Summary

-

Asana is a general project management solution to meet the needs of many

-

Asana is not a practice management solution for accounting firms

-

Asana may be suitable for solo accountants working within small businesses

-

Because Asana doesn’t specialize in accounting, it lacks specific (and necessary) functionality for accounting and bookkeeping firms

-

Asana is a solution to consider if you are a small firm just getting started, but you will quickly outgrow it

-

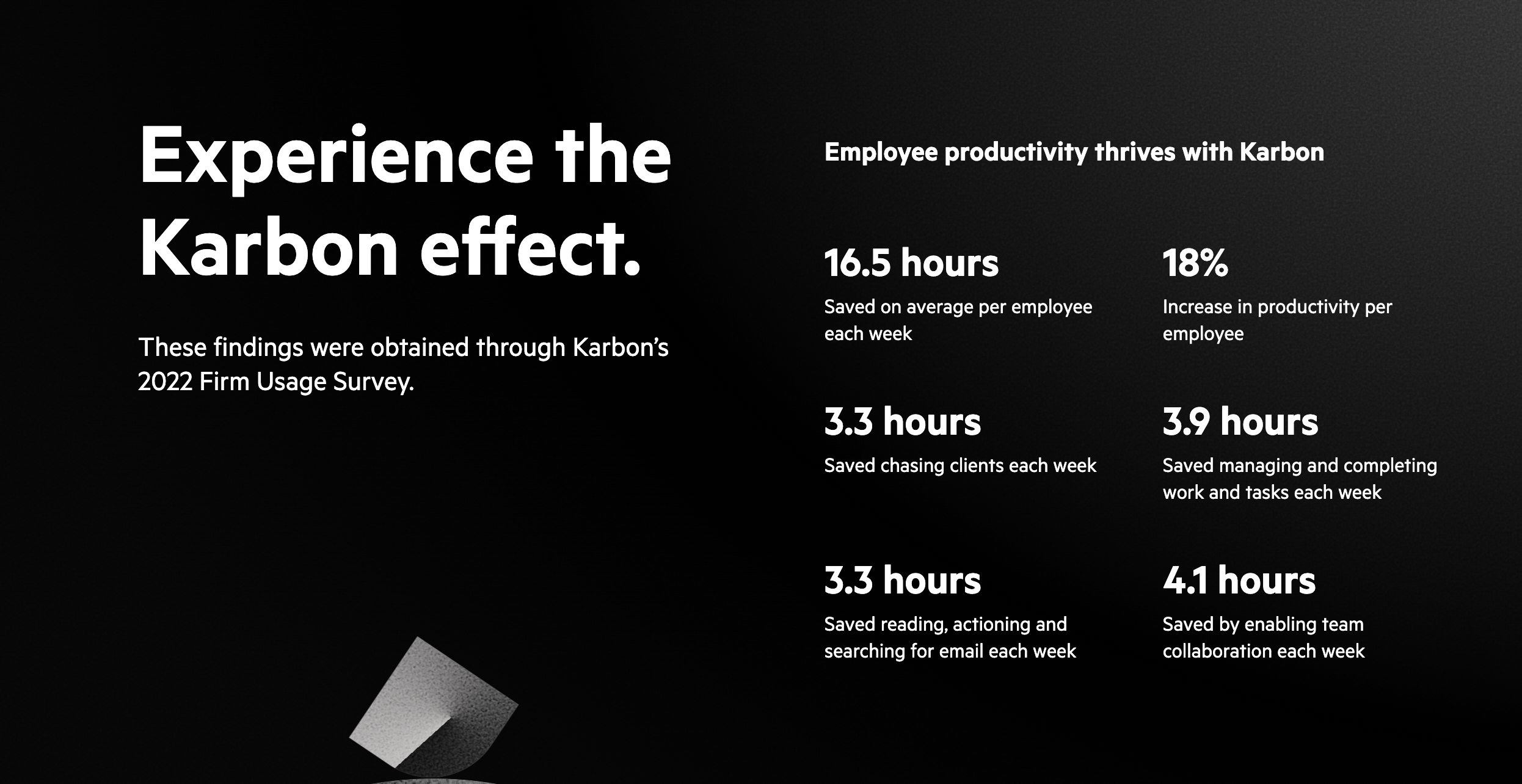

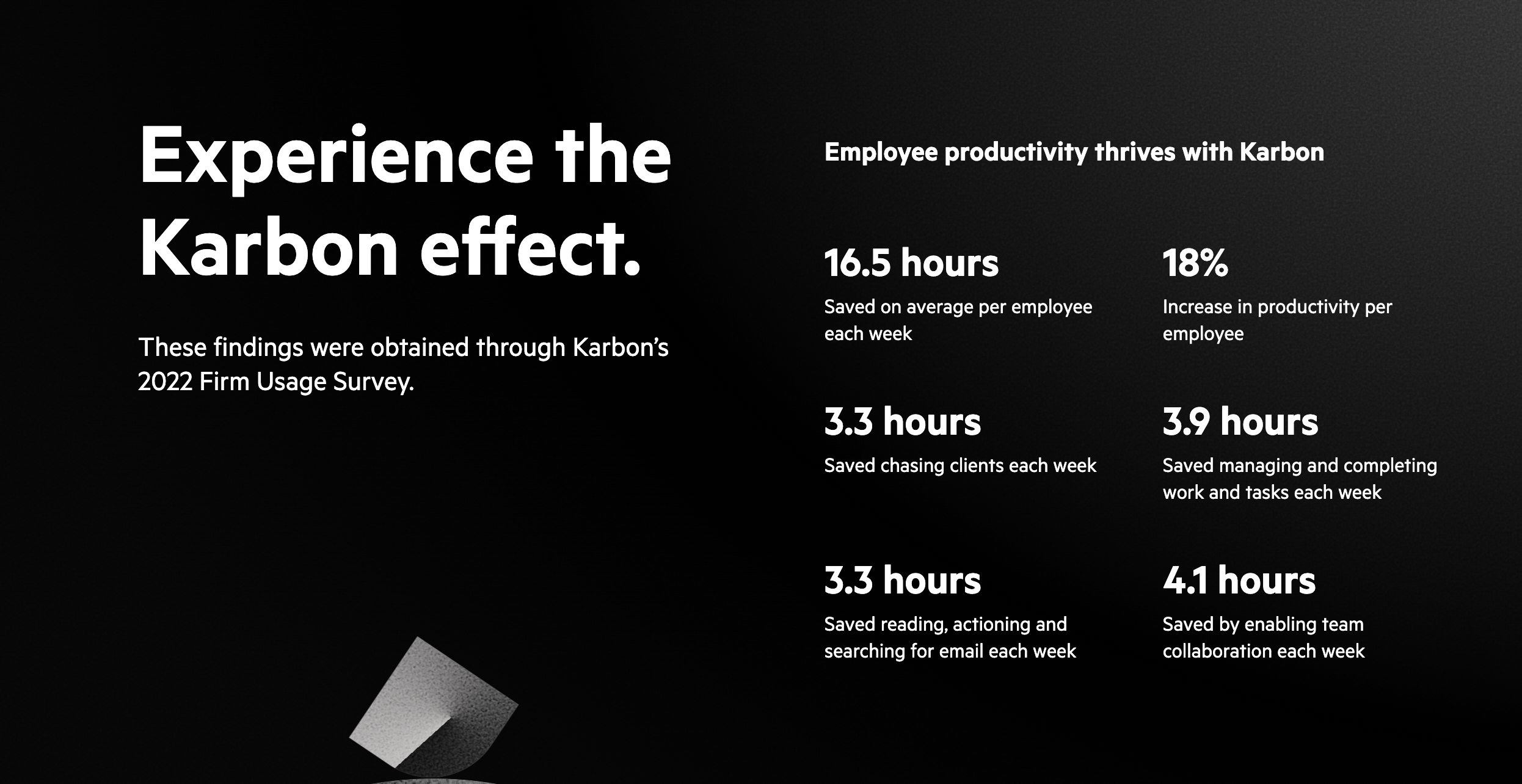

If you use a practice management solution for accounting and bookkeeping firms, like Karbon, expect time savings like 16.5 hours per employee each week

There are countless successful teams that use Asana to deliver impressive results—from marketing teams and advertising agencies to web developers and creatives.

But it’s not practice management. And it’s certainly not practice management for accounting firms and bookkeeping practices.

While powerful in many ways for project planning, Asana lacks the unique functionality to support your equally-unique workflows. It’s missing the basics you need to get work done as an accounting professional.

Here’s a closer look at Asana for accounting firms:

Is Asana right for accounting and bookkeeping firms?

What is Asana?

Asana is a leading project management tool. It’s designed to help you manage and streamline your projects, organize your work in a single place, and collaborate easily.

It’s similar to other project management software like Trello, ClickUp and Monday.com. Asana is a general solution to meet the needs of general small businesses, rather than focussing on the needs of a specific industry.

How does Asana work?

Asana organizes work in a hierarchical structure, so each project houses subtasks. A great feature of how Asana uses projects is the ability to swap views.

You can view the projects as a:

List: View your workflow in a linear format with checklists

Kanban board: View and sort your workflow in easy-to-read sections

Calendar: Shows your workflow in a calendar view

(Note: Calendar view is per-project. You can view an overall calendar for your tasks, but it’s all or nothing. You can’t customize your calendar to include just live payroll projects, for example.)

