Summary

- ClickUp is a comprehensive project management tool aimed at a wide range of industries

- ClickUp comes with a massive amount of customization capabilities, which is great but can also be overwhelming

- ClickUp is not a practice management tool for accounting and bookkeeping firms

- ClickUp might be suitable for solo accountants or bookkeepers working in small businesses

- Because ClickUp doesn’t specialize in accounting, it lacks the necessary functionality and support that accounting professionals need

- ClickUp is a solution to consider if you have time and money to invest in setting it up and leveraging the customization

- If you use a practice management solution for accounting and bookkeeping firms, like Karbon, you can expect to save 18.5 hours per employee each week on average

It’s designed to help you manage your projects from one tool. In fact, that’s one of ClickUp’s taglines: One app to replace them all.

That might suit the many marketing teams and advertising agencies using ClickUp. But for accounting firms, using ClickUp without any complementary apps just isn’t realistic.

That’s because ClickUp doesn’t specialize in accounting. And it’s not a practice management tool. As a result, there are large gaps in its functionality that are critical to how you run your firm and manage your work.

Here’s a closer look at the pros and cons of ClickUp for accounting and bookkeeping firms:

Is ClickUp right for accounting and bookkeeping firms?

What is ClickUp?

ClickUp is a powerful project management software solution designed to help you keep track of your work, collaborate with your team and automate routine tasks.

It’s very similar to other generic project management solutions like Asana, Monday.com, Trello and Wrike. ClickUp is designed to appeal to a wide range of industries, rather than focusing on any particular niche.

This means the product itself is comprehensive. But not in the way that accounting firms need.

How does ClickUp work?

ClickUp organizes your work into workspaces and within those workspaces, you can have folders. Within each folder, you have projects. For accounting firms, you might consider structuring each folder as a client, with that client’s work sitting within their folder.

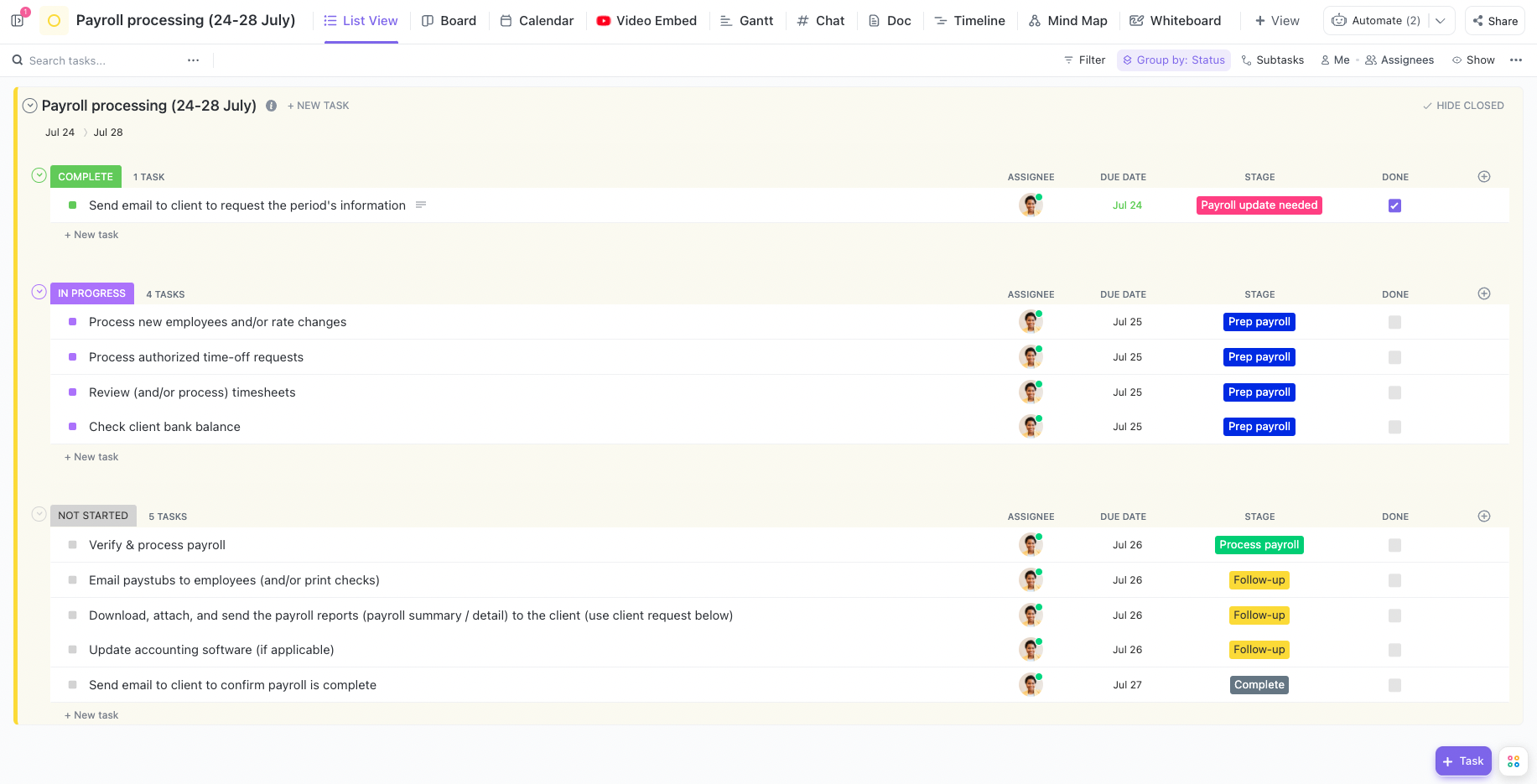

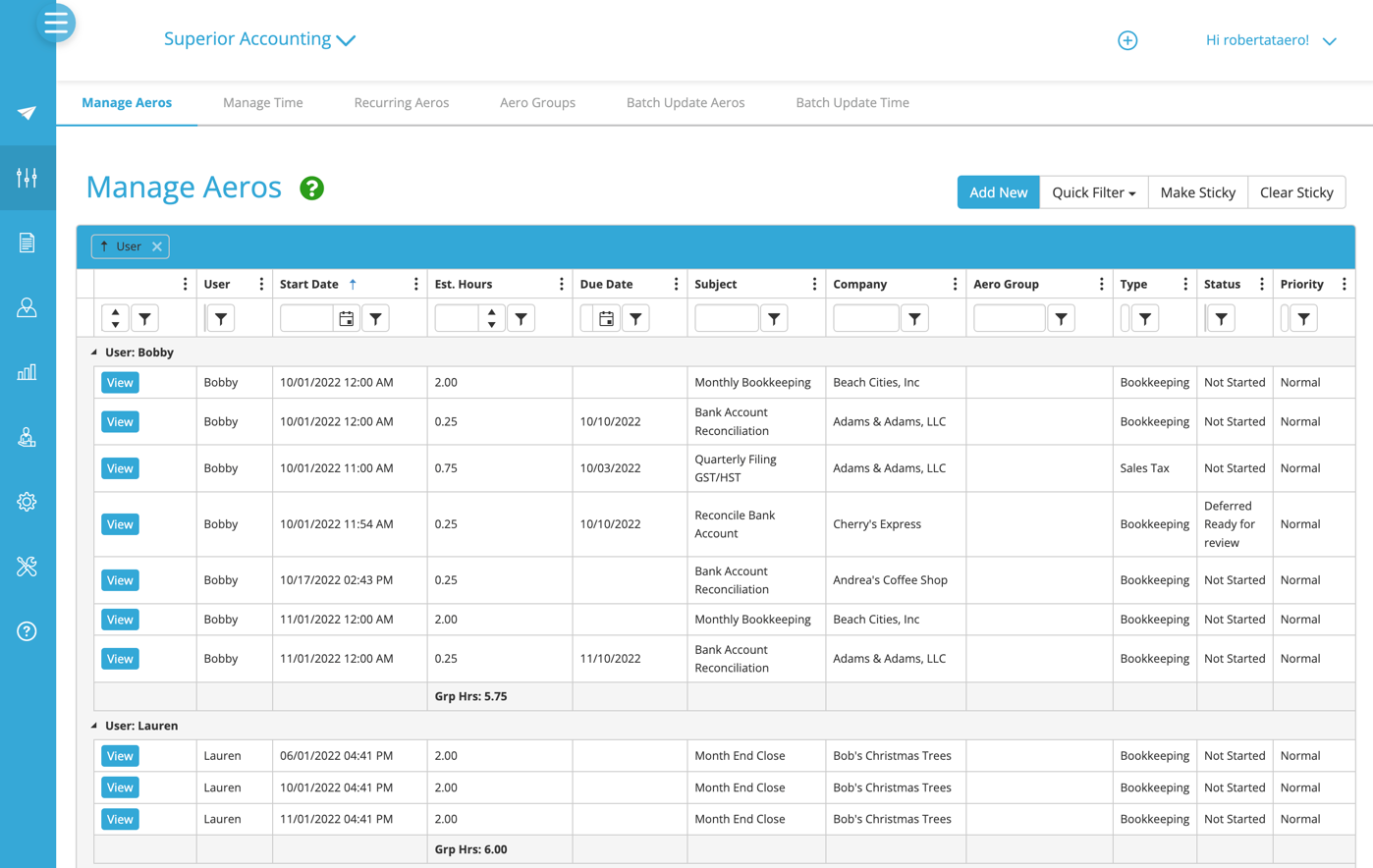

You can view each project as a:

