What is accounting technology?

Accounting technology is any digital tool that improves and automates your accounting processes and increases efficiency and accuracy (think cloud computing, machine learning, AI, blockchain, etc.).

If you look inside today’s leading accounting firms, you won’t find a room of paper shufflers. You’ll find accountants empowered as strategic advisors and consultants behind cutting-edge AI and automation tools.

Accounting technology is any digital tool that improves and automates your accounting processes and increases efficiency and accuracy (think cloud computing, machine learning, AI, blockchain, etc.).

The convergence of finance and tech is ushering in a new era, where having access to modern accounting technology isn't an option—it's a necessity.

What does ‘accounting technology’ actually mean?

Accounting technology is any digital tool that improves and automates your accounting processes and increases efficiency and accuracy (think cloud computing, machine learning, AI, blockchain technology, etc.).

And, across the entire accounting industry, technology and automation are on the rise:

48% of CFOs plan to heavily invest in accounting technology to streamline finance tasks

The accounting software market is projected to reach a $19B valuation by 2026

Leading accounting firms use workflow and CRM tech 120%-130% more than their less competitive counterparts

Want to know what’s behind these numbers and how you can leverage the right emerging technology at your firm?

Here are the top 6 accounting technology trends of 2025 and what it means for forward-thinking firm owners, CPAs, accountants, and bookkeepers looking to streamline production and efficiency.

Accounting has undergone a significant transformation in recent years, largely driven by the rapid advancement of automated technology.

Automation represents a fundamental, positive shift in the way financial data is processed, analyzed, and reported. Studies show that 77% of all general accounting operations can now be fully automated with the right tech stack.

What are the benefits accountants can expect?

Streamlined data entry and processing. Automation tools have revolutionized how data is recorded and stored. Manual data entry is being replaced by software solutions that can automatically extract and input data from various sources—think invoices, receipts, and financial statements.

Real-time reporting. Automation is ushering in a generation of real-time financial reports, which is crucial in today's fast-paced business environment. Stakeholders can access up-to-date financial information, enabling quicker decision-making and strategic planning.

Cost savings. Automation solutions require an initial investment, but more often than not, it leads to big returns. Reduced manual labor, decreased error rates, and improved efficiency all translate into lower operational costs across the board.

Scalability. Automated accounting systems can easily adapt to the changing needs of small businesses. Whether a company is small or large, automation can scale to handle increasing volumes of financial transactions and data.

Automation technology is so big that it touches nearly every emerging trend in the industry.

In 2025, a significant portion of business is done through remote workers, mobile devices, and global interactions.

So, naturally, local servers no longer service the needs of modern accounting firms. And they haven’t for a very long time.

But cloud computing does.

Cloud computing is the practice of using remote servers hosted on the internet to store, manage, and process data and applications, securely placing it at your fingertips anytime, anywhere, and on any device.

Most people use the cloud every day without even knowing it.

Gmail, Microsoft Office, Slack, and social media platforms like Facebook and Instagram are all examples of cloud-based tools.

So what are the benefits accountants are reaping by using cloud technology to streamline accounting and bookkeeping?

They’re getting fast access to detailed financial breakdowns and key metrics from anywhere in the world. They are collaborating on processes remotely, spending less time on data maintenance, and using the cloud’s open API to connect their tools into one platform.

According to Karbon’s 2022 Practice Excellence Report, cloud accounting is the most used technology solution, with 86% of firms reporting adoption of the cloud.

If you’re curious to learn how your firm stacks up against others around the globe, take the free Practice Excellence Assessment and download the most recent findings here.

Speaking of remote work, collaboration tools are addressing the demands of modern work environments, specifically in accounting.

Collaboration tools enable accountants to work efficiently, communicate transparently, and provide clients with high quality services, regardless of where they, their team and clients are located.

Tools like Slack, Google Drive, and Zoom are collaboration tools that accounting teams have quickly adopted in the last decade.

But cutting-edge firms are taking it a step further and adopting all-in-one accounting tools that unite their team in a single platform.

The best practice management tools sync inboxes and break down email silos, offer chat functionality within projects, bring tasks together in collaborative to-do lists, provide project management views and dashboards, and offer it all—in one platform.

Modern data has disruptive potential.

A recent study found that 89% of respondents believe big data will transform business in a similar way the internet did.

