Monthly bookkeeping made easy: Follow this checklist (with template)

Gain complete confidence in your monthly bookkeeping process with this checklist template.

A monthly bookkeeping checklist is more than a to-do list; it forms a critical part of your firm’s foundation.

Nothing keeps an accounting firm more unified and productive than a clear set of repeatable tasks. Even for the most basic bookkeeping processes. In fact, especially for the most basic bookkeeping processes.

A clear monthly bookkeeping checklist is designed to ensure each step of the process is completed and tracked, so nothing falls through the cracks and your clients feel secure in their relationship with you as their trusted advisor.

Here’s everything you should include in your monthly bookkeeping checklist so you can be confident in the process and your bookkeeping services.

Monthly bookkeeping checklist template for accounting firms

The information in this guide is based on the Bookkeeping Best Practice template from the Karbon Template Library.

This template provides a detailed workflow for key bookkeeping steps including:

Weekly bookkeeping

Bi-weekly payroll

Gathering documents

Adjustments

Reports

Review

👇 Download it for free

Items to include in your monthly bookkeeping checklist

On a monthly basis, there are a few key bookkeeping processes that need to be executed for your small business clients.

The best monthly bookkeeping checklists should include action items across:

Account reconciliation

Record and categorize revenue and expenses

Process payroll

Process tax obligations

Month-end close

Financial statement preparation

Update documentation

Share and advise your client

1. Account reconciliation

Monthly bookkeeping checklists should include action items on analyzing and resolving any financial discrepancies. This includes in-depth transition reviews, bank statement and credit card account alignment, and balance verification.

It can be helpful to conduct weekly reconciliation (and consider it as a subcategory of monthly bookkeeping). This not only prevents errors but saves firms precious time at the end of the month.

2. Record and categorize revenue and expenses

Carefully categorize business expenses and liabilities at the end of every month and record all sources of income, including past due invoices. This not only facilitates easy tracking of cash flow but also lays the groundwork for accurate financial reporting.

3. Process payroll

Thoroughly verifying employee hours, wages, and associated benefits is an important step in the monthly bookkeeping process.

A great way to streamline this step of the process is through the perfect weekly payroll template or monthly payroll template.

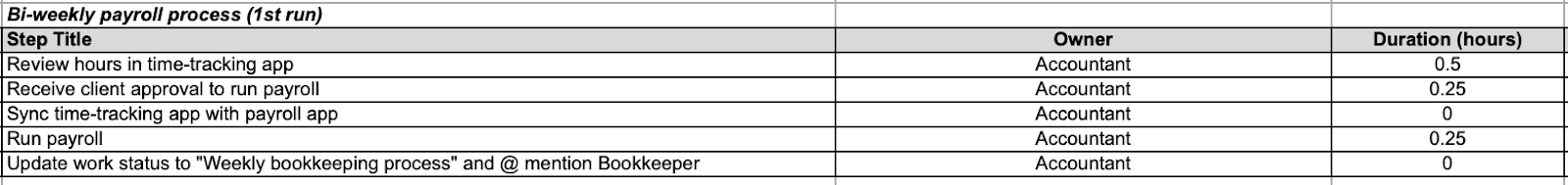

Here’s an example of bi-weekly payroll tasks from Karbon’s Monthly Bookkeeping checklist.

4. Process tax obligations

Ensure you’re well-informed about tax due dates, including payroll taxes and income tax filings. Timely preparation and submission of required tax payments and forms for the current month are essential to avoid penalties and help you facilitate smooth audits.

5. Month-end close

A complete and thorough month-end close process will help your firm achieve financial clarity, make better decisions, and ensure a strong financial foundation for year-end close and beyond.

6. Prepare financial statements

Paint a picture of your clients’ financial health, cash position, and overall financial stability by pulling together accurate financial statements. This includes income statements, bank account statements, credit card statements, balance sheets, and cash flow statements.

7. Update documentation

Updating forms every month can be a hassle, but it’s important to revisit all documentation at the month’s end to stay in regulatory compliance and streamline operations with organized and accurate financial records.

An accounting practice management tool with document management features and a secure client portal will help simplify document storing and sharing with clients.

8. Share and advise your client

Client communication is key. A comprehensive checklist should provide action items like:

Emailing clients with links to financial information and forms

Interpreting financial data

Setting up advisory meetings

Sending meeting follow-ups and summaries

An accounting practice management tool with an email integration and client management features will help streamline this communication and reduce the client chase. You can automate your workflows and your client communication, plus easily collaborate with colleagues in a unified location.

In a video about common bookkeeping workflows, Ian Vacin from Karbon explains that these key bookkeeping tasks should come together in a checklist that is:

Generic yet specific: It should be flexible, yet customizable.

Tight and light: It should be detailed enough to track, but lightweight enough to use.

Clear on ownership: It should showcase clear ownership with smooth handoffs.

Flows into your work: Visibility and processes should be baked into the checklist.

For an easy-to-use checklist that offers all of the above, download Karbon’s free Monthly Bookkeeping checklist:

Watch the full conversation between Ian, Yoseph West (HubDoc), Jennie Moore (Moore Details Bookkeeping), and Allison Hawkins (Hawkins & Co Accounting):

https://karbonhq.wistia.com/medias/iorl0kymx1?embedType=iframe&seo=true&videoFoam=false&videoWidth=640Automating monthly bookkeeping with accounting practice management software

At the end of the day, what separates a good monthly bookkeeping process from a great one—other than a robust checklist—is how much you’re able to automate your processes.

With the right accounting practice management software, firms build accounting workflow automation directly into their most important workflows and streamline their monthly bookkeeping tasks.

How?

Centralized knowledge hubs. Bring all tasks, notes, emails, and documents relating to a job together with an automatically compiled record of all communication in the context of your work.

Document management. Simplify storing, managing, and tracking the documents necessary for monthly bookkeeping.

Client management tools. Keep client details and important information in one place and set auto-reminders for completing your most important client tasks.

Workflow automation. Automate your firm's most time-consuming accounting tasks like updates to status, due dates, and assignees to make monthly bookkeeping easier and more efficient.

Get instant access to all the tools that make monthly bookkeeping tick with a free trial or demo of Karbon.