List: View your workflow in a linear format with checklists, subtasks and due dates

Kanban board: View and sort your workflow in easy-to-read sections

Table: Designed to rival a classic Microsoft Excel spreadsheet

Calendar: Shows your workflow in a calendar view

Gantt chart: A linear visualization that highlights dependencies and milestones

(Limited to 100 uses with ClickUp’s free plan)

Timeline: A linear visualization of your workflow

(Limited to 100 uses with ClickUp’s free plan)

Mind Map: View your projects and tasks as a diagram

(Limited to 100 uses with ClickUp’s free plan)

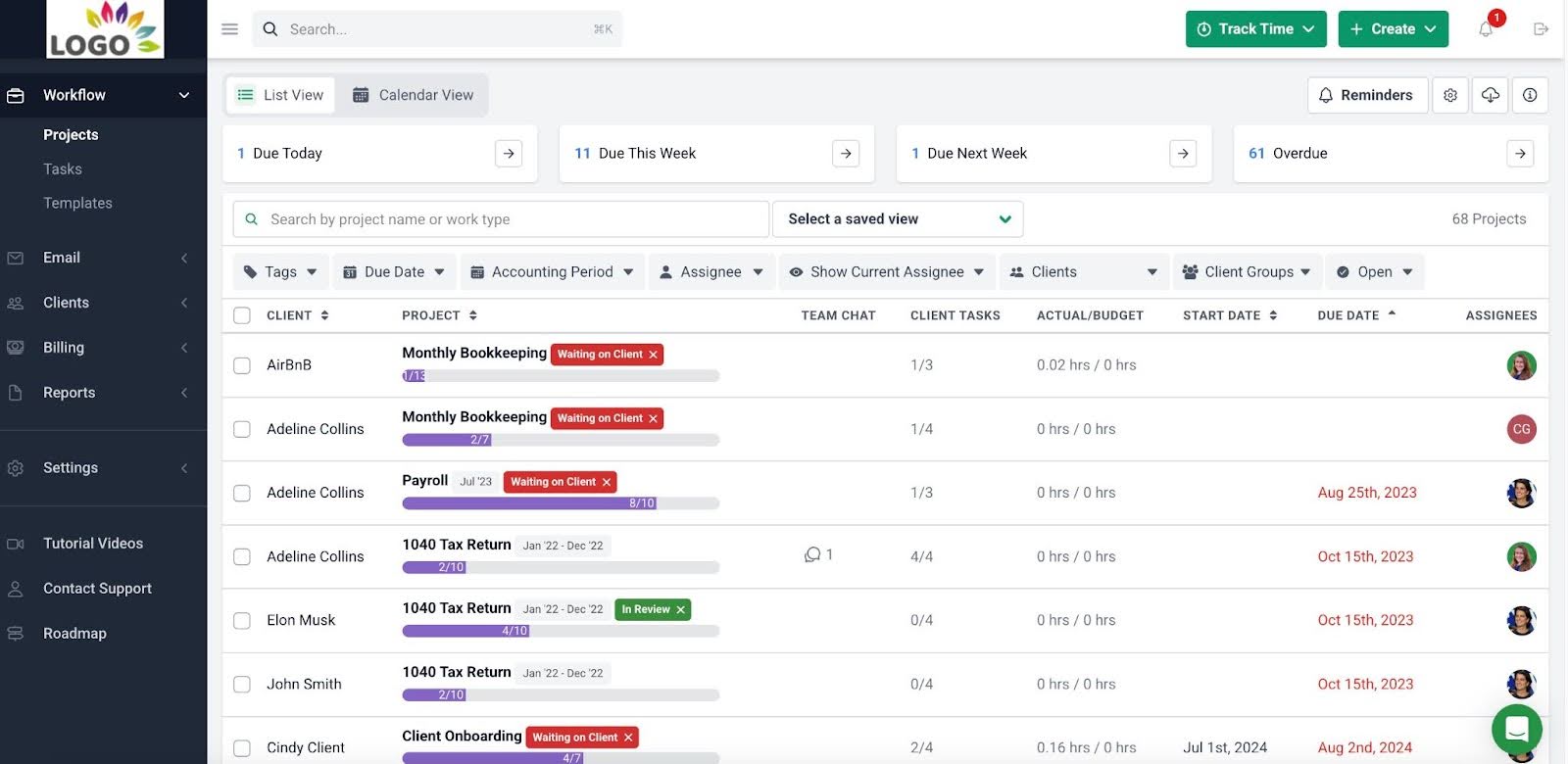

A list view of a payroll processing workflow template taken from the Karbon Template Library and rebuilt in ClickUp

ClickUp also comes with an impressive list of other ways to view your work and collaborate with team members, including chats, whiteboards, docs, widgets, activity views and workload views.

ClickUp is one of the most customizable project management tools available, which is often seen as a blessing and a curse. On one hand, the customization capabilities provide endless opportunities, but they can be very overwhelming and can make the onboarding process lengthy (so much so that there are specific external implementation companies who you can pay to set up ClickUp for your firm).

For immediate value, templates are a great way to quickly get started on any project management tool. Unlike other generic project management tools, ClickUp does offer some pre-built templates for accounting and bookkeeping professionals.

While the list is nowhere near as comprehensive as what other solutions have to offer, like Karbon’s Template Library, the fact that ClickUp offers options for the accounting industry shouldn’t be overlooked.

In ClickUp, you can turn your workflows into templates, set them up to automatically recur (paid plans only), and add basic workflow automators (up to 100 automators per month in the free version).

ClickUp offers email integration with Gmail and Outlook, but again, if you use the free version, you get up to 100 uses in total. Paid plans include either one or two accounts, with fees for each additional email account added.

ClickUp is also available on mobile, both on Apple iOS and Android.

ClickUp's integration library, which lacks any direct integration with accounting-specific apps

In terms of integrations, ClickUp lacks anything that is specific to the accounting industry. While it does have a Zapier integration, this alone isn’t enough to deliver the high-powered app connectivity that modern accounting firms demand.

This is a good segue into why ClickUp isn't the most ideal solution for most accounting businesses.

The limitations of ClickUp for accounting and bookkeeping firms

1. ClickUp doesn’t directly integrate with accounting software

ClickUp does not offer a direct integration with any accounting software. This means you’ll need to set up Zaps with Zapier to work with the tools you use every day, like QuickBooks, Ignition and Gusto. Because of this, you’ll likely need an even more labor-intensive implementation process when getting started with ClickUp.

2. ClickUp does not have a built-in client portal

Offering no client portal is another reason why ClickUp isn’t the most ideal solution for accounting and bookkeeping firms.

While there are ways to create a makeshift portal, dedicating time to building and maintaining your own client portal is probably not the most ideal use of your time (especially when many accounting practice management tools have built-in client portals). Not to mention ensuring it’s a secure location for client collaboration and document sharing.

3. ClickUp’s accounting templates are limited

While it’s encouraging that ClickUp offers finance and accounting templates when many other generic project management tools don’t, roughly 30 templates doesn’t cut it.

This is a perfect example of what happens when a project management tool tries to appeal to many industries—they need to split their focus across many different groups of people with very different priorities and ways of working.

On the other hand, an accounting-specific practice management tool like Karbon is dedicated to the accounting profession and the 250+ accounting and bookkeeping templates in the Karbon Template Library are testament to that.

4. ClickUp’s customer support isn’t specific to accounting and bookkeeping firms’ priorities and nuances

Again, because ClickUp spreads its focus across a wide range of industries, you can’t expect their customer support team to understand the specific needs of accounting professionals.

So unfortunately, if you use ClickUp and have any questions about making it work for your specific accounting workflows, you’re unlikely to find someone on their customer service team with specific accounting knowledge.

5. ClickUp’s out-of-the-box offering is lacking

Accounting professionals don’t have a lot of time to spend customizing a generic project management tool to act as a pseudo accounting practice management tool.

But if you use ClickUp, prepare to invest the time and effort because its out-of-the-box offering is not enough to help you streamline your firm’s processes from the get-go. It’s important to note that many ClickUp users report steep learning curves when getting started.

ClickUp alternatives for accounting and bookkeeping firms

Here is a collection of ClickUp alternatives that deliver on the specific needs of accounting and bookkeeping practices.