Big data refers to data that has greater depth and breadth than traditional data. It's more reliable, pulling and compiling data points from a vast amount of sources, like historical data, social media activity, the cloud, stock markets, and even the weather.

The same study reports that 79% agree that companies that refuse to embrace big data will lose their competitive position.

So how are leading accounting firms harnessing big data today?

Gaining customer insights: Big data is personalizing solutions by providing insights into client behavior, preferences, and needs.

Predictive analytics: With big data you can make predictions about future trends, cash flow, and financial performance.

Real-time reporting: Firms are using it to uncover real-time financial insights that can guide immediate decisions.

Fraud detection: Utilizing diverse data points like transactions, employee actions, and external cues, big data reveals patterns that can uncover fraud.

Remember that statistic that says 77% of all accounting activities can now be fully automated?

According to a survey from Deloitte, over 75% of accountants report that their processes still require a considerable amount of manual effort.

What does that mean for you?

Adopting the right automation technology to streamline your day-to-day work and eliminate time-consuming tasks can put you light years ahead.

Here are some ways you can start automating your work today:

Automate repetitive tasks. Automate client data collection, client and staff onboarding, and standardized daily processes—anything to keep you from wasting time on repetitive, time-consuming accounting tasks.

Use forecast automation. Automation can be used to rapidly create and compare multiple scenarios, helping you with proactive decision-making, while also fostering seamless collaboration among team members.

Try tasklist automators. These are a critical part in unlocking productivity. Think of these as customizable ‘triggers’ that automatically update task statuses based on a series of conditions that you set.

Build app integrations. Using ‘no- and low-code’ tools like Zapier, you can automate parts of your workflow that rely on several apps that don’t directly integrate with each other. Here are 10 Zapier automations to consider.

Headlines have been completely riddled with talks of artificial intelligence taking over and stealing your job.

Artificial intelligence in accounting is projected to grow 32% year-over-year through to 2028.

But, the reality is this: AI is here to make your job easier, not redundant. Current AI trends in accounting all involve accounting professionals leveraging the power of AI to work smarter.

Here are some ways accountants are already using generative AI:

Finding deep, real-time data about their clients

Identifying financial patterns, trends, and anomalies in a fraction of the time

Harvesting big data automatically to inform strategy and forecasting

Summarizing large volumes of content and financial reports to uncover actionable insights

Transcribing phone calls and rendering minutes for meetings

Looking ahead, accounting technology promises to help you continue to become your clients’ trusted strategic advisor.

The right tech stack will help you navigate complex financial landscapes as well as perform human-centric, relationship-building activities.

Evidence of this evolution is already taking shape:

ChatGPT saw over 1 billion monthly visits in February 2023 alone, with 25% of users reporting that the tool saves them over 10 hours of work every week.

While technology is taking the brunt of routine tasks and data processing, accounting professionals are being liberated to step into a more consultative role, offering clients insightful financial analysis, risk assessment, forward-thinking strategies, and personalized services.

