that value the Canopy tax resolution cases and integration with the IRS.

Canopy pricing

Canopy has a modular pricing model that charges by the number of features you add on.

Their Standard and Pro pricing tiers include 250 free contacts and charges extra for these add-ons:

Document Management: starting at $40 USD/month, per user

Workflow: starting at $35 USD/month, per user

Time & Billing: starting at $25 USD/month, per user

Tax Resolution: starting at $50 USD/month, per user

Canopy also offers two other tiers for firms with fewer than four staff members:

Starter:

$45 USD/month per user, plus $50 USD/month per user for their tax resolution feature.

Essentials:

$45 USD/month per user, plus $50 USD/month per user for their tax resolution feature.

Features

Integrated email inbox

Client tasks and auto-reminders

Client portal

CRM and client management

Invoicing and payments

Time tracking

Document management

Budget planning and tracking

Basic analytics

Integration with ChatGPT AI (for email creation)

Mobile app for both you and your clients

Reviews

Pros

Tax resolution cases and integration with IRS (paid add-on)

Flexible document and file management functionality (paid add-on)

Time, billing and invoicing capabilities

Comes with pre-built reports on firm efficiency, revenue, and billing

Cons

Key product features are only available at additional costs (e.g. document management)

Complicated and expensive pricing (pay per client, per add-on module, per user)

Limited workflow templates

Despite the prebuilt reports available, customized reporting is minimal

Karbon vs. Canopy: Which platform is right for your firm’s workflow needs?

