Summary

-

A firm’s management is one of the most important areas to focus on, yet it’s one of the most ignored.

-

Your people are key—young accounting professionals want flexibility, inclusivity, purpose, development, and an investment in technology.

-

Failing to leverage AI will leave you behind.

-

An accounting practice management solution will help you balance each key area of running your firm.

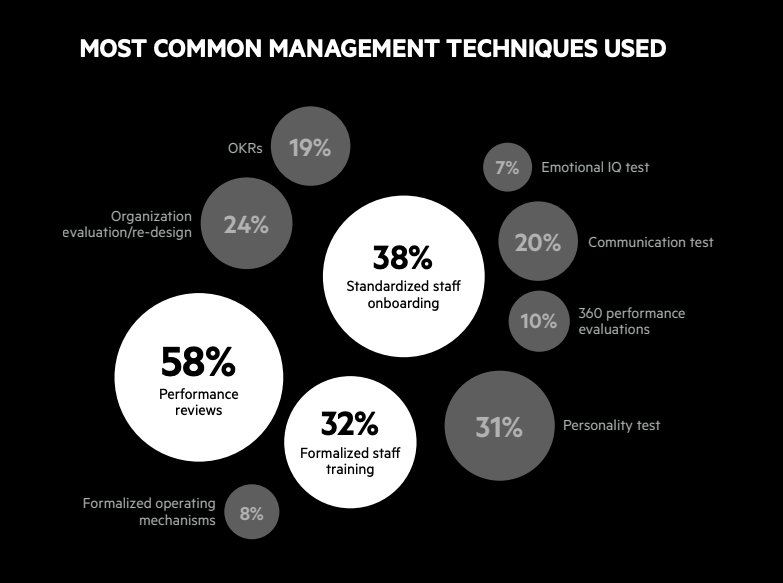

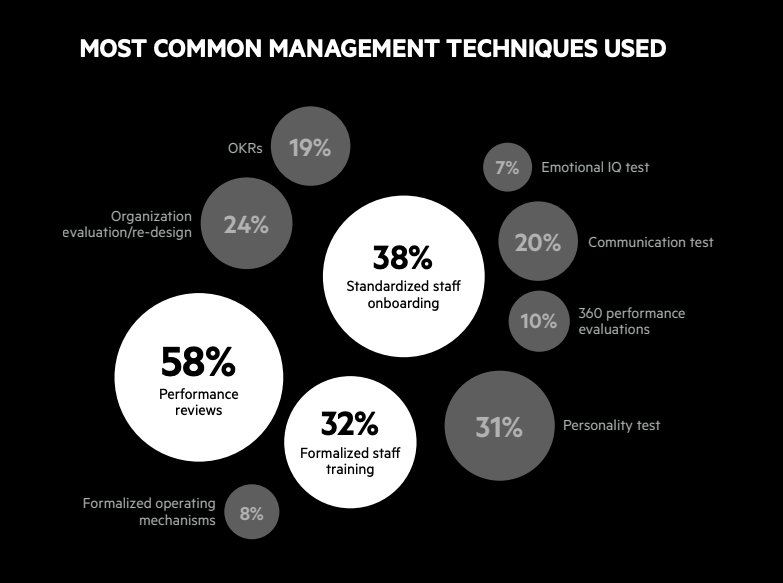

According to the 2022 Practice Excellence Report, focusing on your firm’s management has the greatest effect on propelling your growth. In fact, of the 10 activities that have the strongest impact on Practice Excellence, half of them are related to management techniques.

And leading accounting firms score 133% higher in management techniques than firms with below average Practice Excellence scores.

The thing is, management techniques aren’t widely used across firms. For example, only 19% of accounting firms are using the objectives and key results (OKR) goal-setting framework.

The most common management techniques used by accounting firms, according to the 2022 Practice Excellence Report

How does your firm fare? Take the Practice Excellence Assessment to understand your performance in the key business areas of management, growth, efficiency and strategy.

