What is the month-end close?

A month-end close is an accounting process that involves the collection, reconciliation, and finalizing of all financial transactions from the previous month.

The month-end close doesn't need to be such a stressful process. Here's a template and automation tips to help reduce the chaos.

A month-end close is an accounting process that involves the collection, reconciliation, and finalizing of all financial transactions from the previous month.

The month-end close is one of the most common and essential processes that an accounting professional completes, and yet a staggering 82% of accountants describe it as a negative experience.

But it doesn’t need to be like this.

Common frustrations involved in the month-end close process include a lack of visibility and a poorly documented process.

On top of that, it’s important that the month-end close is error-free and completed efficiently in order to keep forecasts accurate and your clients ready for audits, tax season, and the year-end close.

Taking a systematic, tech-supported approach can solve these challenges. It will standardize the outcome and ensure deadlines are met, making it a simpler and more rewarding process.

The information in this guide is based on the Month-End Close template from the Karbon Template Library.

It assumes the bookkeeping (typically done weekly) has been done in conjunction and isn’t included. The process begins on the first of the month and should take a maximum of 10 days to complete.

👇 Download it for free

Here are seven best practice steps to a month-end close process:

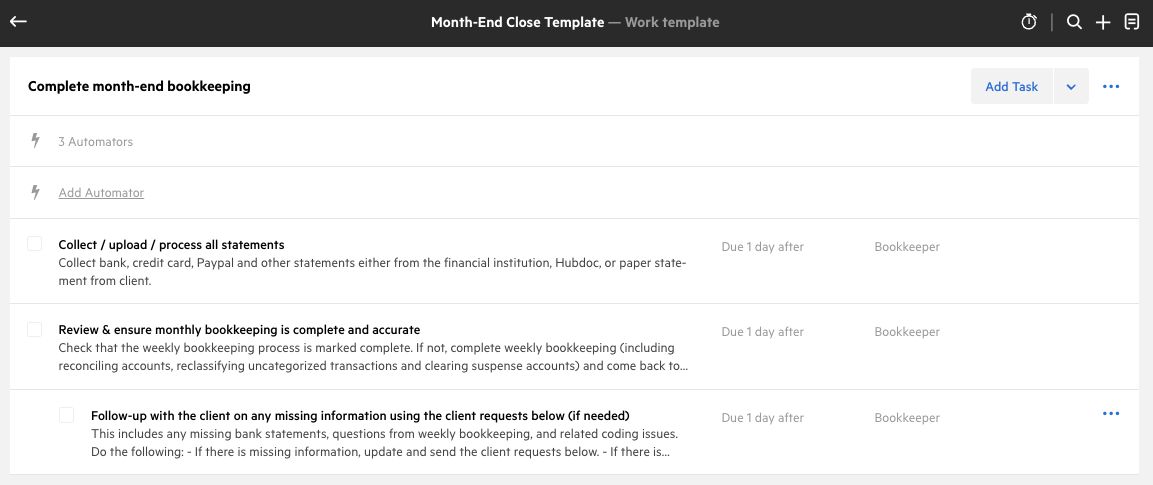

Collect, upload and process all statements for the month

Review and ensure monthly bookkeeping is complete and accurate

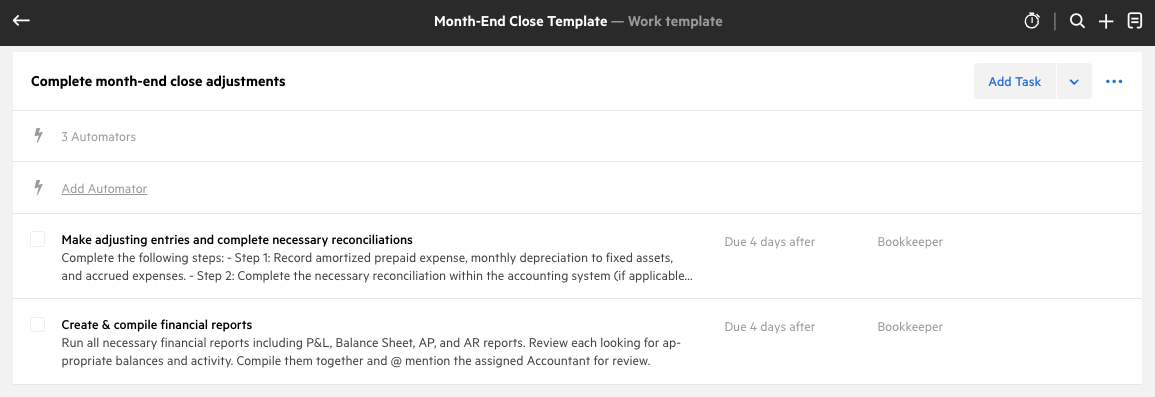

Complete month-end closing adjustments and necessary reconciliations

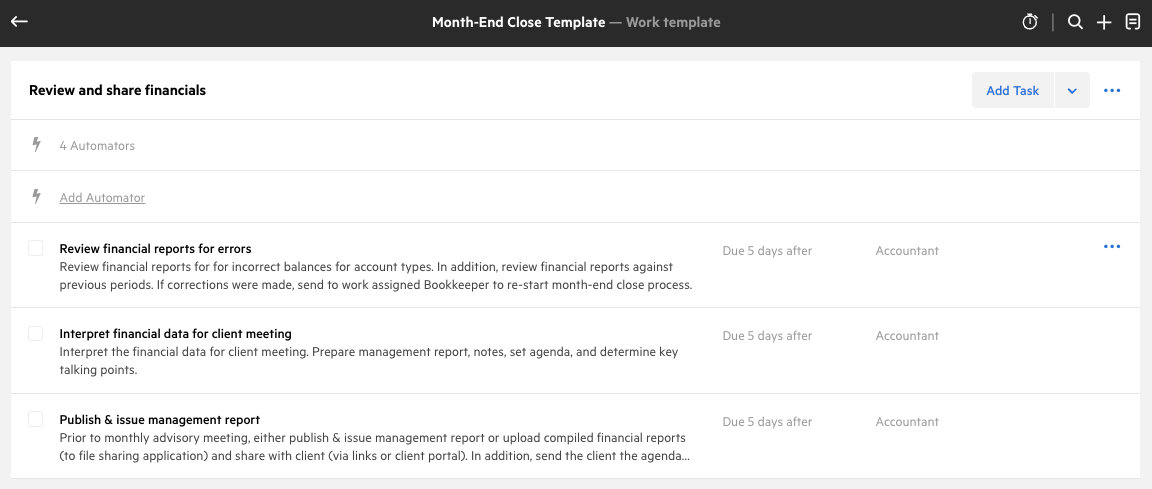

Create, compile and review financial reports

Prepare, interpret and publish management report

Advise your client

Close books and update documentation

Collect bank, credit card, PayPal and other statements either from the financial institution, other accounting software like Dext, or paper statements and receipts from your client.

Review and complete the bookkeeping for the accounting period to ensure accuracy—classify uncategorized transactions, unpaid invoices, invoice payments, and clear suspense accounts.