Karbon

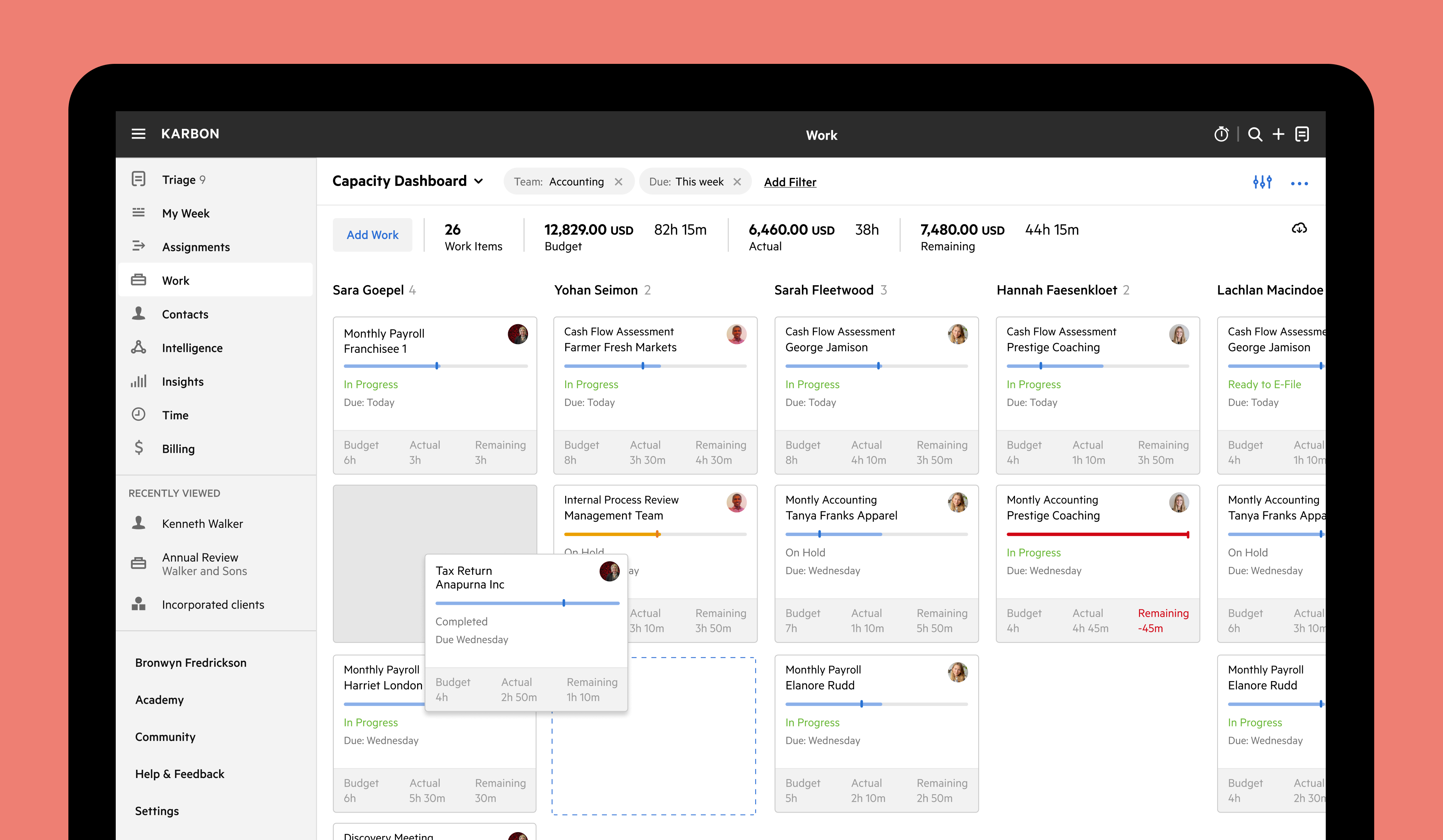

Karbon is a practice management solution for accounting and bookkeeping firms. By focusing on you, your industry, your clients, and all your unique requirements, Karbon is built specifically for you.

It enables intuitive communication and seamless workflows so you know who is doing what, when, why, and how. It offers customization capabilities that are relevant to what you do every day.

And as a practice management system, task and accounting project management is only one aspect of the wider Karbon offering.

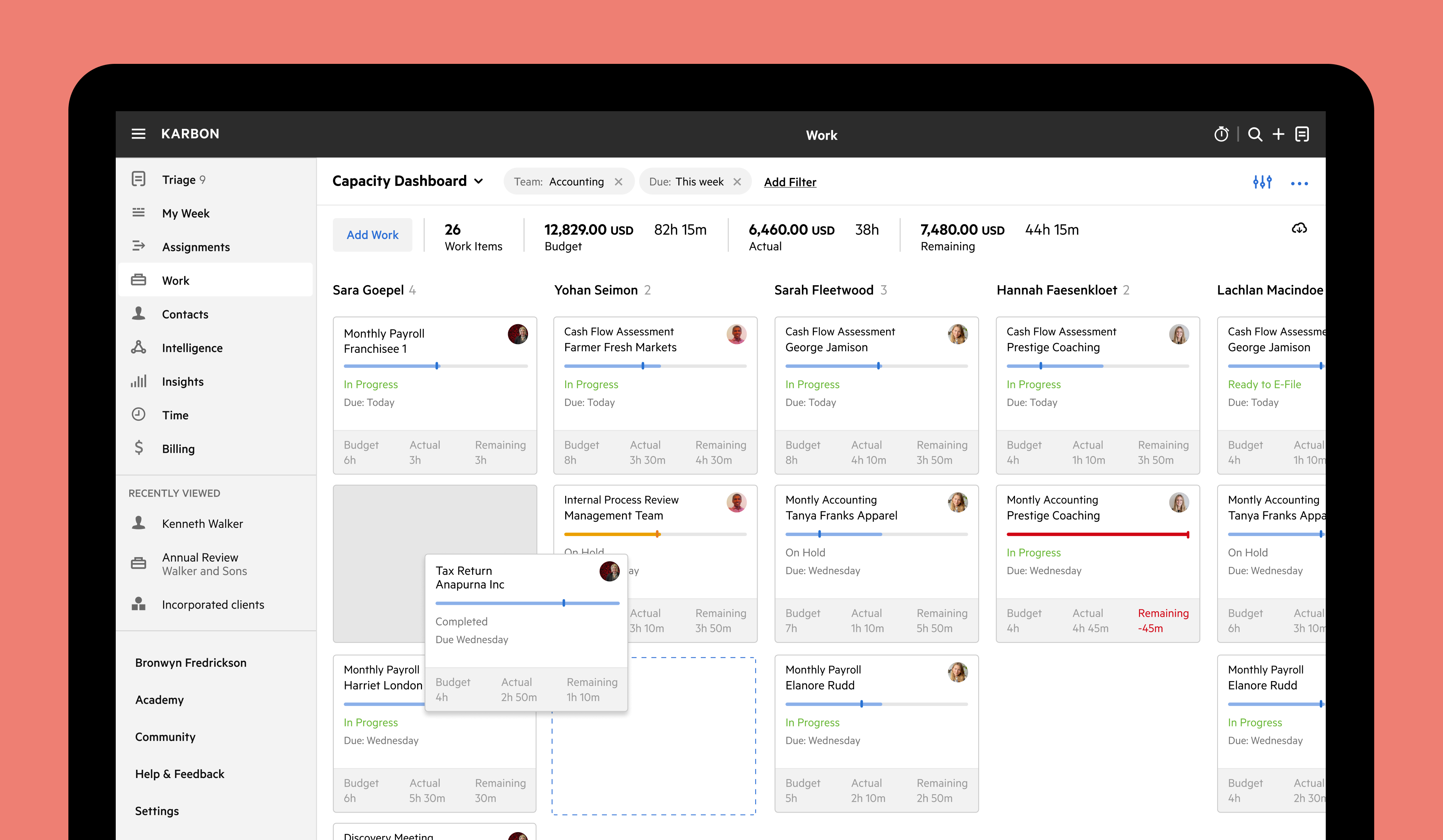

Karbon’s capacity management dashboard

Benefits of Karbon

Direct email integration (Gmail, Microsoft Outlook and Microsoft Exchange)

Built-in CRM

Automatic client reminders and client tasks

Client portal

Collaborate in context with @mentions

Template library with 250+ accounting-specific workflows

Time and budget tracking

Unlimited document storage

Document management system integration (Dropbox and OneDrive)

Invoicing and payment processing

Karbon AI: GPT-powered artificial intelligence built into email and workflows (currently in beta)

User community with 3,000+ members

Integrations that make sense for you (i.e. other leading accounting software)

Open API so you can build your own custom solutions

Limitations of Karbon

Learn how Karbon can give you the practice management confidence you need. Book a demo.