But what does accounting firm management even involve? And why aren’t more firms focusing on it?

If you’re eager to improve your management practices, here are 9 strategies you can use at your accounting, bookkeeping, tax, or CPA firm.

9 strategies to efficiently manage an accounting firm

Recruit the right team

Set rates that reward efficiency

Get proactive with technology

Take advantage of templates to prioritize value-add services

Prevent bottlenecks by automating workflows

Harness AI

Fine-tune your processes

Take client management seriously with a robust CRM

Encourage feedback from clients and employees

1. Recruit the right team

Great firms are built with great people. But with the 17% decline in US accountants and auditors over the last two years—over 300,000 have quit—attracting and retaining staff is getting more difficult.

There are key staffing trends that will help you find the right people:

The data is clear: young accounting professionals want remote work flexibility, inclusivity, purpose, development, and an investment in technology. And these key areas won’t just attract and retain top accounting talent—they’ll also strengthen how your firm operates:

Hiring remote employees can expand your talent pool

A modern tech stack will result in a more efficient and productive firm

An inclusive and diverse firm will strengthen your culture

Developing your staff will result in more confident and competent team members

2. Set rates that reward efficiency

Are you pricing competitively? Is your pricing optimized to drive value for your clients and your firm? Or are you leaving money on the table? Or maybe even experiencing burnout due to underpaid work?

Getting your pricing right can be difficult, especially in the accounting profession, but it’s critical. A great place to start assessing your pricing is with its structure.

For example, charging by the hour can cap your potential profit, doesn’t reward efficiency, and involves spending effort on time tracking and billing.

On the other hand, value-based pricing maximizes profitability and flexibility, and helps build client relationships.

For a detailed breakdown of pricing structures, check out this comprehensive accounting services pricing guide.

3. Get proactive with technology

How often do you need to chase clients repeatedly for information? How many details have fallen through the cracks thanks to poor communication?

These common challenges can make it difficult to efficiently manage your firm. But the good news is this: technology is here to help solve those challenges.

The accounting software market alone is projected to reach a $19 billion USD valuation by 2026. And almost 60% of accountants believe technology has made their lives significantly easier.

One of your firm’s key tools should be a robust, cloud-based practice management solution. It’s a must-have. In fact, per employee, some firms are saving an average of 3.2 hours per week chasing clients and 3.9 hours per week managing and completing work.

If you haven’t already, find the best accounting practice management software for your firm.

4. Prevent bottlenecks by automating workflows

Accounting automation is reshaping the accounting landscape. Overall, 40% of accounting functions can be fully automated with the right technology. And there’s no slowing down.

Consider how automation can streamline the following processes at your firm:

Your accounting software should help make this happen with robust automation capabilities. Some firms are saving 2.1 hours per week, per employee by automating the low-value admin tasks.

If you want to explore more ways to automate your firm’s processes, check out these no-code and low-code resources and tools.

5. Take advantage of templates to prioritize value-add services

What if you never had to create a workflow from scratch again? What if you never had to manually update a task status or assign a piece of work?

This can all be achieved with accounting templates.

For many firms, it means hours of time savings.

For example, UK firm BKL saves at least three days per month by using templated workflows. And bookkeeping firm, Tabworks, has sped up their staff onboarding process, while Leppert Group has streamlined their client onboarding and offboarding.

The time you save can be spent on advisory, strategic planning, and other value-adding services that improve your bottom line.

But templates shouldn’t be exclusive to client work. Templates can also help manage your firm and team.