Code these transactions to a general ledger account.

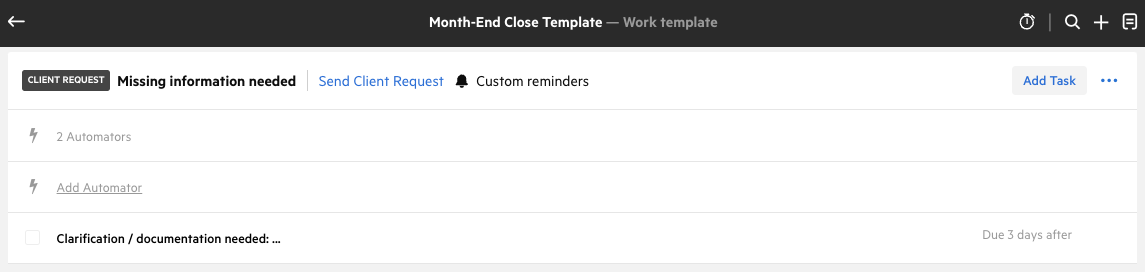

Follow up with the client for any missing statements or to clarify any financial activity for that month.

Record amortized prepaid expenses, monthly depreciation to fixed assets, and accruals.

Run reconciliation reports for each asset account in the system, cross-checking for discrepancies in the account reconciliation report numbers with the balances of the bank statements and credit cards.

Make any journal entry adjustments (i.e. accrued interest, depreciation, inventory, deferred revenue).

Run all necessary financial reports including profit and loss statements, cash flow, balance sheet, expense reports, and accounts payable and accounts receivable reports.

Review them and investigate any inaccuracies.

Review the reports against previous months.

Interpret the data in preparation for a client meeting: prepare notes, an agenda, and decide on key talking points.

Prior to the advisory meeting, send the reports along with your notes and agenda to the client for their information.

Engage the client in an advisory meeting (if your firm is engaged for advisory services), help them understand their financial data and health, and key actions they should take (an important step for your small business clients).

Email them a summary of the discussion and schedule next month’s meeting.

Close the books, notify the bookkeeper of any changes to the client process, and mark the work as complete.

The Month-End Close Process template can be downloaded as an Excel spreadsheet from the Karbon Template Library, or you can add it straight to Karbon. If you’re not already a Karbon customer, you’ll have the opportunity to start a free trial with this template added.

When you use it in Karbon, you benefit from pre-built automations, role and task assignments, pre-set deadlines, and automated client reminders.

Either way you use this template, it’s fully customizable to suit your firm’s needs.

See the Month-End Close process template in action:

https://karbonhq.wistia.com/medias/e2cak4ck0n?embedType=iframe&seo=true&videoFoam=false&videoWidth=640In order to manage the monthly closing process, you need certain financial records and documents on hand. It may vary slightly, but here is a checklist of all the must-have information you need to complete the month-end process.