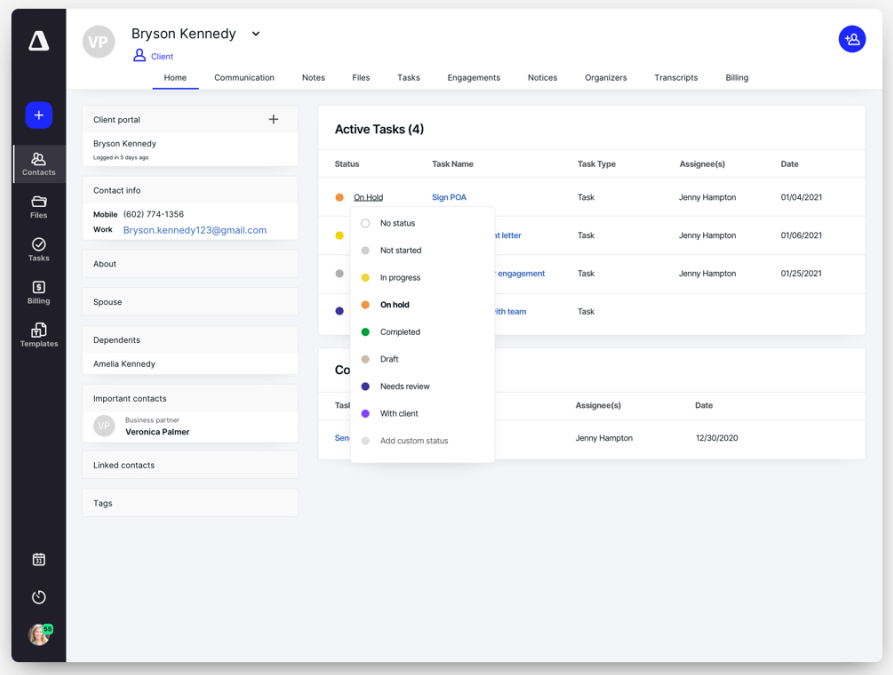

Canopy

Like Karbon, Canopy is a practice management tool for accounting and bookkeeping firms.

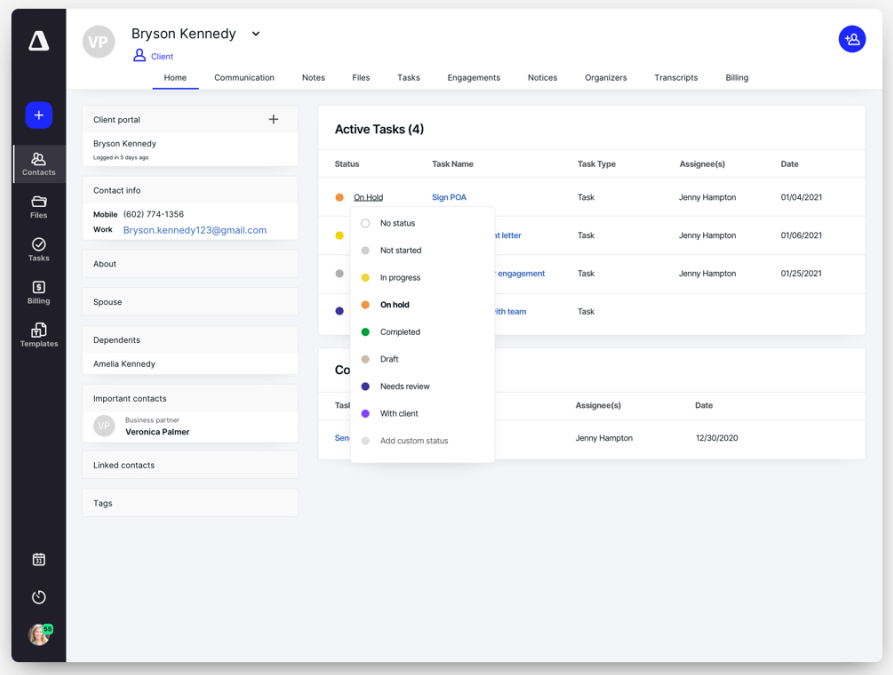

Client view in Canopy

Benefits of Canopy

Tax resolution cases and integration with IRS (paid add-on)

Flexible document and file management functionality (paid add-on)

Time, billing and invoicing capabilities

Limitations of Canopy

Key product features are only available at additional costs (e.g. workflow management and document management)

Complicated and expensive pricing (pay per client, per add-on module, per user)

Limited workflow templates

Compare Karbon vs. Canopy

Financial Cents

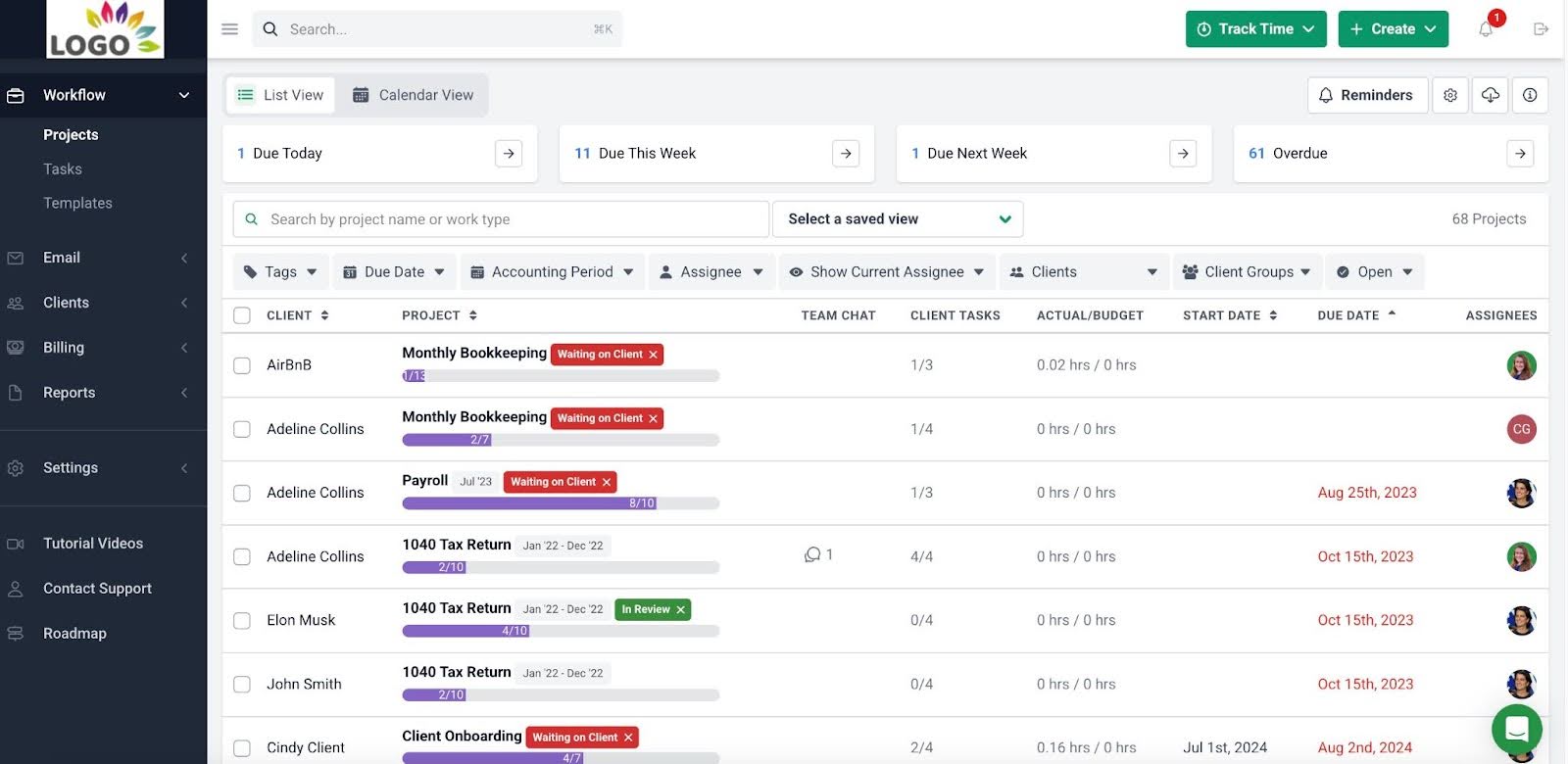

Financial Cents is a simple practice management solution for accounting firms looking for a solid entry-level tool.