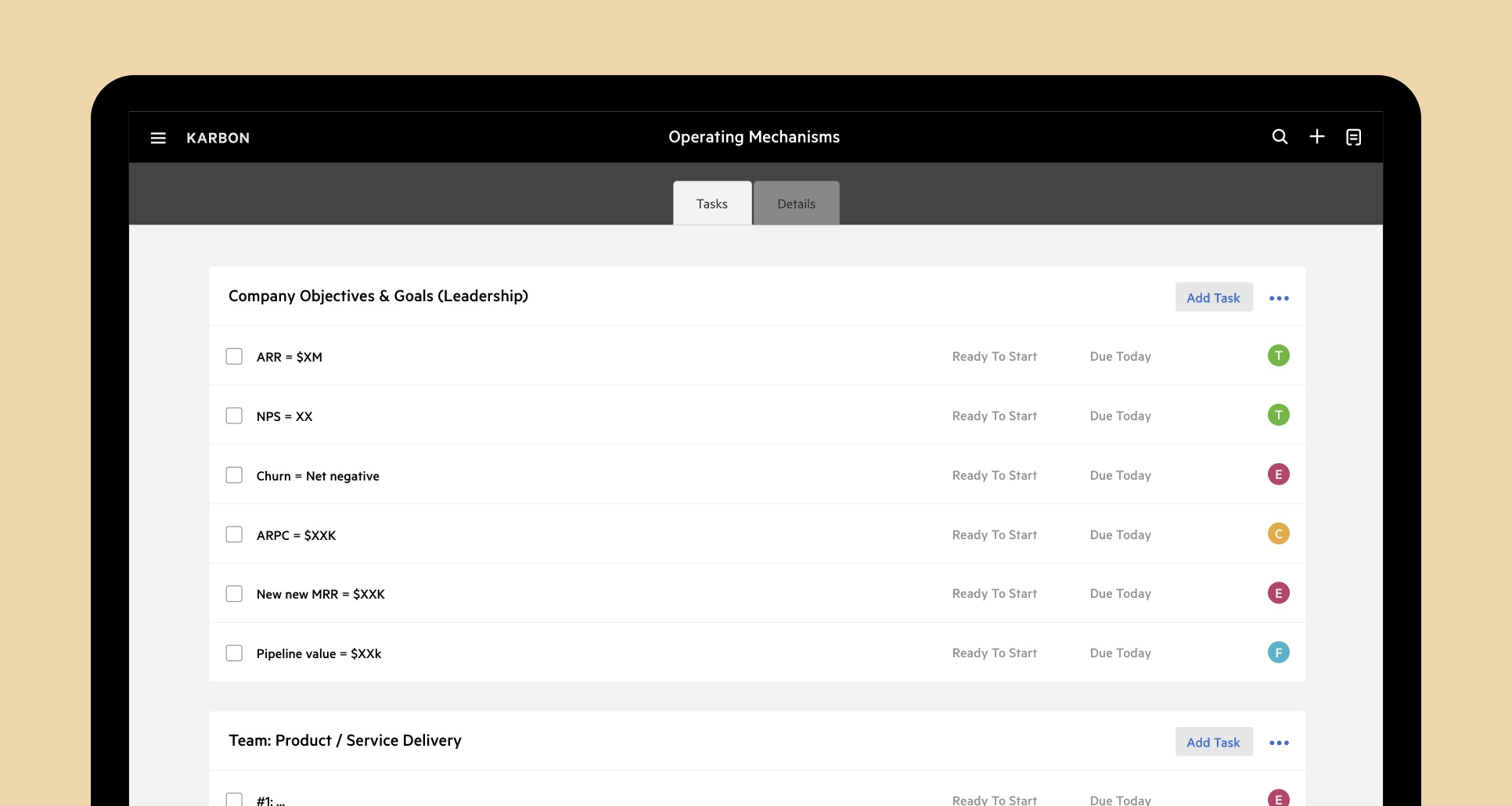

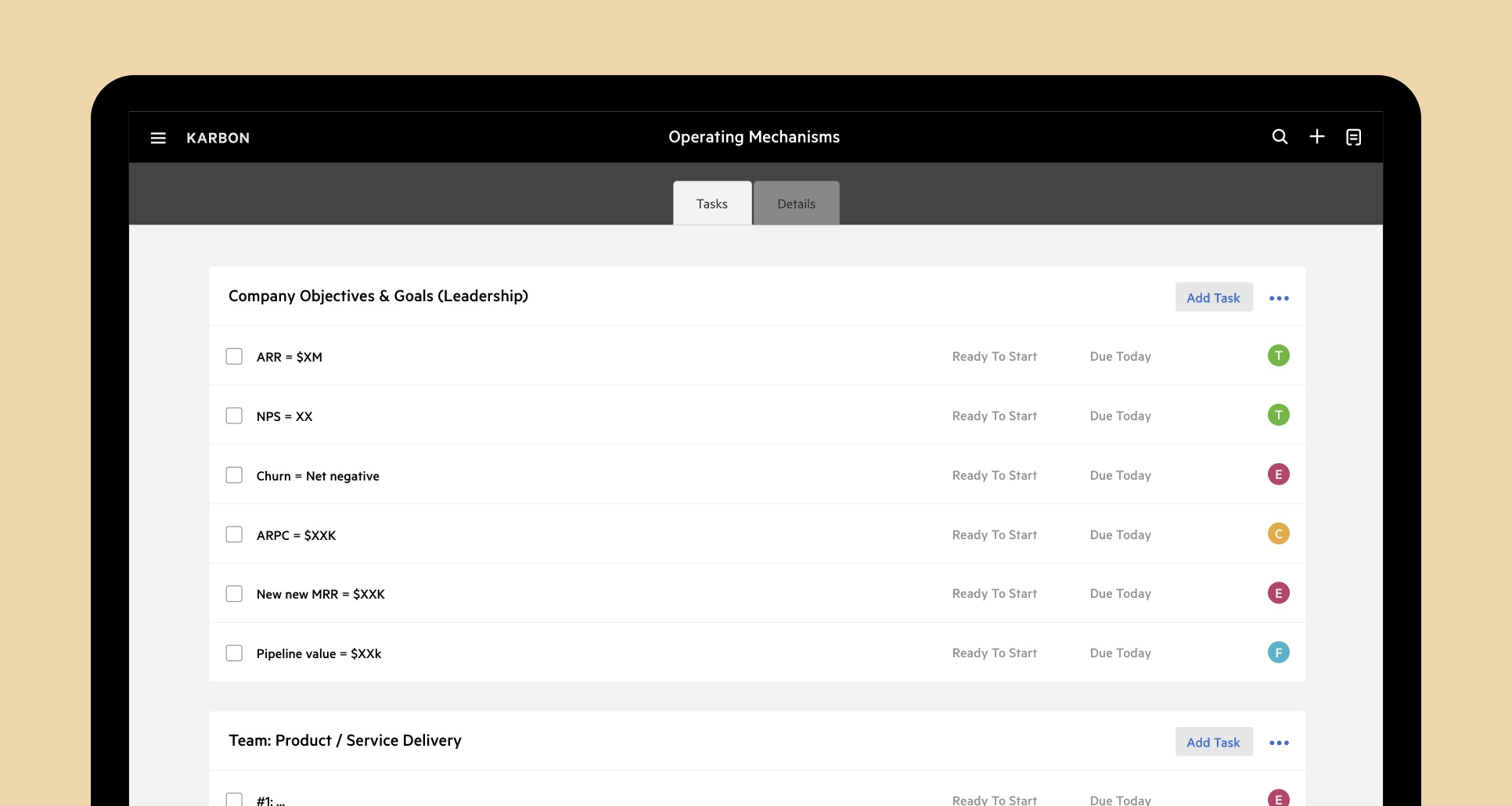

For example, the Operating Mechanisms template from the Karbon Template Library is designed to manage your firm’s quarterly objectives and key results (OKRs).

It includes tasks for daily updates from your team, and weekly and monthly reviews.

👉 Download it for free

This is the Karbon best practice process for managing firm-wide objectives and key results

Discover hundreds of other templates to help you work more efficiently.

