How to write an accounting engagement letter (plus examples)

The accounting engagement letter is the first official step in your relationship with a new client. Cover all your bases with this template.

First impressions can make or break a business relationship. And an iron-clad accounting engagement letter is crucial in setting up each client relationship for success.

It’s the first major communication with a client and is the perfect opportunity to set expectations and lay ground rules to avoid scope creep, disappointment, or miscommunication further down the road.

Rather than start from scratch, you can download the Accounting Engagement Letter template from the Karbon Template Library. You can customize it to suit your firm and each client.

What is an accounting engagement letter?

An accounting engagement letter is a comprehensive legal document that outlines and then details the terms of your business relationship with each client. Though it is generally shorter than a contract, it is legally binding and designed to reduce liability. It should clearly state the following:

Identification

Scope of services

Period of engagement

Fee structure and terms

Responsibility and commitments

Professional standards

Dispute resolution and arbitration

Terms and conditions

The engagement letter signifies the beginning of an accounting relationship and can (and should) be referred to regularly to ensure standards and expectations are met.

Why your accounting firm needs engagement letters for every client

Every client relationship is unique and has the potential to change and develop as time progresses. That’s why you need specific accounting or bookkeeping engagement letters for every client.

Not only does it protect the interests of your firm and your clients, it also ensures clarity across every aspect of the engagement.

Tip: In situations where you have a personal relationship with a client, engagement letters can be even more important. Establishing the terms of your business relationship will help prevent disputes or awkward moments—tasks you’re unsure about charging for, for example.

Essential elements: How to write an iron-clad accounting engagement letter

Here are the key components of a professional accounting engagement letter:

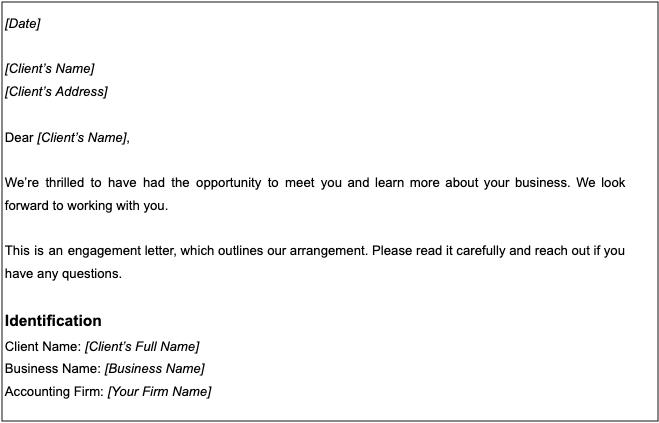

Identification

Identify the various elements that comprise the agreement: firm name, client name, the nature of their business and your business relationship.

Engagement letters should clearly explain their purpose and legal function in terms that clients can understand. Don’t assume clients understand accounting or legal terminology. Taking complex accounting terms and helping clients understand them is part of what you do when advising them, and your engagement letters should do the same.

Sample of the introduction and identification section of an accounting engagement letter

Scope of services

An engagement letter should detail exactly what accounting, bookkeeping or other advisory professional services you will provide for a client. If the language is broad or open to interpretation, then so is your scope. This will almost certainly lead to scope creep.

Scope creep is a constant battle for every accountant but having a detailed written reference of what has been agreed to helps prevent it.

Identifying the scope of work benefits your clients, too. It tells them exactly what they’re paying for, giving them the right to question your services if there are needs not being met.

Scope of services sample section of an accounting engagement letter template

Period of engagement

This refers to the start date and other key dates throughout the engagement period.

It is also worthwhile to define how the nature of your agreement will continue after the period of engagement:

Will it automatically renew?

Does there need to be a review of terms at the end of the contract before another agreement is entered into?

Period of engagement sample text in the Accounting Engagement Letter Template from the Karbon Template Library

Fee structure and payment terms

The engagement letter should define the pricing structure as clearly as possible. You can break down each of the services you’re providing along with their respective fees, or if you’re providing a service package, you can outline exactly what’s included.

Recommended reading: Accounting services pricing strategy guide

The fee structure is linked to the scope of services and should specify the process for handling requests that fall outside the agreed scope. For example, 'Should any additional services be required, both parties must agree on the fees in writing before work begins.’

The engagement letter should include how often you will invoice, i.e. upfront, quarterly, monthly, year-end and include an expected timeframe for payment.

Learn how you can double your firm’s pricing: Download The Pricing Playbook.

Pricing, fee structure and payment terms should be outlined in an accounting engagement letter for each client

Responsibilities and commitments

This outlines each party’s responsibilities and commitments, keeping you accountable to your client, and your client accountable to you. It outlines a clear path to address what to do if parts of the agreement aren't being upheld.

For example, clients have a responsibility to provide prompt, accurate documents and financial information, which will allow you to meet your responsibilities. If you can’t perform the services you're engaged for because your client hasn’t provided the information you need, you can refer back to your engagement letter.