Work dashboard view in Financial Cents

Benefits of Financial Cents

Limitations of Financial Cents

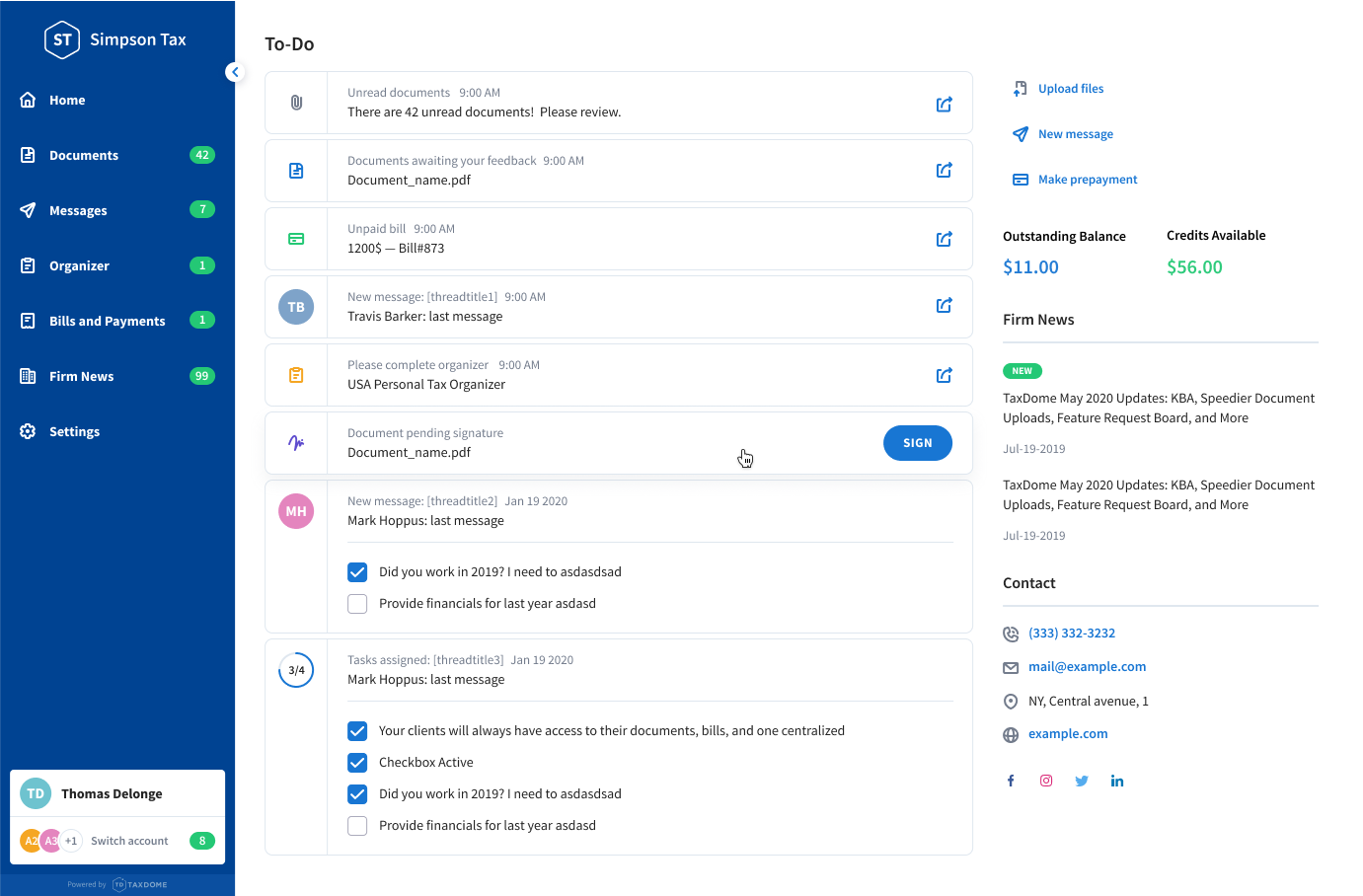

TaxDome

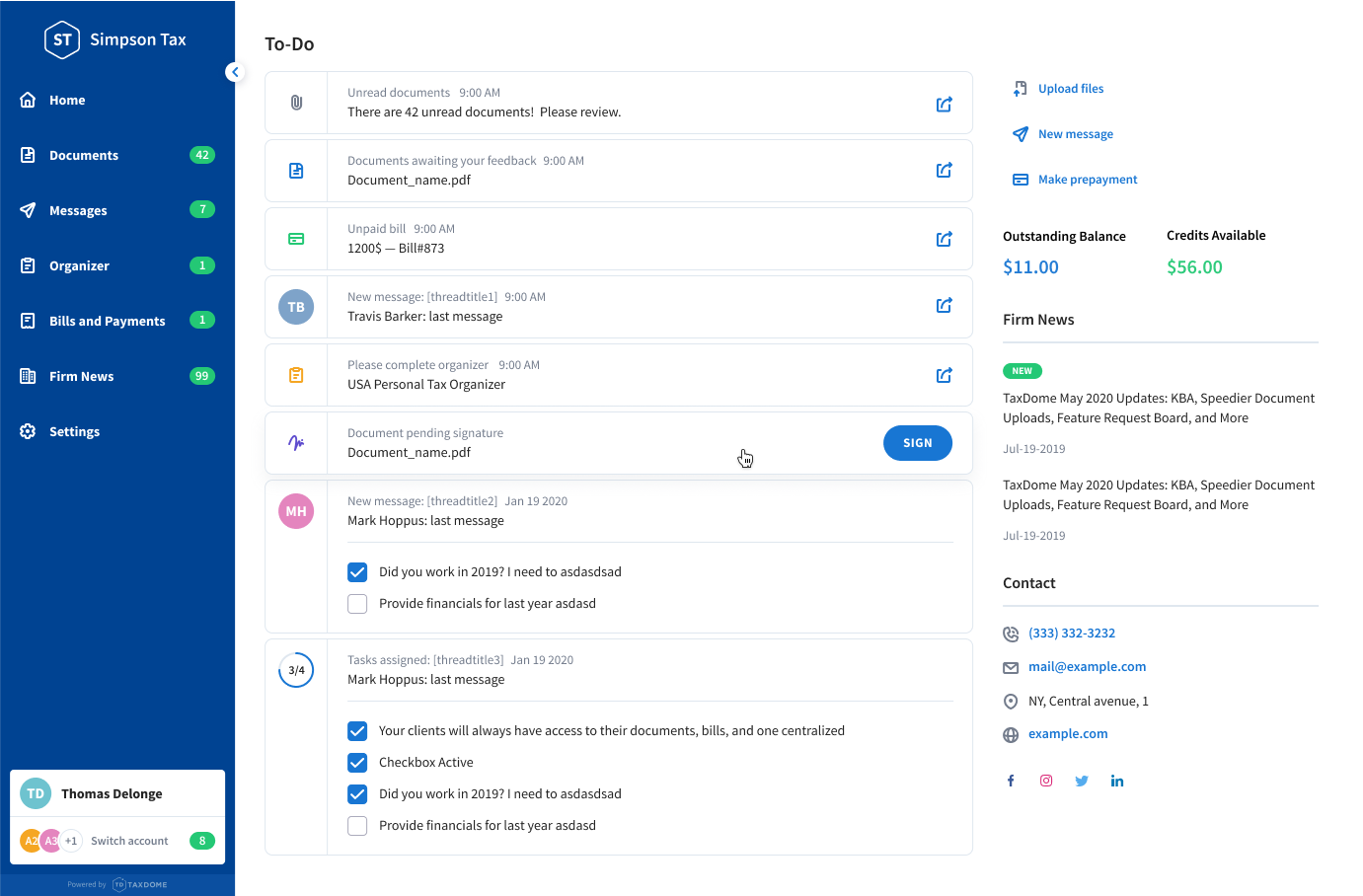

TaxDome markets itself as the ‘all-in-one platform for accounting, tax, and bookkeeping firms’. It offers a breadth of basic functionality.