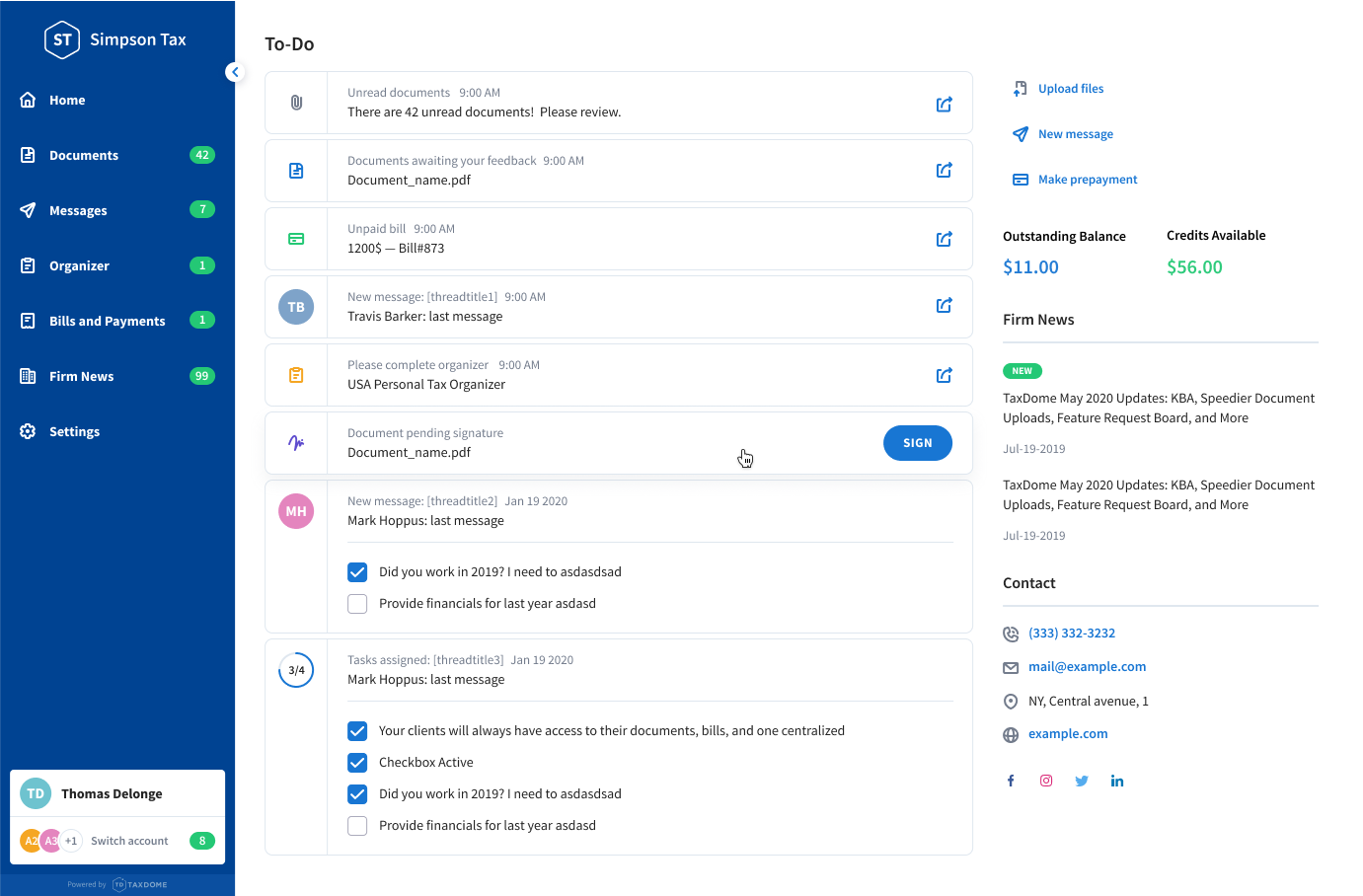

TaxDome

TaxDome markets itself as the ‘all-in-one platform for accounting, tax, and bookkeeping firms’. It offers a breadth of basic functionality.

To-Do view in TaxDome

Who is TaxDome best suited for?

TaxDome is best suited for tax firms that are looking for basic functionality across a wide range of features, but don't mind these features lacking any kind of depth or usability.

TaxDome pricing

TaxDome offers three pricing tiers. Pricing depends on how many years you sign up for and payment is required upfront (only billed annually).

The pricing below is based on a one year subscription:

Solo: $800 USD/year per user

Pro: $1,000 USD/year per user

Business: $1,200 USD/year per user

For a 5-user firm on a 1-year contract on the Pro plan, the total price would be $5,000/year.

Pricing and tiers change for those in other countries, including Australia and the UK.

Features

Workflow automation

CRM

Document management

Client portal

Client-facing mobile app

Website creation service

eSignature capabilities

Invoicing and payment processing

Reviews

Not listed on Capterra

Pros

Robust and customizable client portal

Unlimited document storage with a PDF editor

Affordable pricing (however the primary user must sign up for an annual subscription)

Cons

TaxDome has a wide variety of features, which makes it difficult to do them all well—this means a lot of functionality is underdeveloped

No budget vs. actual reporting

No high-level visibility across your entire firm’s work (limited to each ‘pipeline’)

No built-in reporting and analytics or customizable business insights dashboards

Karbon or TaxDome? Compare them to find out which tool is right for your firm’s workflow needs.