6. Harness AI

The global artificial intelligence industry is expected to grow 37% every year from 2023 until 2030. Growth that rapid cannot be ignored, and slow adopters will be left behind.

AI will improve the efficiency of your firm, both administratively and functionally for general firm management and accounting tasks.

AI can help you:

Distill large amounts of information into key points

Detect inaccuracies in account reconciliations

Categorize transactions

Analyze financial data to provide insights and trends

Implement chatbots on your website

Simplify communication by writing emails

Generate marketing strategies, plans and copy

Sort data

Extract transactions from financial statements

Learn new Excel skills

But remember that while there are plenty of pros when it comes to AI, there are also significant cons. Above all else: check its output every single time.

7. Fine-tune your processes

The larger your firm grows, the more important processes become.

Your staff and client onboarding processes are arguably the most important to get right. For Tabworks, their refined client onboarding process means that they’re now able to turn a brand new lead into a paying client within five days.

If you invest the time in getting your processes standardized and set-up the right way, it won’t matter if you have five or 5,000 clients—you’ll be able to deliver consistent, high-quality service to each of them.

The Process Playbook is full of ideas to optimize your processes, including templates, worksheets, and stories from accounting firm leaders and owners from across the globe.

8. Take client management seriously with a robust CRM

Leading accounting firms are leveraging workflow and CRM technology 120-130% more than their less-competitive counterparts.

These firms have:

Better access to client data

Enhanced client management

A more connected team

Plus, the most recent research has found that the return on investment of a CRM tool is $8.71 USD for every dollar spent.

It’s difficult to ignore the potential transformative effect a CRM can have on your client management strategy. Find the best CRM for accounting firms.

9. Encourage feedback from clients and employees

Organizations are much more likely to perform well financially when their employees feel heard, engaged, and have a sense of belonging.

Your team and clients are incredibly rich in feedback—they’re the ones delivering and receiving the service after all. Tap into this resource. And importantly, do it before it’s too late.

Consider asking for feedback regularly on one-on-one meetings. Encourage your team to provide feedback on a weekly or monthly basis, not just once every six months or once a year.