✅ Total income/revenue

✅ Expense accounts

✅ Supplier invoices

✅ Total fixed assets

✅ Balance sheet accounts

✅ Inventory count

✅ Petty cash fund total and all cash balances

✅ Financial statements

✅ Sum of cash flow—income and expenses

✅ General ledger data

Getting everything together before you start will make the process run more smoothly. Anything that can be sourced before the end of the month will help alleviate the pressure.

It’s better to be accurate than fast

Use templates and checklists

Automate repeated tasks

Centralize your client information and communication

Accuracy is the backbone of accounting. According to a study by PricewaterhouseCoopers, 32% of customers would stop doing business with a company after just one negative experience.

If you make a mistake in your month-end close, it takes a lot longer to locate and fix your error than it would have been to work fastidiously, and slightly slower, in the first place.

And if you don’t catch your mistake and deliver inaccurate reporting to your client, chances are their trust in you will begin to erode.

Organizations that use project management practices consistently achieve a 92% success rate in meeting project objectives. Having a clear owner for the process is crucial in realizing that.

A clear owner, whether it’s the accountant or the bookkeeper, will oversee the month-end close, ensuring it’s completed accurately and efficiently.

The month-end close is a repeatable process: a perfect one to templatize. Using a workflow template to manage your month-end means your team will:

Never have to start the process from scratch again

Be able to continuously improve and customize the template as the process is refined

Save time

Produce consistent work

Provide your clients with accurate accounting data

Other month-end close templates from the Karbon Template Library include:

Month-end closes don’t need to be time-consuming. Data entry, reconciliations, and aspects of financial trend analyses can all be automated and AI-assisted.

Having the low-skill tasks done by accounting automation software means you can focus your time in forecasting and business behavior analysis—adding value to clients.

It doesn’t just save time either. A McKinsey study finds automation reduces errors in finance tasks by up to 66%.

Using an accounting practice management tool will help collate all the items you need to complete your month-end close thanks to the following features:

Integrated email: centralizes your client communication and internal communication

Client portal: securely share and request client information and documents

Document storage and management: collate and securely store client documentation

Workflow management: gain real-time visibility over all month-end closes, in conjunction with other in-progress and planned work

Workflow automation: automate repeatable tasks like work status updates and work assignments

Accurate financial projections and better business decisions

More visibility into clients’ financial health

Prepared for audits

Easier tax filing

Accurate month-end closes contribute to accurate financial forecasting for your clients. And consistently accurate closes and financial forecasting lead to growing client businesses. And when your clients thrive, so do you.

Accurate data is crucial for financial planning, and in fact, bad data can increase operating expenses by upwards of 30%. A consistent month-end process will support your team in providing valuable advice to your clients.

Audits don’t need to be stressful, keeping scrupulous books month-on-month will keep you prepared for potential audits.

Consistent and accurate month-end closes—among other recurring processes—will help during busy season.

For example, Two Roads began doing their bank reconciliations weekly in order to speed up their month-end closes.

Two Roads also track staff hours against monthly recurring revenue (MRR). Everyone is paid a percentage of the MRR that they manage. A great example of leveraging monthly data and progress for a greater efficiency, the effective rate for each of their bookkeepers has gone up 53%.

Inefficient processes

Multiple spreadsheets leading to human error

Difficulty coordinating multiple departments

Failing to automate low-value, manual tasks

Because it is a process that is done every month, any inefficiencies will add up over time. Process inefficiencies can cost companies 30% of their annual revenue and waste 26% of an employee’s workday.

That’s why a best practice template is so helpful. It leaves no wasted time, reduces errors, and standardizes the month-end close.

If you’re working from individual Excel sheets, it’s more likely there will be mistakes in the financial close at the end of the month, including:

Duplicate data entry

Data omission

Uncategorized transactions

Delays in the information getting to where it needs to be

Centralizing your month-end workflow will ensure your team is aligned, and information is accurate and error-free.

Coordinating the bookkeepers, accounting department, client managers, and other parts of the team is important to delivering the month-end on time.

That’s why having good project management is so important. Robust practice management software with project management capabilities will provide:

A central source of truth

Centralized communication (integrated emails and internal collaboration features)

Automations and workflows that clearly show responsibilities and work statuses

A workflow template library with specific accounting procedures

Customizable Kanban layouts to cut out the noise and visualize progress

If, at the end of every month, accountants and bookkeepers are spending hours inputting data and arranging processes that can either be completely automated or done from a template, that’s time wasted.

In this report by Salesforce, 74% of leaders find that process automation has helped their employees save between 11-30% of the time previously spent on manual processes.

If the technology exists, there is no sense in not using it. When trying to increase your bottom line, time is your greatest resource.

Using a robust practice management system like Karbon will help standardize, optimize and automate your month-end close process. As a result, your accounting team will become more efficient and accurate and your client satisfaction levels will benefit.

In fact, Karbon can save every employee 18.5 hours each week.

With Karbon, we can automate the repetitive, low-value tasks. Our clients are ultimately getting better service and better value because we are more focused on the activities that add the most value.

See for yourself: book a demo or start a free trial