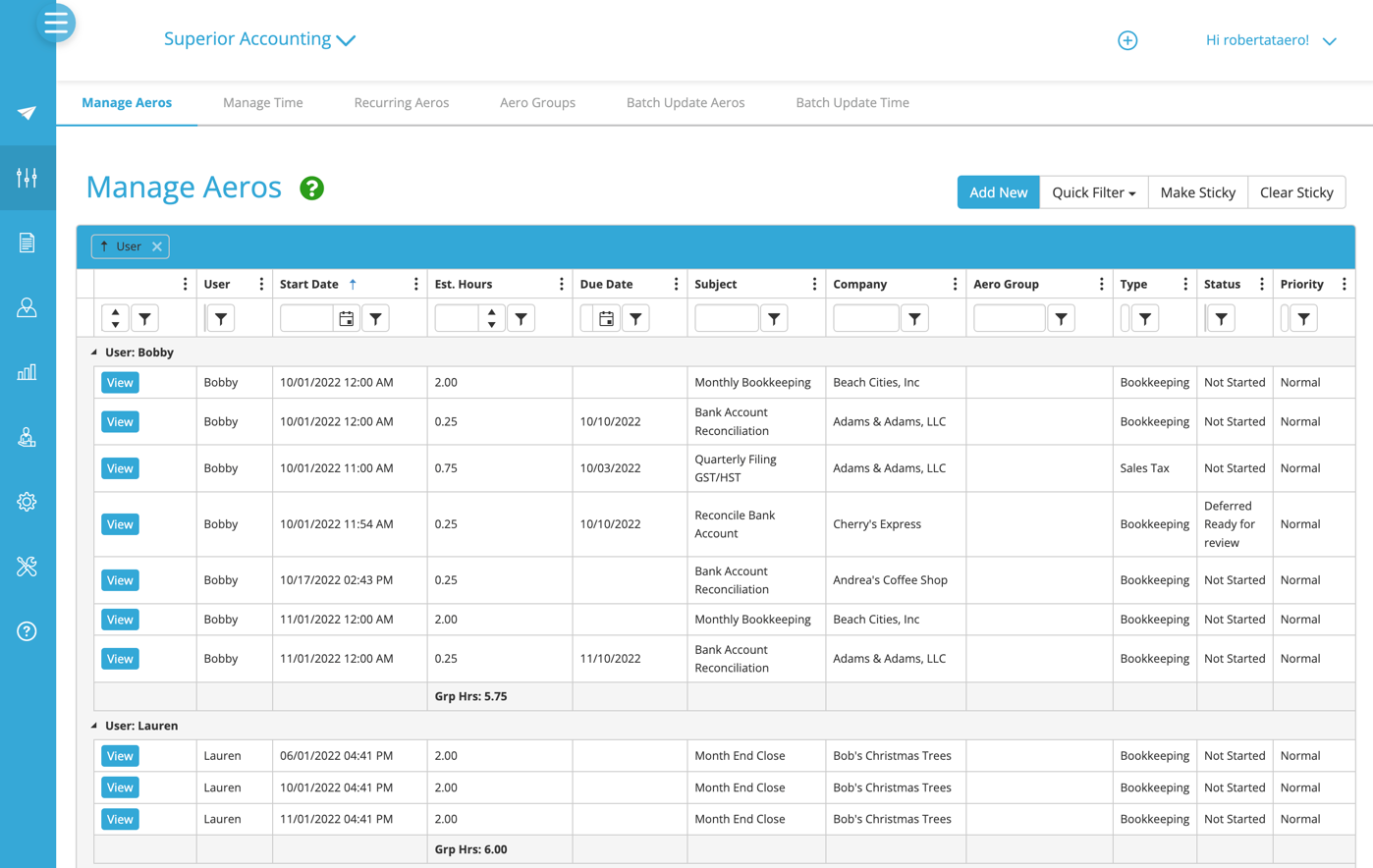

Aero Workflow

Aero Workflow is a basic accounting workflow management tool that prides itself on being ‘built for accountants, by accountants’.

Team capacity view in Aero Workflow

Who is Aero Workflow best suited for?

Aero Workflow is best suited for solo accountants looking for an accounting-specific workflow tool.

Aero Workflow pricing

Aero Workflow has four pricing tiers:

Sole proprietor: One user at $39 USD per month (billed annually)*

Small firm: 2-5 users at $79 USD per month (billed annually)*

Large firm: 6-25 users at $149 USD per month (billed annually)**

Enterprise: 25+ users with custom pricing

* Upgrade to premium subscription required to access their premium library content for $40 USD/month per user

** Upgrade to premium subscription required to access their premium library content for $80 USD/month per user

Reviews

Features

Checklist templates

Recurring work scheduler

Secure vault for client passwords

Capacity viewer

Time tracking

Basic reporting

Resource storage for standard operating procedures

Pros

Affordable solution with basic functionality for a solo accountant

Built-in ability to create, store and update standard operating procedures

Automatic timer that begins when you open a task (although that might be a downside if you’re opening a task before you’re ready to actually begin work)

