Nov 14, 2022

In this release, we’ve improved contacts, and setting tax rates and identification numbers.

Billing and Payments Update

Karbon Billing and Payments is currently being beta tested and will be released to all customers later this year.

If you would like to be part of our beta testing group, please sign up now.

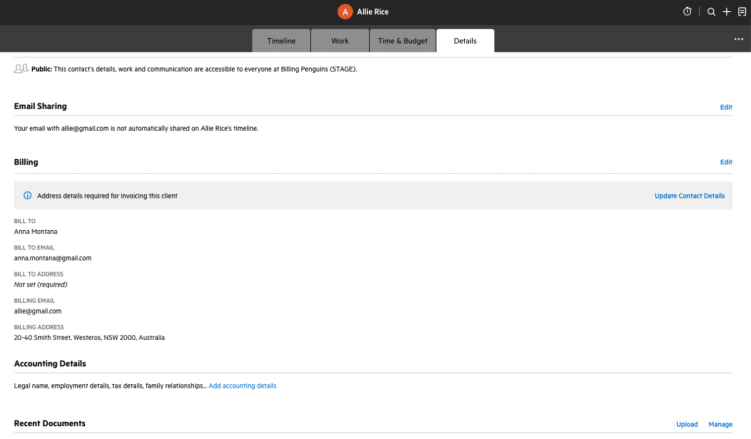

Billing section on contacts and work

Soon you will be able to send invoices to your clients from Karbon. To aid this, we’ve added a Billing section on the Contact details tab where you can select ‘Bill To’ and ‘Billing Address’ for that contact. When invoices are created, the information will be applied by default to the invoice. This ensures invoices are accurate and comply with all applicable laws and regulations in your region.

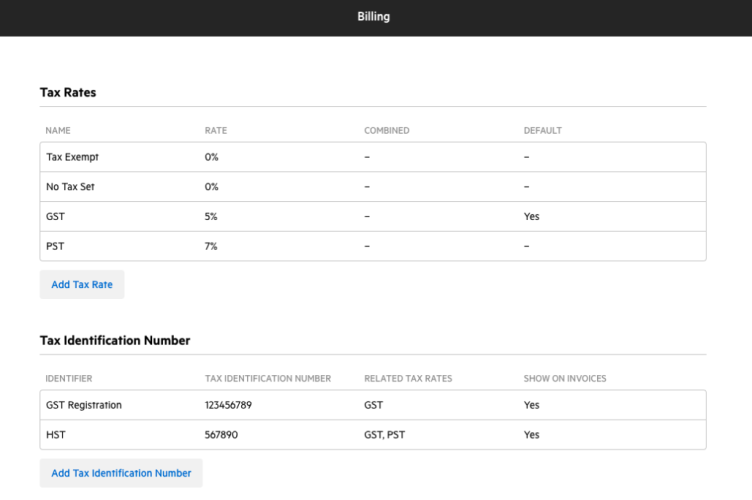

Setting tax rates

As of today, you have the option to set up tax rates that can be used when preparing invoices. Based on your firm's country (set in Account Settings), we have populated some core tax rates.

You can set single tax rates and choose a default tax rate from this list. If you have clients that have different tax rate requirements, you can select a tax rate for those contacts by going to the Billing section on the Details tab for that client. When invoices are created for that contact, the tax rate will be applied to all invoices by default. Your preferred settings here will save you a lot of time later from individually inserting a tax code per work item.

Tax Identification Numbers (TIN)

It is a requirement in many countries to display tax identification/registration numbers on invoices. To enable this, you can navigate to Settings > Billing, where you can set tax identification numbers by clicking 'Add Tax Identification Number'.

From this modal, you can select an identifier name, enter the TIN and choose the related tax rate(s) for that number. If you choose the option to show the number on the invoice, when the related tax rate(s) is applied, the tax identifier name and number will automatically appear at the bottom of the invoice.