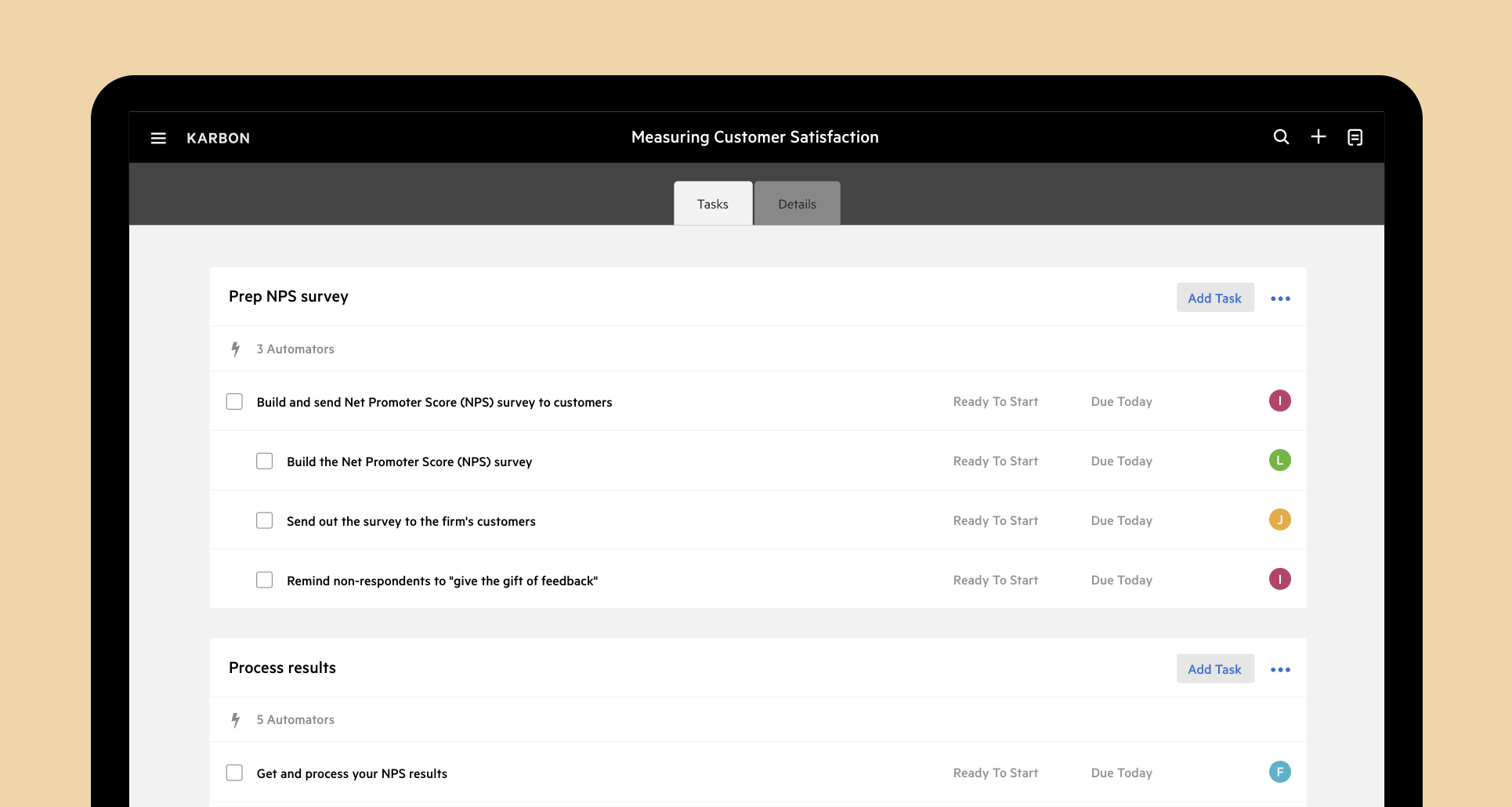

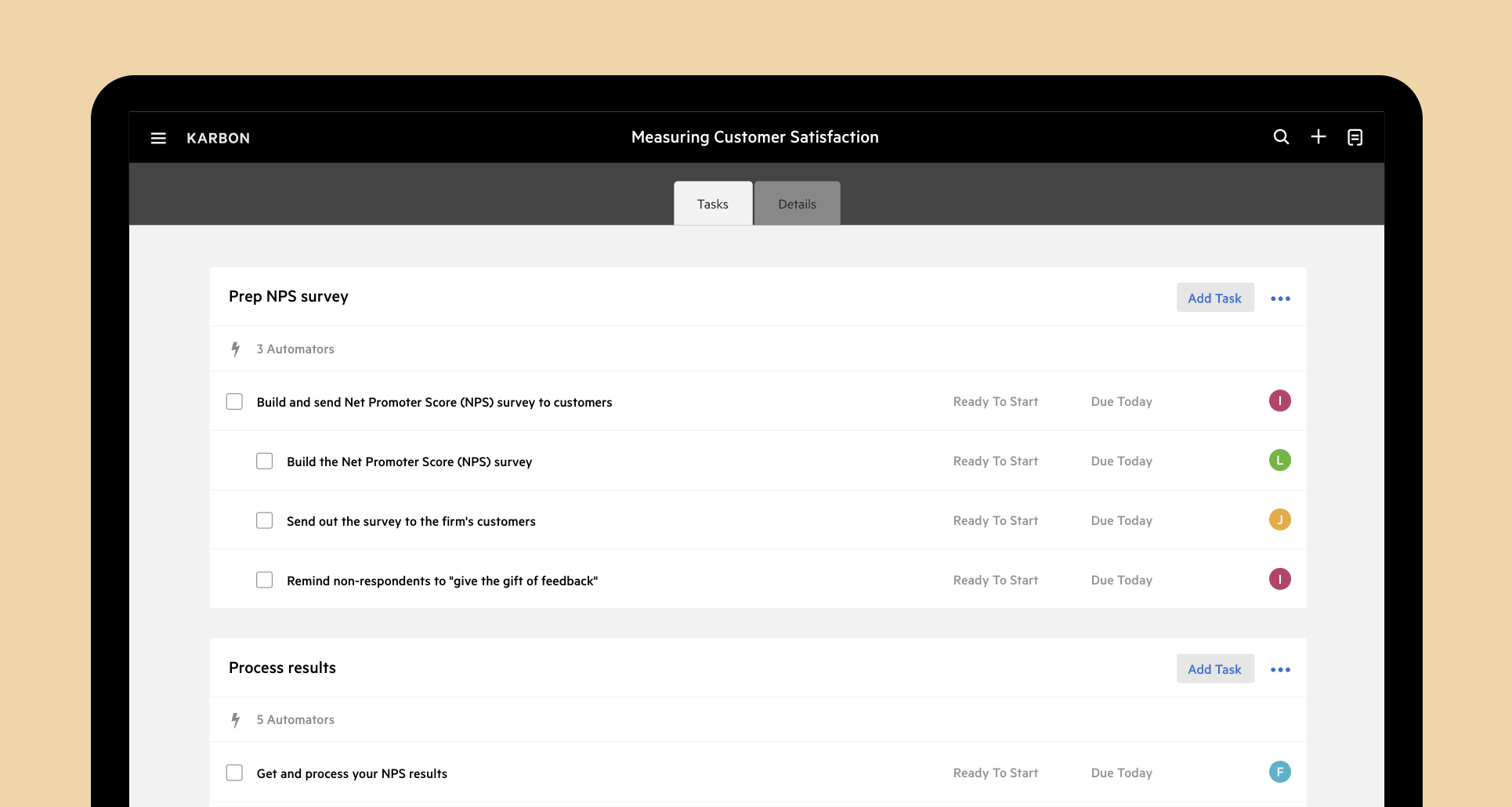

And for your clients, you can use this Measuring Customer Satisfaction template to capture their satisfaction using the Net Promoter Score (NPS) method.

👉 Download it for free

This is Karbon's best practice process for measuring your accounting firm's customer satisfaction using NPS

Capturing NPS after busy season is a way to gauge how your clients experience this time of year. This is referred to as transactional NPS or tNPS.

You may uncover interesting insights that can help shape your future tax seasons and tax preparation processes. For example, your tNPS results might uncover that your clients are anxious while they wait for their tax returns to process. So you might consider setting up automated emails that inform them of the progress of their returns to reduce their anxiety.

Why you should invest in practice management software to help manage your firm

Managing your firm can feel like you’re trying to balance many, many spinning plates. One distraction, and it can all come tumbling down.

But it doesn’t need to be quite so strenuous. That’s where practice management technology can help.

Accounting practice management tools are specifically designed to solve common practice management frustrations, like workflow management, capacity planning, visibility across a remote or hybrid team, tasks, projects, internal collaboration, and client management and communication.

Karbon customers save on average 18.5 hours per week per employee per week. In an industry where time is the most precious resource, statistics like that can’t be ignored.

Key practice management features

Choosing an accounting practice management software platform can be difficult—keep these must-have features in mind:

Integrated email and internal communication features, like comments and @mentions

Accounting workflow and project management

Automation

CRM capabilities, including a client database, activity timelines and client groups

Secure client portal

Business analytics and reporting

Document management and file storage

Work templates

Time tracking and billing

Integrations with other accounting apps

To learn how Karbon can help your firm, book a demo or start a free trial.

More resources to help you manage your accounting firm

Here is a collection of additional resources to help you dig deeper into each of the key competencies related to managing your accounting firm:

Change management

Talent management

Organization management

Client management