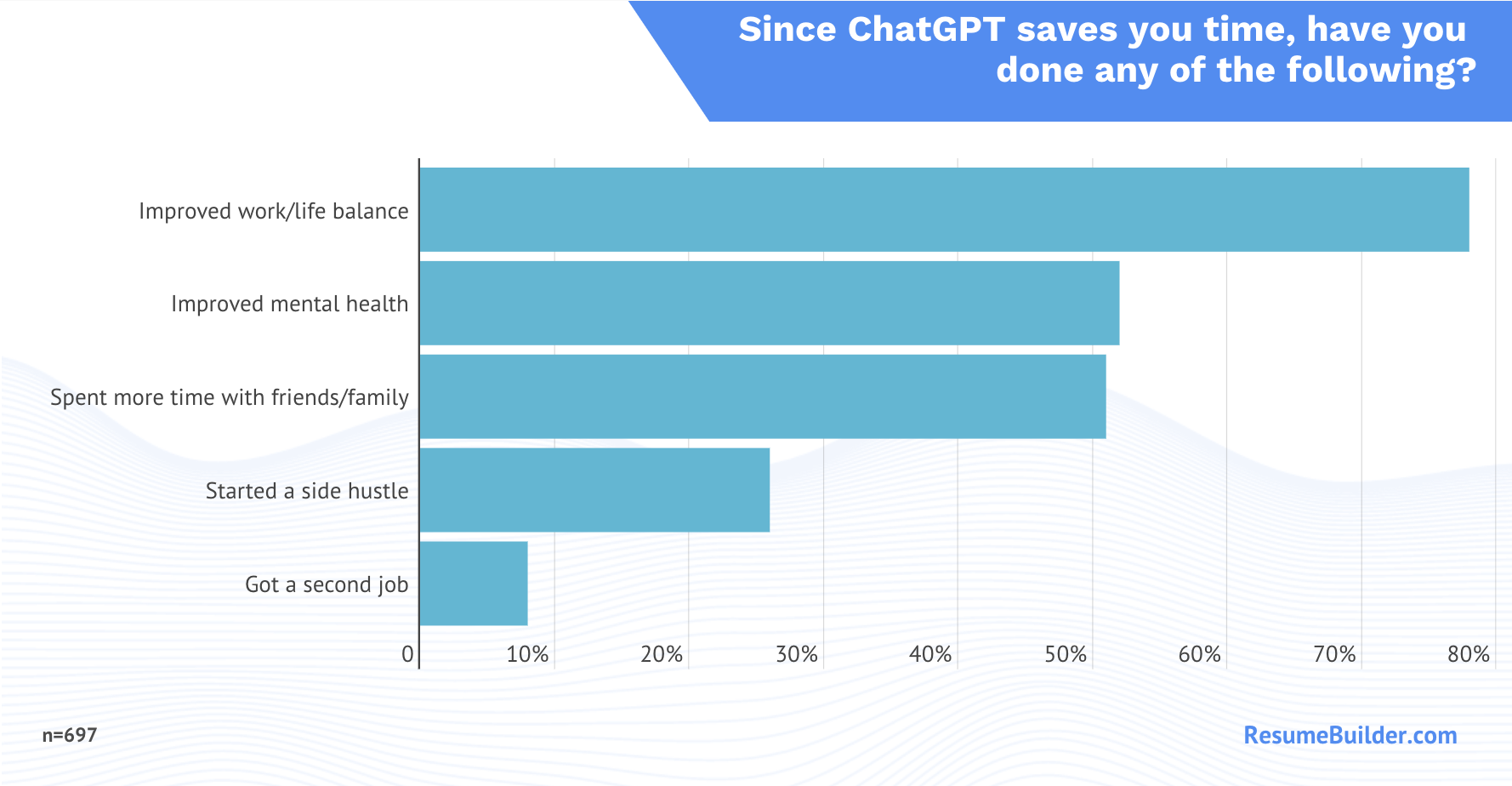

As if that wasn’t enough, automation tools are offering people a better work-life balance, improved mental health, and even time to start side projects.

As powerful as ChatGPT and artificial intelligence are, it’s important to keep in mind that they aren’t a one-size-fits-all solution. They come with limitations and considerations that must be acknowledged.

For example, generative AI tools are only as good as the data they’re trained on.

Biases in data, along with potential gaps or inaccuracies, can propagate into the AI's responses, leading to poor conclusions or advice.

They lack the complex judgment that human experts possess to weed through information that’s incorrect and irrelevant.

Here are some other things generative AI technology can’t do:

Adjust to unseen or uncertain situations

Empathize, relate and respond in the way that humans can

Interpret highly-nuanced language (e.g. legal documents, financial spreadsheets)

Always give accurate and tailored guidance and advice

Provide present-day information and data

Using generative AI tools presents an opportunity to reshape your workflow and concentrate on the unique strengths that only humans can bring to the table.

In this way, AI will become your partner, not your adversary.

When you choose your accounting tools, you only get out what you put in. Is the accounting technology at your firm paying off?

As you search for the best accounting software for your firm, look for a few key features:

Workflow automation. Save time by automating the repetitive (but still necessary) tasks like work status updates and data entry.

Email automation. Find software that streamlines client engagements by scheduling your emails (even better if they include GPT-powered technology to help you draft your messages).

Automated client reminders. Reduce wasted time chasing clients for information and increase everyday efficiency with a tool that gives you automated email reminders.

Karbon is an accounting practice management solution that can do all three, plus more.

Each week and per employee, firms using Karbon save:

3.2 hours chasing clients

2.1 hours automating low-value admin tasks

3.9 hours managing and completing work and tasks

To better understand the benefits of using Karbon, you can calculate your firm’s ROI using Karbon’s ROI calculator or book a demo.

With the right mindset and approach, accounting technology will become a powerful ally for driving growth, efficiency, and excellence in your practice.