To-do view in TaxDome

Benefits of TaxDome

Robust and customizable client portal

Unlimited document storage with a PDF editor

Affordable pricing (however the primary user must sign up to an annual subscription)

Limitations of TaxDome

TaxDome has a large amount of features, which makes it difficult to do them all well—this means they generally feel underdeveloped

No budget vs. actual reporting

No high-level visibility across your entire firm’s work (limited to each ‘pipeline’)

No built-in reporting and analytics or customizable business insights dashboards

Compare Karbon vs. TaxDome

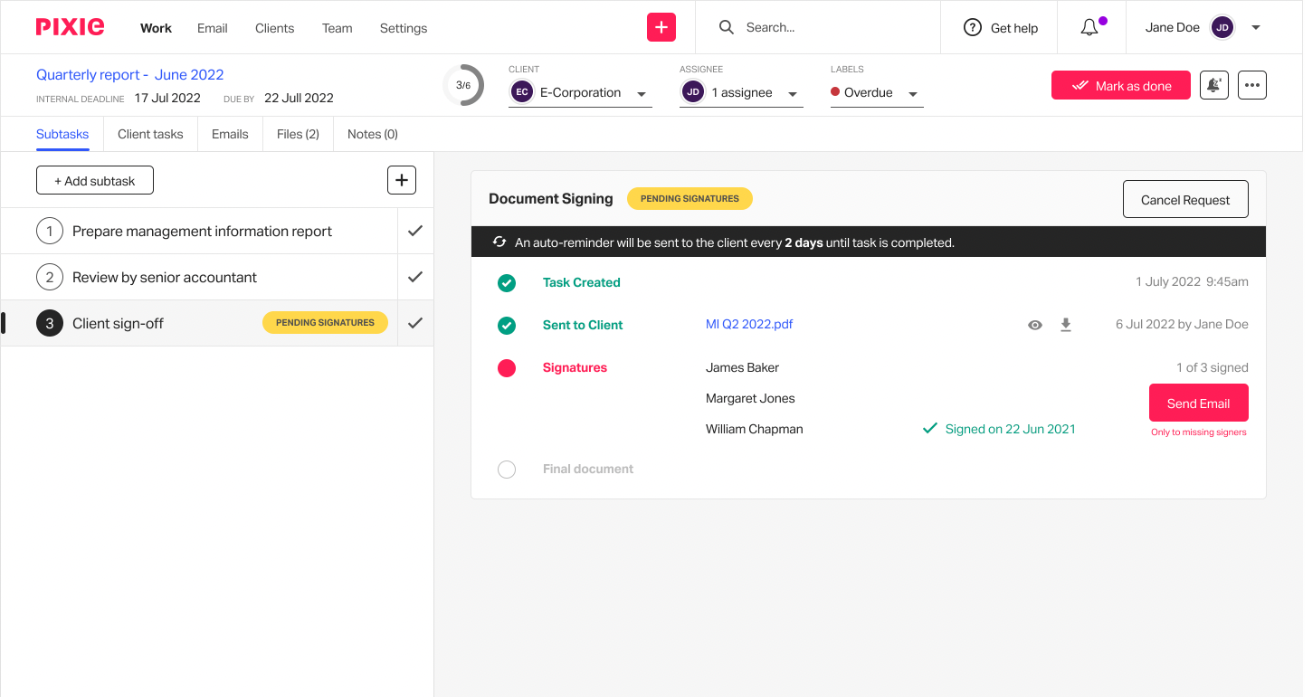

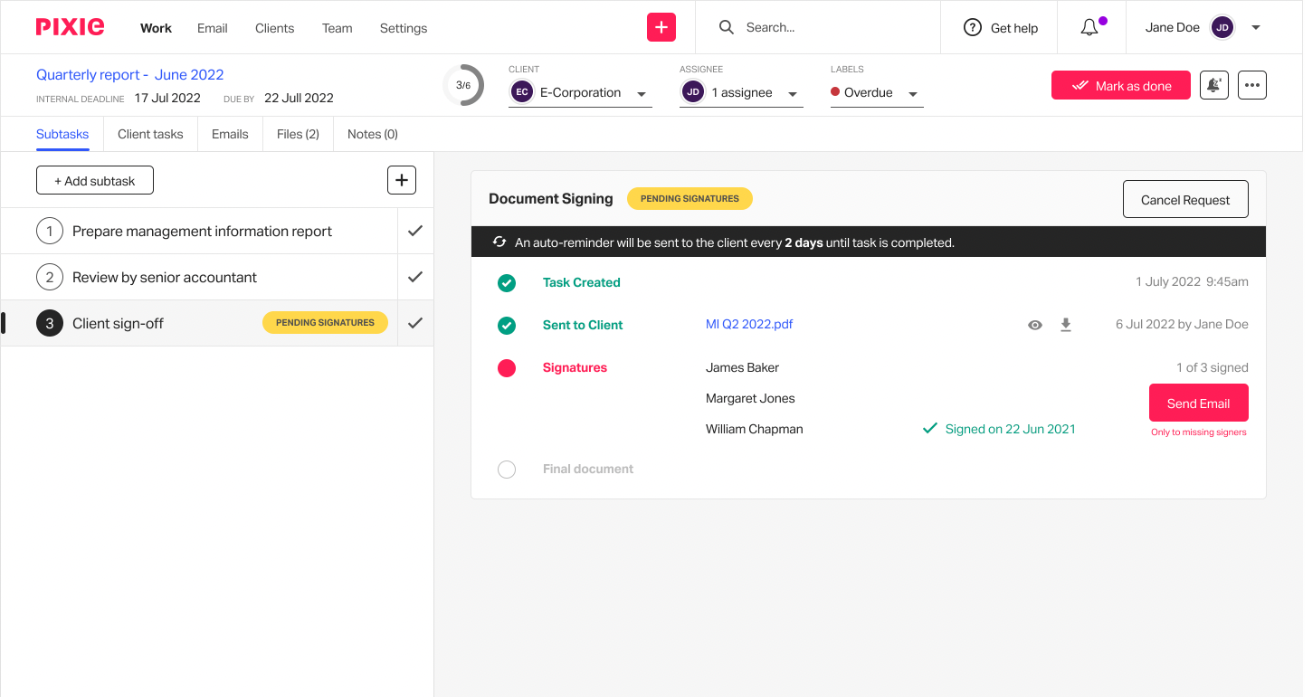

Pixie

Pixie is a practice management solution that primarily focuses on smaller firms across the UK.

Work view in Pixie

Benefits of Pixie

Affordable solution, especially for small firms with 1-3 employees

Flexible recurring work functionality

Best-practice template library

Limitations of Pixie

Limited collaboration functionality (unable to tag colleagues in comments or notes, making teamwork difficult)

Limited automation

No time and budget tracking

Compare Karbon vs. Pixie

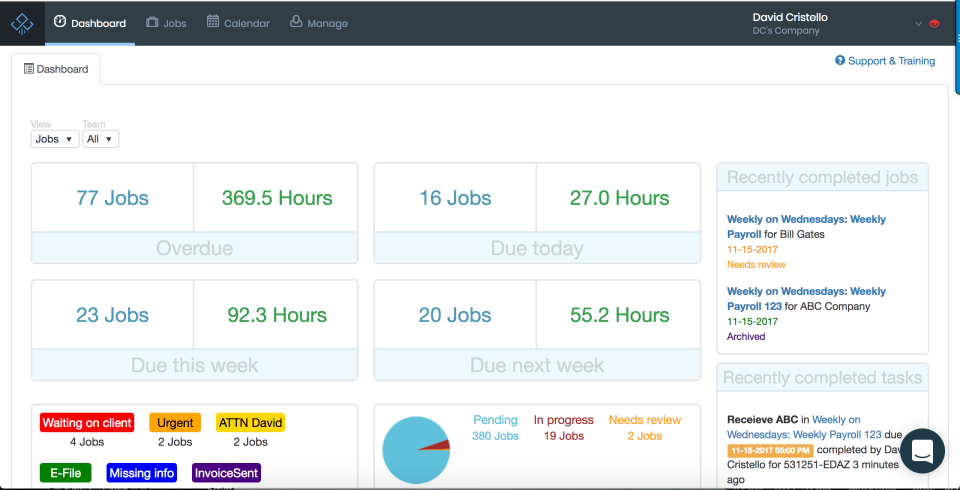

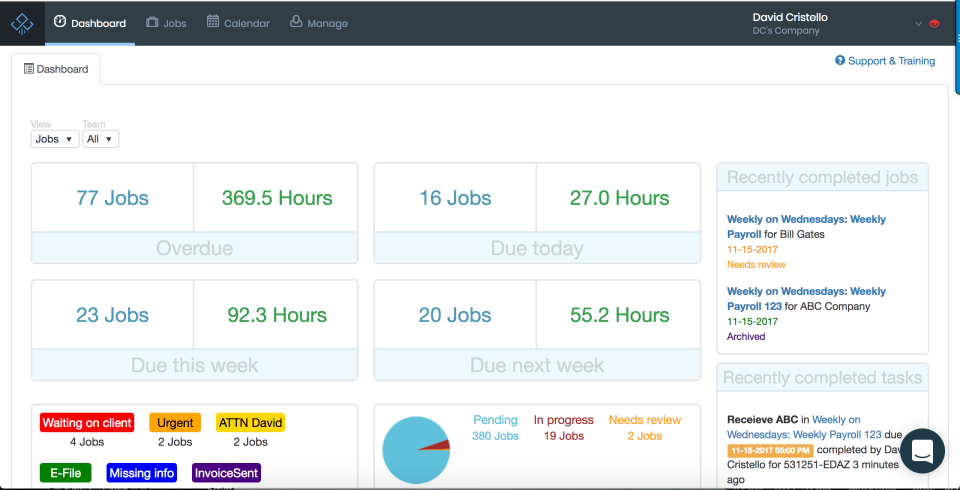

Jetpack Workflow

As its name suggests, Jetpack Workflow provides workflow management for accounting firms. So it’s important to note that Jetpack Workflow is not a practice management solution, but it's often mentioned in the practice management category.

