5 revenue KPIs every firm must track

The revenue coming into your accounting practice is one of the key factors that impacts your success, so it's critical that you understand it inside out.

And not just from the point of view of how much is coming in—but how fast, how much you are losing, and where any noteworthy activity is happening.

To help you uncover this, we handpicked the five best metrics for calculating everything that is impacting your firm's top line. Find out what each KPI is, why it's important, and how you can calculate it.

Monthly recurring revenue (MRR)

What is it?

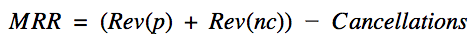

MRR tracks the sustainability of your firm by taking into account your recurring revenue at the end of your previous month, added to any additional committed revenue this month, less any cancellations from existing clients. You should usually measure this when your revenue is committed—your client has agreed to pay.

Why measure it?

One of your single most important metrics to track, your MRR is the lifeblood of your accounting practice. It very reliably predicts your ongoing revenue, which should be the major contributor to your top line. And remember, once a new client is acquired, there is no ongoing sales or marketing expenditure associated with that revenue regularly coming in.

MRR in action

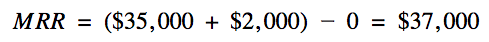

If you have 35 clients each paying $1,000 every month, your MRR is $35,000. If the following month you acquire 2 more $1,000 clients, your MRR would grow to $37,000.

You can also multiply your MRR by 12 to determine your Annual Recurring Revenue (ARR), which in this case would be is $444,000.

Outside of your recurring revenue, it's likely that your firm will perform some one-off projects or have once-a-year clients.

For tax services or special projects where there is an additional recurring component, you can annualize this one-off revenue and add it to your MRR. For onboarding or other one-off jobs without a recurring component, you can still do the same, or discount them completely and remove them from your recurring reports.

MRR is the most important metric for us because it provides a predictable outlook on future revenue and cash flow, which makes it easier to manage our practice.

Expansion monthly recurring revenue (Expansion MRR)

What is it?

Your expansion MRR shows any increase in MRR from your existing customers. For example, if a client goes from engaging you just for compliance, to engaging you for compliance and also advisory services, this additional revenue would be counted as expansion MRR.

Why measure it?

Expansion MRR shows how much you are providing additional services to existing clients, on top of the services they were already paying for previously.

This metric allows you to see the potential and opportunities your firm’s services have to offer. It's much more cost-effective to expand the services you provide to existing clients than to acquire new clients, so knowing this figure will highlight how well—or how poorly—your firm is at upselling and cross-selling your services.

Expansion MRR in action

2 clients agree to pay an additional $500 per month for CFO services, and another pays an additional $200 per month for tax planning, your Expansion MRR would be $1,200. If you began the month at $37,000, your new MRR would now be $38,200.

We wanted to get our average revenue per client up and our number of clients down, because we had a lot of clients who we weren’t making money from. We fired lots of clients but our revenue stayed the same, because we were able to increase our prices on everyone else and added lots of expansion MRR.

Churned monthly recurring revenue percentage (Churned MRR %)

What is it?

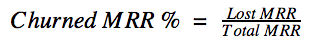

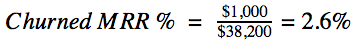

Churned MRR % looks at any reduction in MRR as a percentage of overall MRR. The reduction in MRR can be as a result of clients who decide they no longer need your services, from clients who decide to downgrade the services you provide to them, or from clients that your firm has decided to fire.

Why measure it?

Knowing this figure highlights areas where you lose revenue and how that affects your bigger picture.

Churned MRR is not necessarily a result of a client not being satisfied with your firm’s services—it might mean that client went out of business or you fired them because they were proving inefficient. But a Churned MRR figure that grows will highlight larger problems that you must address.

Measuring your Churned MRR as a percentage of your overall MRR will show you more about what this lost revenue means. You should look at it together with details of lost clients—are you losing a few big clients or many little clients? Or worse, are you losing several large clients?

Churned MRR in action

If your current MRR is $38,200 and 1 client paying $1000 each month decides to switch accountants, your churned MRR % is 2.6%. This percentage does not sound alarm bells, however, you should monitor it constantly over time to ensure it does not grow, and explore what type of clients are downgrading their services or no longer require your services.

I watch my MRR grow and my churn. We have almost no churn because we don't accept everyone who wants to sign up.

Client churn rate

What is it?

Also known as attrition rate, your client churn rate counts your percentage of clients lost (as opposed to churned MRR, which measures their lost revenue value). Usually, it makes more sense to factor in only consistent monthly clients, not one-off clients.

Why measure it?

Knowing your client churn rate highlights areas where revenue is lost. To grow, the number of new clients you acquire must exceed your churn rate.

When your churn rate steadily grows, you know you have a problem. Like your churned MRR %, understanding your client churn rate requires you to look at your sources of churn to properly understand whether you have an issue that needs addressing.

Client churn rate in action

Divide your number of clients lost, by your total number of clients. If you lost 1 client this month out of 36, your client churn rate is 2.8%.

Average revenue per client (ARPC)

What is it?

ARPC tells you how much, on average, each client is contributing to your top line.

Why measure it?

ARPC is an extremely handy metric to know because it indicates if your practice is growing or not, and why. Are you aiming your business at higher paying customers—and probably less of them? Or are you aiming for volume—lots of bookkeeping clients that you can service very efficiently?

When you have an understanding of your ideal client and have tailored your services and sales and marketing activities to reach them, your ARPC will tell you how well you are achieving that.

This metric also allows you to segment your clients to determine the effectiveness and combined revenue of your different client types and service offerings.

ARPC in action

Dividing your MRR by your total number of clients gives you your ARPC. If you have 35 clients and a current MRR of $37,200, your ARPC would be $1063. This is interesting to know, but knowing your ARPC becomes even more meaningful when you can monitor its change over time, with a detailed understanding of who your ideal client is.

Each of our customers are on a fixed monthly fee, which allows us to set growth goals with real numbers to compare. We keep track of cost per customer, and the average revenue and profit per customer.