How AI will affect accounting, your firm, and you

Technology has always changed accounting, but it’s never replaced the accountant. And it won’t start now.

Look at the cloud: it digitized work, making it accessible from just about anywhere. It didn’t replace the accountant. It made the job easier. The accounting profession has always evolved with the tools of the time.

The rise of AI is no exception.

Its fast automation, deep learning capabilities, and predictive pattern recognition will transform the industry, but like every new technology before it, artificial intelligence is only as powerful as the people who use it.

And there will always be demand for intelligent humans who can do what AI can’t, like interpret nuances, contextualize information, and empathize with clients.

How will AI affect accounting?

For the accounting industry, the uptake of AI is mostly unavoidable. According to The State of AI in Accounting Report 2025, 80% of accounting professionals report increased AI functionality in their existing accounting software.

Change is already here, and the reception is mostly positive. In that same report, 85% of respondents shared that they’re excited, or at least intrigued, by the prospect of AI.

They’re mostly excited by the prospect of AI increasing firm-wide speed and efficiency (85%), reducing errors (68%), and automating tasks (65%).

Could the future of accounting be AI-driven?

“If you told me five years ago that accountants would be excitedly sharing AI prompts and automation tips like grandparents sharing baby photos, I would’ve questioned your understanding of both accountants and excitement,” says AI expert, Chad Davis. “Yet here we are.”

Like with any new technology, there are pros and cons to AI. Here’s a breakdown of what that means for the accounting firms:

What AI can do for accounting firms

Running an efficient firm means knowing how to leverage the strengths of each team member. Think of AI as another employee. Based on its strengths, here’s what you can ask it to do:

Automate routine tasks. AI and agentic AI can take care of low priority, time-consuming, and repetitive tasks like data entry, freeing up valuable time for more complex, value-adding activities. 41% of accounting professionals are already doing this.

Streamline communication. 63% of accountants are using AI systems to compose emails and fine-tune their writing tone.

Make compliance work more efficient. AI can automate data collection, monitor regulations, review documents, detect anomalies, and generate audit-ready reports—reducing errors, saving time, and improving accuracy at scale.

Assist with financial forecasting. AI excels in pattern recognition and predictive analytics, allowing it to make predictions with relative accuracy, helping you to offer better insights and informed decisions to clients and other stakeholders. This is a quickly emerging AI use case in accounting.

Make tax season less chaotic. Some firms are starting to use AI’s capacity for data tracking and reporting to relieve year-end tax pressures.

Generate meeting transcripts. 40% of accountants are using AI to transcribe meetings, and automatically generate action items and meeting summaries for clients and colleagues.

Data analysis. Tools like ChatGPT are designed to learn from and analyze large volumes of data sets faster than humanly possible. Accountants and bookkeepers are using AI tools to identify valuable insights and discrepancies in financial statements and reports. In real time.

Research. This is a top emerging use case for AI in accounting over the last 12 months. 39% of accounting professionals are using AI technology like machine learning and generative AI to support a broad range of research activities and assist with decision-making.

What AI won’t replace in accounting firms

While AI continues to revolutionize the accounting industry, it’s still in development. Here’s where the use of AI falls short today:

Understanding contextual nuance. AI can crunch numbers, but it often fails to grasp the subtleties behind them. Like why a client made a certain financial decision or how industry dynamics in the accounting sector can affect financial reporting, financial data, strategic decision making, and data-driven decisions.

Replacing human judgment, experience, and creativity. Complex scenarios often require ethical judgment, critical thinking, and the kind of ingenuity that only comes from years of hands-on experience.

Managing worried clients. Even the best Language Learning Models will never replace human connection. Clients dealing with financial stress want empathy and reassurance from someone who can look them in the eye, and make them feel seen.

Keeping up with regulatory changes. Tax codes and compliance laws are constantly evolving. AI algorithms or models may sometimes lag behind or misinterpret the changes, and lack the ability to exercise discretion on gray areas.