Cons

Limited direct integrations with accounting apps

Clunky and unstable user experience

Counterintuitive user experience

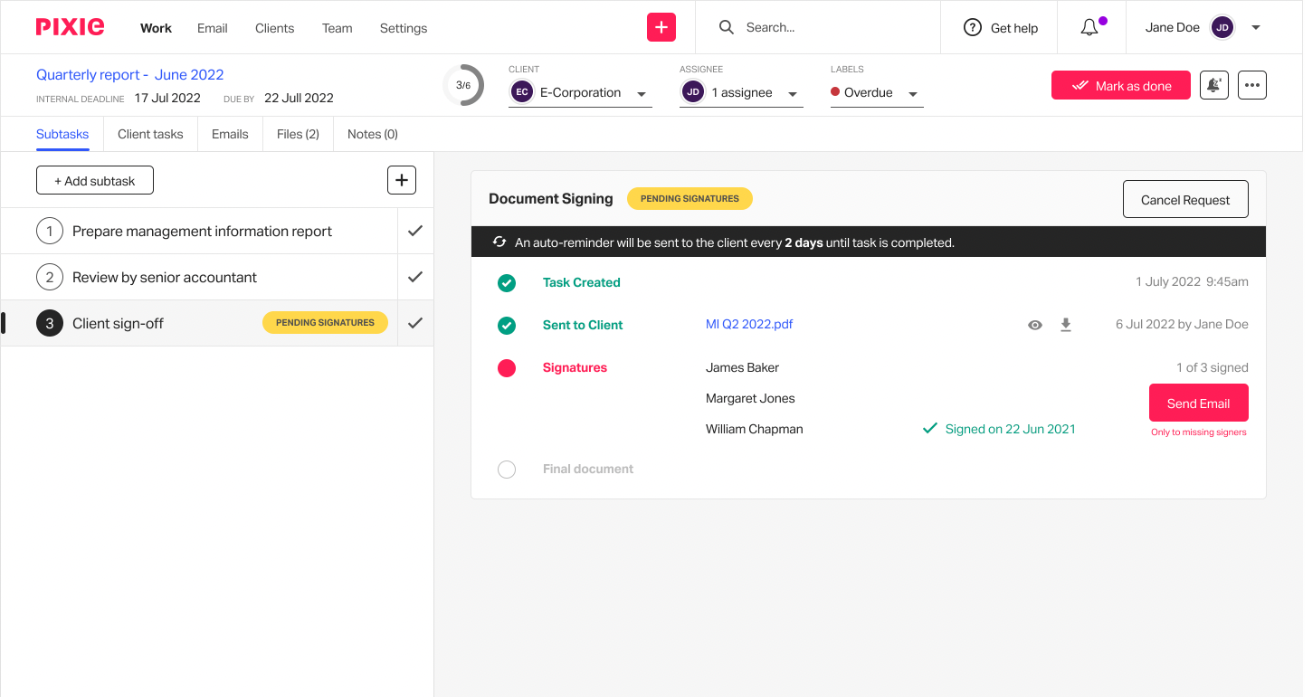

Pixie

Pixie is a practice management solution with workflow management capabilities that primarily focuses on smaller firms across the UK.

Work view in Pixie

Who is Pixie best suited for?

Pixie is a solution to consider if your firm is small (1-3 employees) and you don’t yet require robust workflow functionality that can handle complex requirements.

Pixie pricing

Pixie’s pricing is based on the number of clients you have and includes an unlimited number of users:

Less than 50 clients: $69 USD per month

51-250 clients: $129 USD per month

251-500 clients: $199 USD per month

501-750 clients: $249 USD per month

751-1,000 clients: $329 USD per month

More than 1,000 clients: Custom pricing

Features

CRM with custom fields

Workflow management

Email management

Workflow template library

eSignatures

Client reminders

Reviews

Pros

Affordable solution, especially for small firms with 1-3 employees

Flexible recurring work functionality that can be based on a client’s specific year end date

Best-practice template library

Cons

Limited collaboration functionality (unable to @mention colleagues in comments or notes, making teamwork difficult)

Limited automation

No time and budget tracking means that productivity and profitability insights are limited

No Kanban board view, which makes it difficult to get a high-level view of your firm