Jetpack Workflow dashboard view

Benefits of Jetpack Workflow

Affordable pricing for simple workflow management

Time tracking capabilities

Useful dashboard with a high-level overview of work and your firm

Limitations of Jetpack Workflow

No email integration

Limited automation

No client portal

Compare Karbon vs. Jetpack Workflow

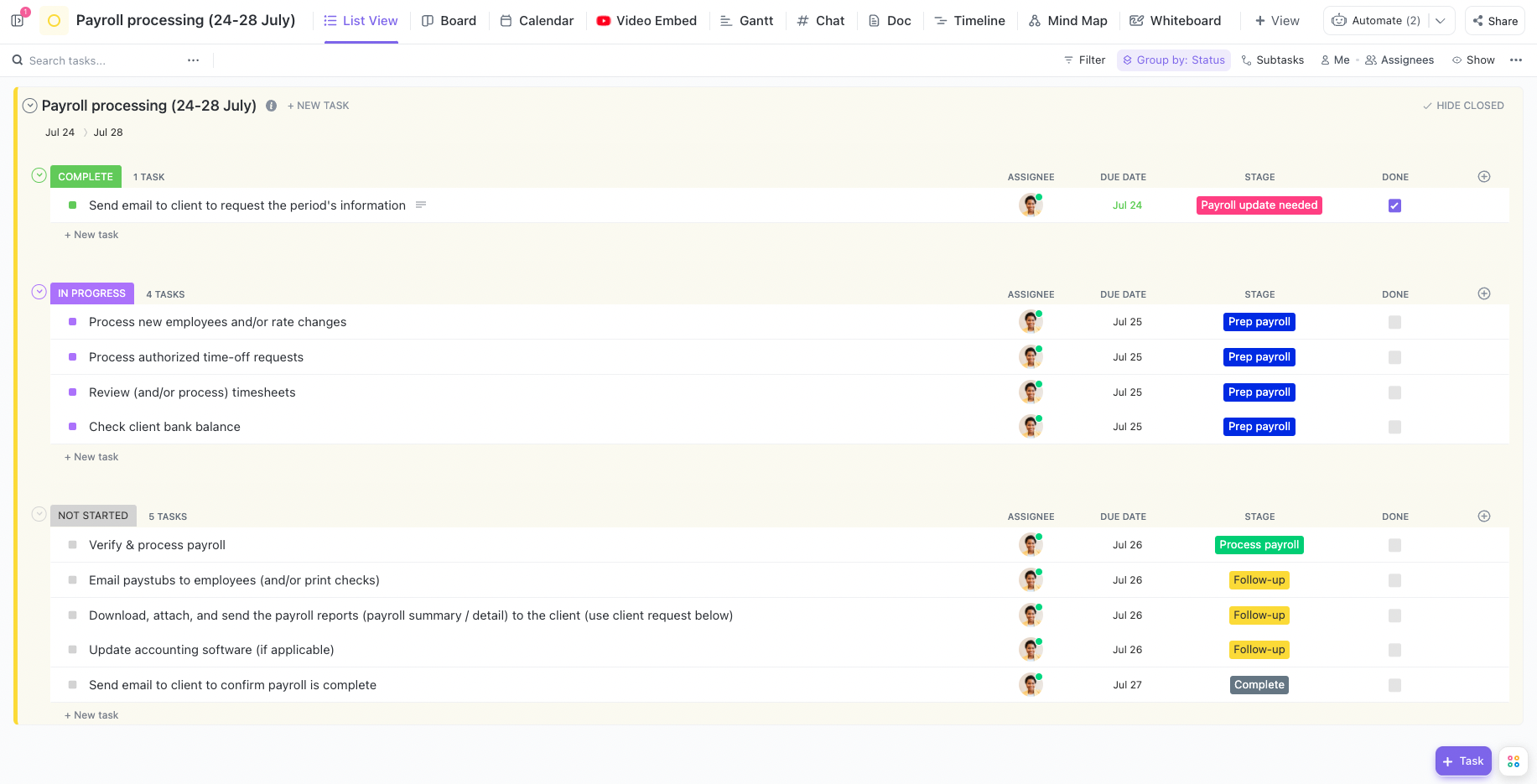

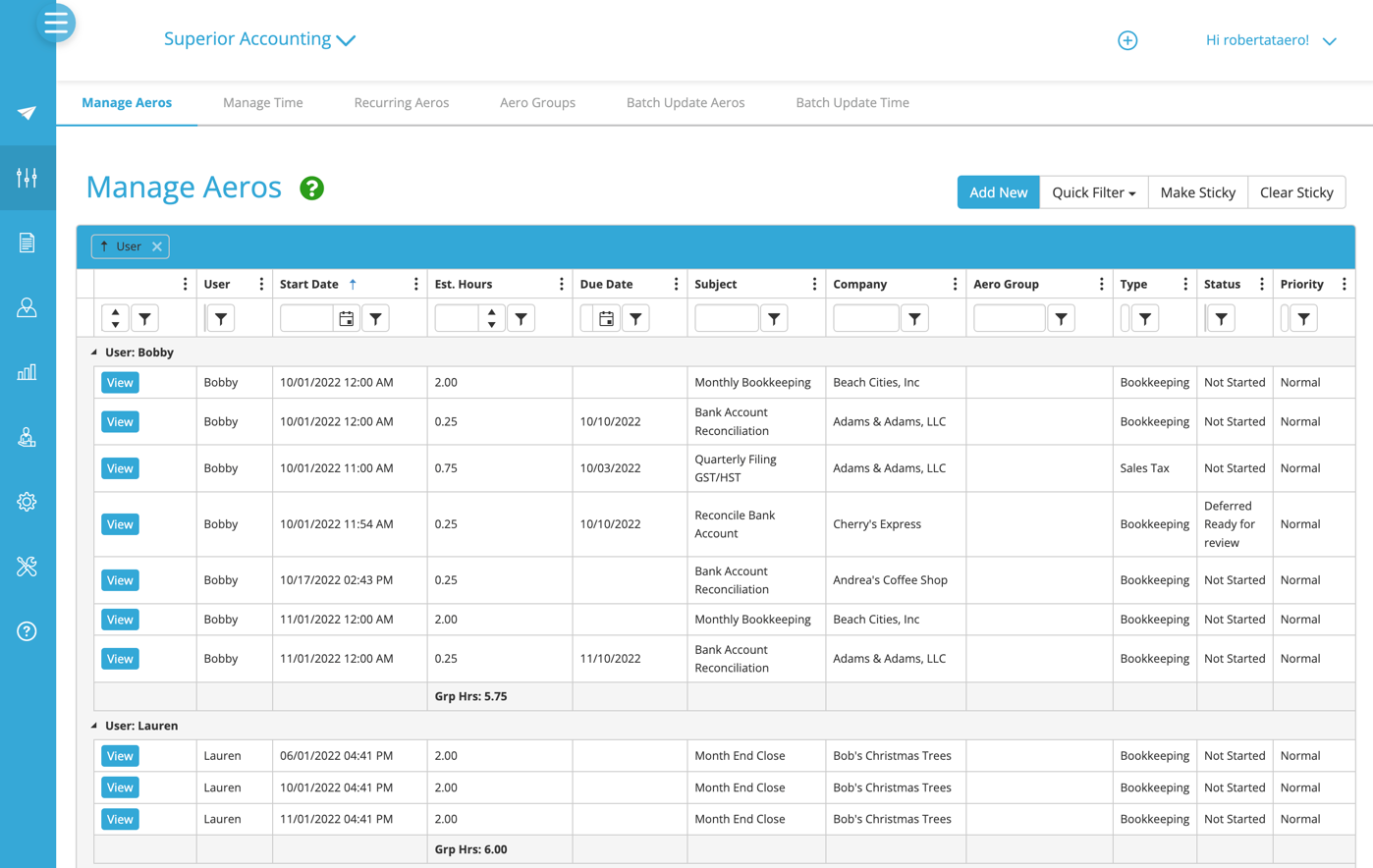

Aero Workflow

Aero Workflow is another solution that provides workflow management capabilities for accounting firms. Again, it’s important to note that Aero Workflow is not a practice management solution, so it does lack in areas you need to manage your firm.

Team capacity view in Aero Workflow

Benefits of Aero Workflow

Limitations of Aero Workflow

Not a practice management solution

Lack of direct integrations

Limited automation

Not suitable for firms with 3 or more staff

Compare Karbon vs. Aero Workflow

Is ClickUp right for accounting firms?

Here’s the important question: Is ClickUp the right solution for accounting firms?

If you’re a sole practitioner or have just started your firm, ClickUp might be a solution to consider. And if you’re looking for a free option, ClickUp includes a decent amount of functionality in its basic plan (more than other general project management tools).