Sample text for the Responsibilities and Commitments section of an accounting engagement letter

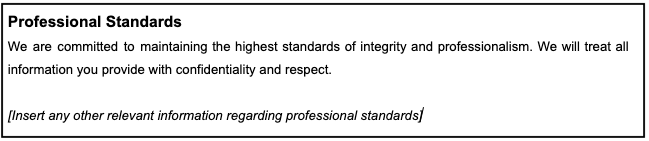

Professional standards

The letter is a commitment to professionalism and a formalization of the standards that you hold yourself to. It’s a promise to honor deadlines, conduct business professionally, and hold your client’s best interests at heart.

But it is a two-way street, and you can also detail expectations for prompt communication, payment, and professional courtesy.

Sample text for the Professional Standards section of an accounting engagement letter

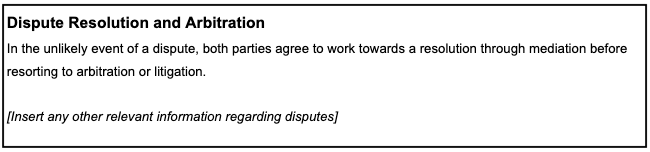

Dispute resolution and arbitration

Define a step-by-step process and identify any arbiters if there is a dispute at any point. These stipulations reduce liability and inherent risk, helping avoid legal action by laying the foundations for peaceful mediation in the event of a misunderstanding.

Miscommunication can snowball quickly, and having a de-escalation procedure in place stops things before they get out of hand.

Dispute resolution sample text found in the Karbon template: Accounting Engagement Letter

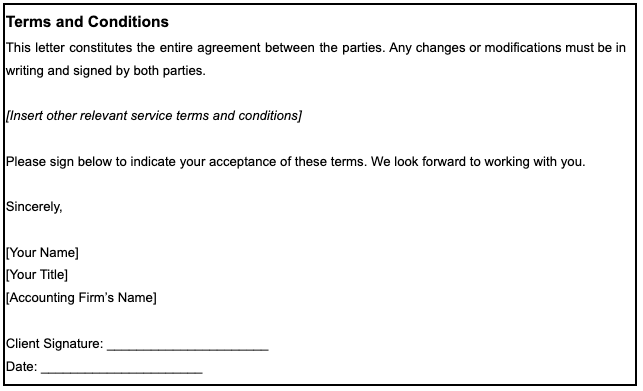

Terms and conditions

Accounting engagement letters are legal documents and should be treated as such, with general terms and conditions specified. It’s important to consult a lawyer for legal advice when writing these letters to address the nuances of different industries or client needs.

Include a confirmation of these terms by asking for your client’s signature so they formally understand the agreement they’re entering into.

Terms and conditions section of a sample accounting engagement letter

When to use an accounting engagement letter

Generally, a client engagement letter should be used prior to starting any new work for a client, especially if they include:

Long-term projects

The engagement letter can outline a timeline for long-term projects,serving as a blueprint to guide how the work will move forward.

The engagement letter should also stipulate how and if the relationship continues after the project is completed. Is there the potential for continued engagement? If so, will a new engagement letter be required?

High-risk clients

When dealing with high-risk clients, you can include stipulations about what action will happen if there are any late or missed payments, as well as state in unambiguous terms what your expectations are from them.

Bad billing practices can result in expensive losses and lessons, so it’s far better to take the appropriate caution from the beginning. In general, the letter can serve to preempt any issues for you when working with high-risk clients.

Accounting engagement letter: Samples and templates

Different types of clients require different styles of engagement letters. The Accounting Engagement Letter template from the Karbon Template Library is a good foundation that can be customized to suit your firm and individual clients.

This example engagement letter from the AICPA, although general, encompasses all the aspects discussed above. It provides a practical starting point for US-based accounting professionals.

Here is a selection of templates for UK-based professionals. The examples provide explanations as to which aspects to include for various service types.

You can also generate engagement letters using accounting software like Ignition and GoProposal, which integrate with practice management tools like Karbon and can automate aspects of the client onboarding process.

Engagement letters start relationships, an efficient firm maintains them

A well thought-out, professional, and airtight engagement letter starts business relationships on the right foot, with everyone on the same page. Templates can be utilized to ensure a consistent high-quality output while saving time.

Templates aren’t limited to engagement letters and onboarding, either. Almost every bookkeeping and accounting process can be expedited by using templates. The Karbon Template Library has hundreds of workflow templates, ready for you to add to your Karbon account with one click or download as Excel spreadsheets.

Templates are available for common processes including:

Here is a comprehensive list of the top free templates every accounting firm should have.

Efficiency is key when using templates, but they're not the only resources available to optimize your time. Practice management software like Karbon can further improve your operations, saving each employee an average of 18.5 hours per week.

Book a demo or sign up for a trial to transform your firm’s efficiency and profitability.