No ability to assign subtasks within a piece of work to different team members

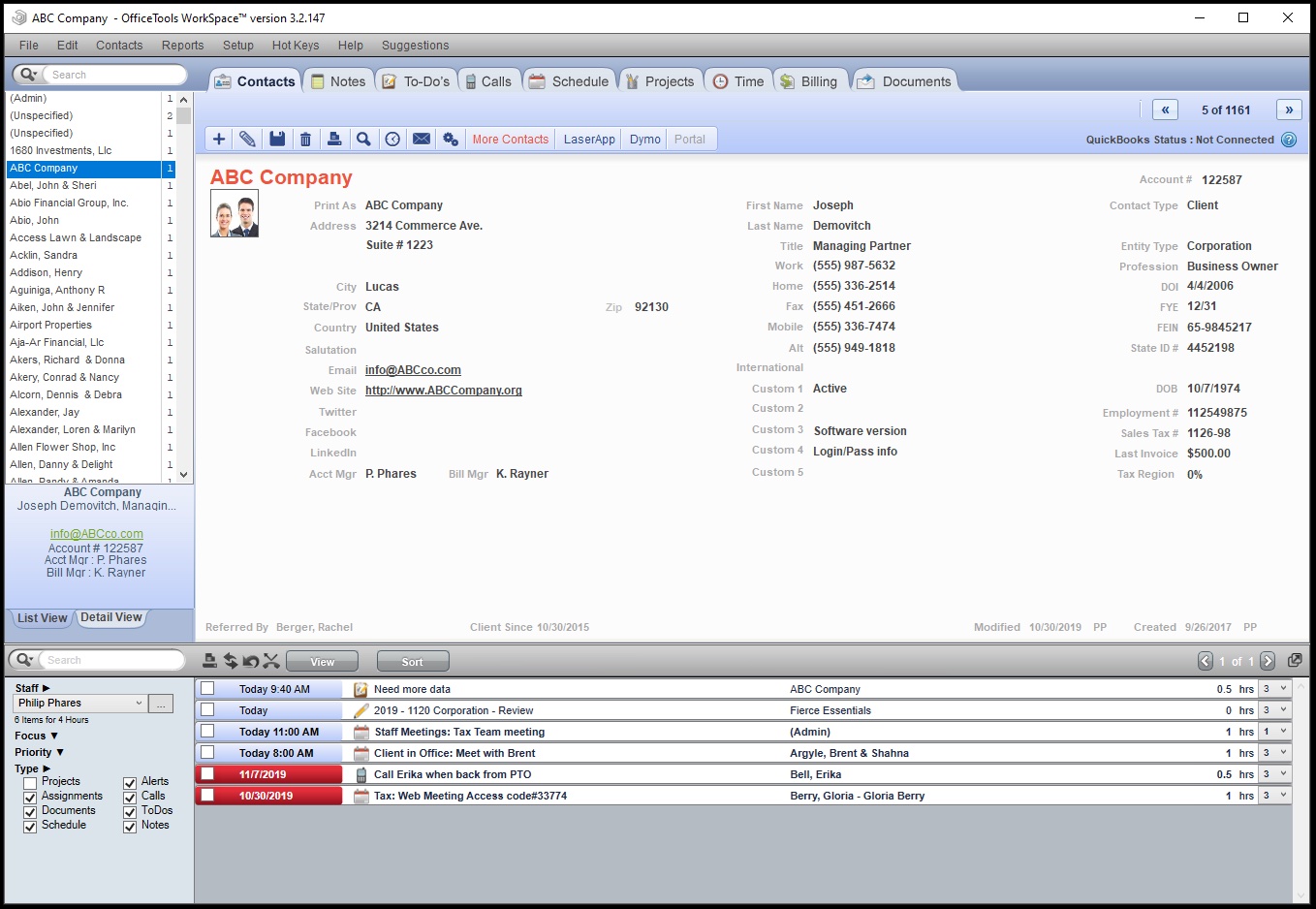

OfficeTools

OfficeTools was originally built in the old era of server-based technology.

To keep up with modern, cloud-based accounting firms, they now offer two versions of accounting practice management:

OfficeTools Cloud: Their answer to web-based technology

OfficeTools WorkSpace: Their original desktop-based software

Client view in OfficeTools WorkSpace

Who is OfficeTools best suited for?

OfficeTools WorkSpace is primarily used by long-standing customers. Due to it being outdated desktop software and not cloud-native, it is rarely considered today as a solution for new customers.

OfficeTools Cloud, on the other hand, is suited for accounting firms that are willing to trade certain workflow features—like customizable reporting—for flexible document and file management capabilities.

OfficeTools pricing

OfficeTools Cloud pricing starts at $59 USD/month per user billed monthly ($49 annually), and OfficeTools WorkSpace requires custom pricing.