But your firm will grow. And as it does, it’ll outgrow ClickUp. You’ll find yourself working hard to manipulate it to suit your firm’s way of working day-to-day, not to mention battling the overwhelming customization options.

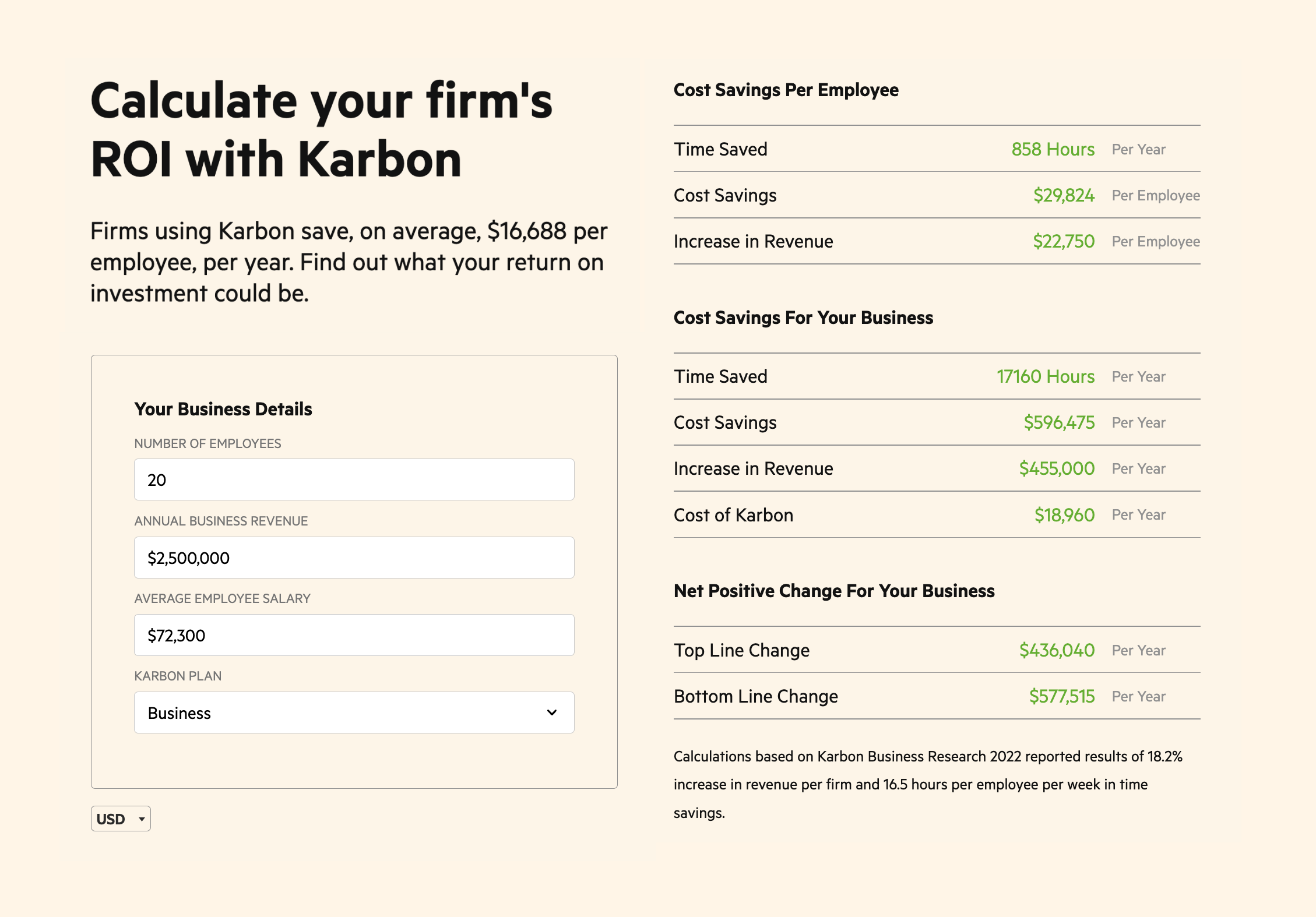

An accounting-specific practice management tool will grow with you, your team and your firm, helping you get work done the way you need to.

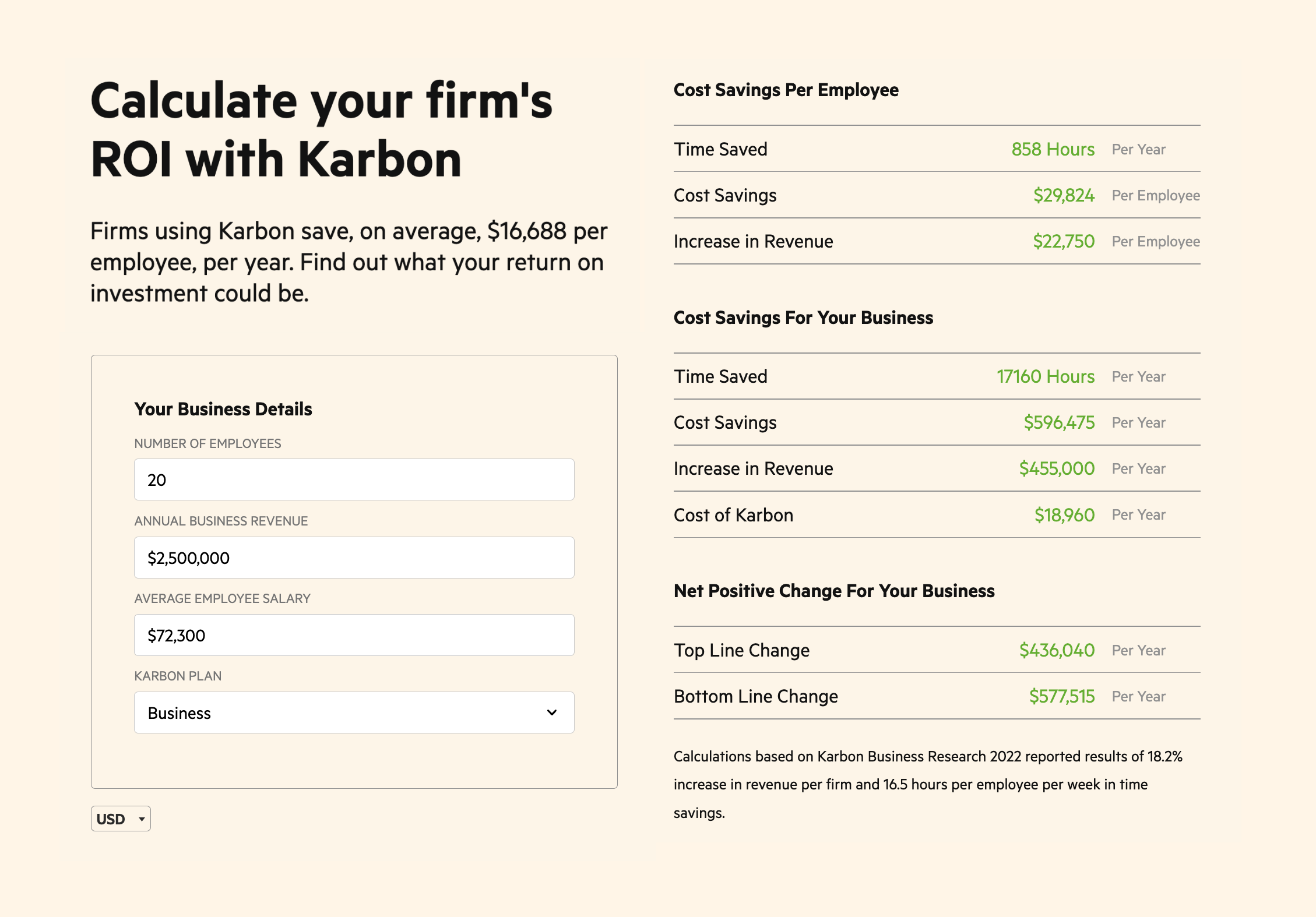

Take Karbon, for example. Accounting firms using Karbon save an average of 18.5 hours per employee each week, giving them more time to focus on client relationships and growth activities.

Average time and money savings for firms using Karbon

To better understand the benefits of using a practice management tool like Karbon, you can calculate your firm’s ROI using Karbon’s ROI calculator.

For example, if your firm has 20 employees, you would:

Save 858 hours per year, per employee

Save $29,824 USD per employee

Increase revenue by $455,000 USD per year

Karbon’s ROI calculator

For a more in-depth understanding of how Karbon can impact your firm’s profitability, book a demo.

Selecting the right tool for your accounting firm has the potential to be one of the most important decisions you can make. It’ll either set your firm up for scalable growth, or simply add to the problems you already have.

To ensure the former, start with a practice management tool that makes sense to you, your team, your firm, and your vision.