Defending against cyber security concerns. AI-powered cyberattacks are on the rise, and as always, humans are the first line of defense.

Operating without quality assurance. Even when AI is used for automation, its output must be reviewed. It can hallucinate, pull outdated data, or make confident errors. You can’t fully ‘set and forget’ AI in accounting yet.

While AI replacing accountants may feel like a possibility, the technology has its limitations. Ultimately, it’s the human element, human expertise, and your ability as a human accountant to deliver a high standard of care that attracts clients and fuels good business. As long as you maintain that, accounting jobs will be safe in a world of ChatGPT and AI.

AI for accounting done right

Technological advances have always worked for people who are willing to understand them, and use them well. AI expert Inbal Rodnay encourages AI adoption as a way to grow accounting practices. “Some teams will know how to put AI to use, and some teams will not,” she says. “We know who we want to be.”

Karbon’s automation features and work templates have taken much of the rote work out of accounting firms, like building accounting processes and workflows, assigning tasks, sending client requests, and streamlining communication. As a result, firms like DigitPro save at least 8 hours a week.

And when it comes to Karbon’s AI features, it’s giving firms “an edge over the competition” while ensuring critical enterprise security and compliance.

With Karbon AI you can:

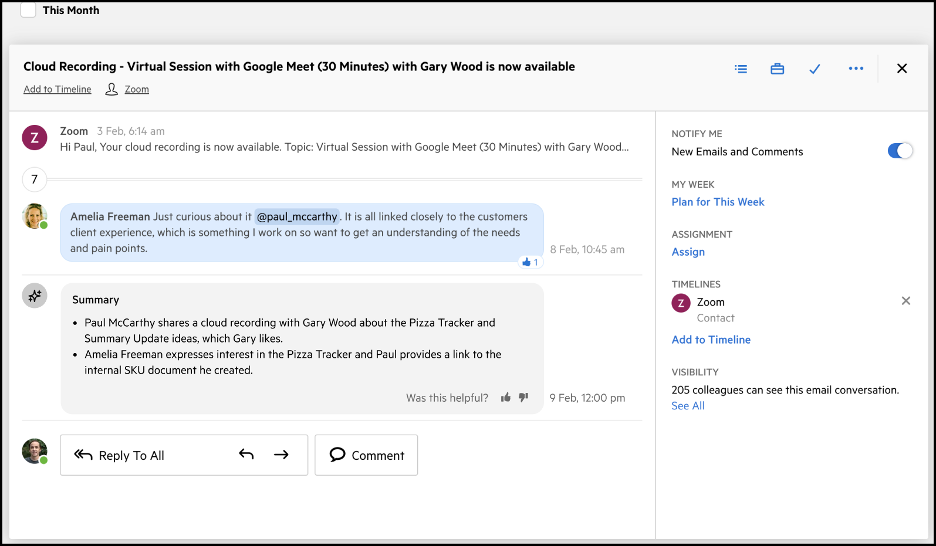

Summarize long email conversations and internal discussions. No need to comb through a long email chain to understand what’s important and actionable.

Summarize client timelines. An overview of any client’s emails, work, notes relating to them, and billing data into a single client brief.

Summarize work. A snapshot of key highlights and recent updates on any work item.

Compose email drafts. Karbon AI can create the first draft of an email based on short prompts or keywords, ready for you to review and adjust before sending.

Respond to emails quickly. Access fully editable email suggestions for fast email responses.

Assign colleagues and contacts quickly. Smart Suggestions recommend assignments based on prior work history.

Provide personalized updates to your clients as their job progresses. Set a task within your Karbon work item to automatically draft an email reflecting your progress and any other prompts you provide.

Karbon AI summarizes an email and internal conversation thread

Like with any new technology, knowledge is key. Firms that position themselves as experts, not just in accounting, but in modern solutions like AI will be in much higher demand than those without the adequate knowledge to apply them.

Karbon saves each individual user an average of 18.5 hours every week. Book a demo or start a free trial to learn more about Karbon and Karbon AI.