Features

Contact management

Billing and invoicing (with pre-built invoice templates)

Payments

Calendar integration

Client portal

Reviews

Pros

The robust calendar integration means you can set your appointment availability and view calendars by department (only available in OfficeTools WorkSpace)

Flexible document and file management that organizes and tags documents

Track time, billing, invoicing and payment collection

Intuitive client information import from Excel spreadsheets

Integration with QuickBooks and Lacerte Tax (only available in OfficeTools WorkSpace)

Cons

Long and difficult implementation process, with minimal support

Outdated and counterintuitive interface that requires workarounds to function as expected

Limited internal and external communication functionality

No customizable reporting

Setting up the customizable client portal isn’t straightforward

Users report having issues with the QuickBooks integration breaking

CCH iFirm Practice Manager (Wolters Kluwer)

CCH iFirm Practice Manager is a Wolters Kluwer product that makes up one part of a larger CCH app ecosystem.

CCH iFirm dashboard

Who is CCH iFirm Practice Manager best suited for?

CCH iFirm Practice Manager is best suited for firms that require their workflow tool to deeply integrate with the CCH ecosystem.

CCH iFirm Practice Manager pricing

CCH iFirm Practice Manager starts at $640 USD for one user (only available as an annual payment). You can then add an additional single user for $165 USD per year, or a three-user bundle for a total of $385 USD.

This doesn’t include pricing for their client portal, which starts at $575 USD (annually) for a single user, and an additional $165 USD or $386 USD for a single user or a three-user bundle, respectively.

Alternatively, you can purchase both the practice management and client portal solutions together for $1,020 USD for a single user and an additional $165 USD for another user or $385 USD for a bundle of three additional users.

Each option requires an additional single payment of $124.50 for set up, and storage is available in 5GB increments for $32 USD as an add-on.

Features

Client portal

Time tracking and invoicing

Basic insights and reporting

Billing and payments

Reviews

Pros

Highly customizable dashboard with widgets

Deep integration with other CCH products, which is useful for firms within that ecosystem (but this can be seen as a drawback for firms that also want to integrate with apps outside of this ecosystem)

Cons

Limited work templates

No Kanban board view

No task dependency automators, so work statuses must be updated manually

No team collaboration tools like @mentions

Unreliable and clunky user experience

Poor customer reviews

ClientTrack/Clear Biz

Known as ClientTrack in Canada and Clear Biz in the US, this option is one of the original accounting practice management tools on the market. Unfortunately, it still looks and functions like it did in the early 2000s.

Client communications log in Clear Biz

Who is ClientTrack/Clear Biz best suited for?

ClientTrack/Clear Biz is best suited for smaller firms that don’t need as many communication tools from their workflow management solution.

ClientTrack/Clear Biz pricing

The ClientTrack/Clear Biz pricing is complicated.

Basic Edition: $34.96 USD/month per user

Workflow Pro Edition: $49.95 USD/month per user

Optional support packages

1-hour set up: $100 USD

6-month support: $425 USD

12-month support: $650 USD

ClientTrack pricing (Canada)

ClientTrack pricing is extremely complicated and involves separate pricing for the client portal and document e-signing. You can view the pricing here.

Features

Appointment scheduler

Automatic client reminders

Time tracking and billing

Document vault

Client portal

Reviews

Pros

30-day free trial

Advanced reporting options that can be grouped by firm, partner, manager, employee or client and then sub-grouped by tasks, projects and work codes

Cons

The outdated user interface is clunky and difficult to use

No email integration—instead, staff are required to manually log their communication with clients as additional data entry activities

The client portal is an additional cost

Complicated pricing model

Initially built for Canadian firms and hasn’t adapted to a global (or US) market

Support is an additional cost

Try Karbon for free

Now that you have a clearer understanding of the accounting workflow management tools that are available to you, you should have an idea which options best-suit your firm.

If one of those is Karbon, you can learn more and book a demo.

If you need more convincing, you can explore the Karbon Effect. It shows that Karbon firms save every employee 18.5 hours each week, on average.

Or you can hear directly from Karbon customers about what Karbon is enabling them to do at their firm (and for their clients).