Timeline: Designed to rival the visual representation of a Gantt chart workflow typically seen in Microsoft Excel spreadsheets

(Not available in the free version.)

Dashboard: So you can visualize and report on your team's progress with custom charts

(Not available in the free version.)

This flexibility can help you increase visibility over your workflows. Plus, Asana’s mobile app is robust, so you can keep an eye on your workspace when you’re on the move with real-time notifications.

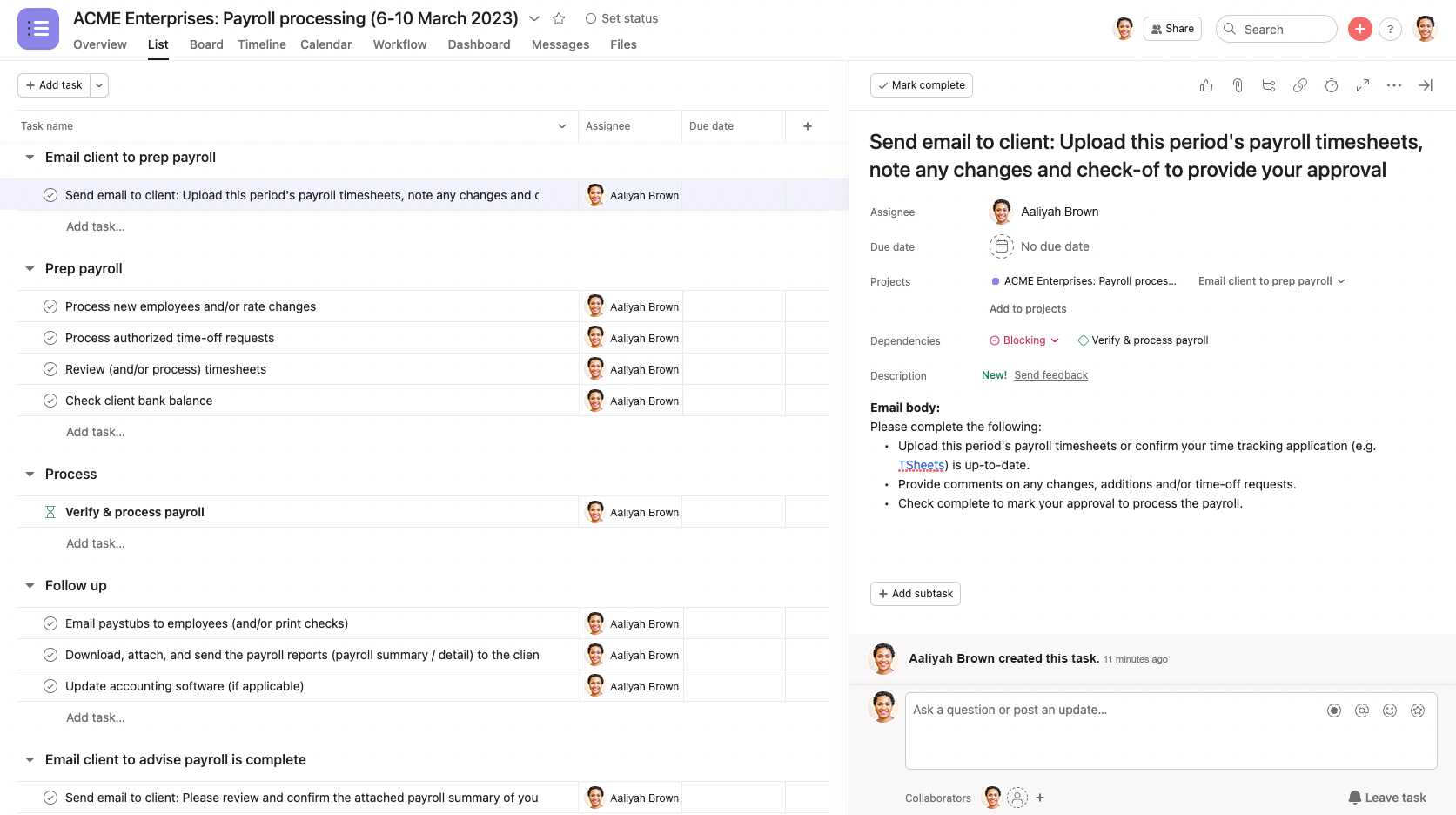

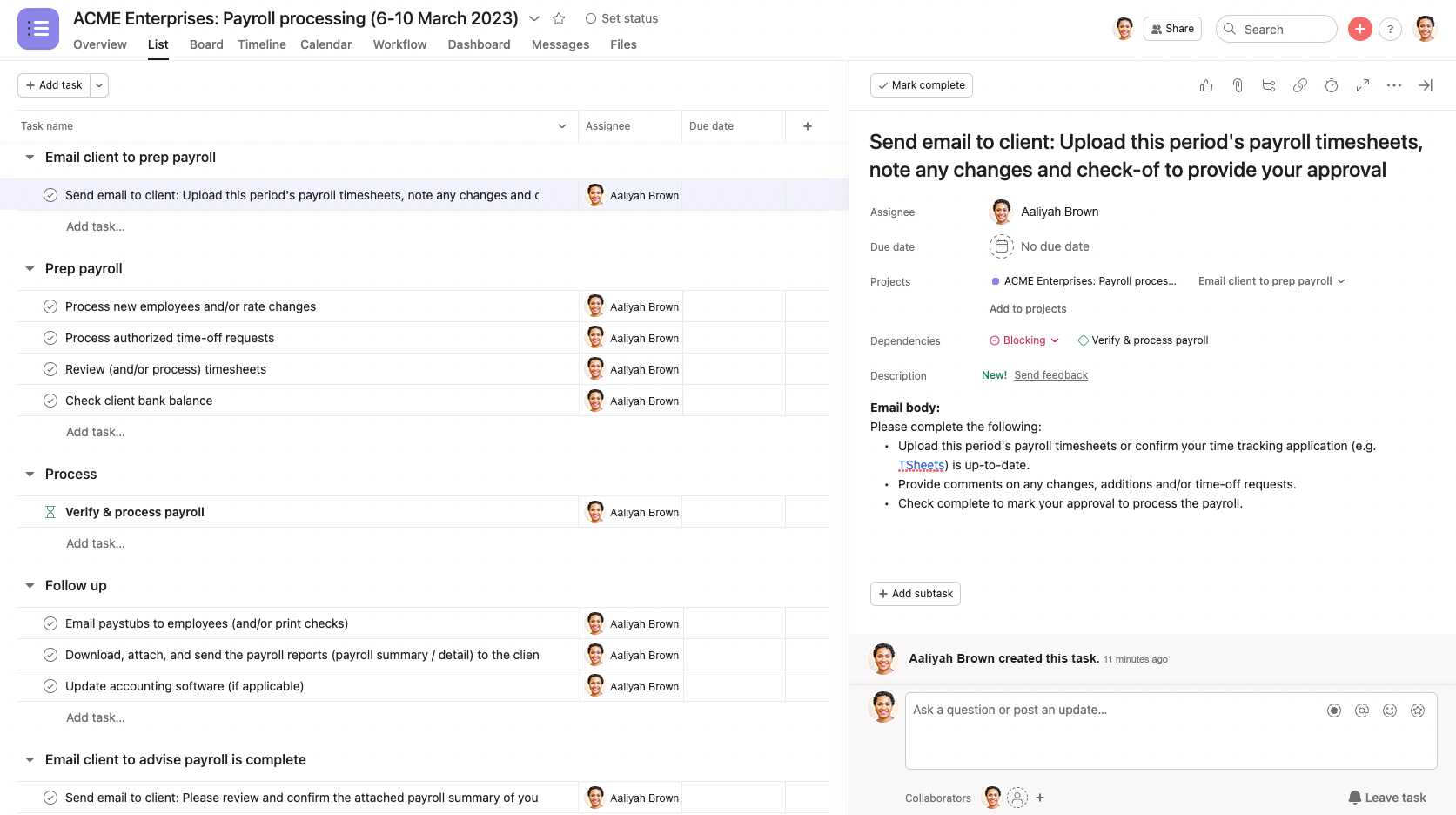

Use case: Using Asana to manage your weekly payroll processing workflow

Managing recurring accounting and bookkeeping workflows in Asana can be done using the recurring project function.

While there’s an impressive library of pre-built workflow templates in Asana, none are specific to accounting or bookkeeping workflows.

Instead, let's use a purpose built template from an accounting practice management tool as an example: Weekly payroll processing workflow from the Karbon Template Library.

To recreate this workflow in Asana, you would create a project and build it out based on the workflow using:

Payroll processing workflow example in Asana

From here, you can turn this workflow into a template and set it up as a recurring workflow.

You may have already noticed a few must-haves are missing that are critical for an accounting workflow like this.

Asana’s limits for accounting and bookkeeping firms

There’s a lot to love about Asana. It’s powerful, customizable, and well, it’s fun to look at. While that’s nice, ‘nice’ doesn’t get work done for those in accounting.

In the above example for a weekly payroll processing workflow, there are some glaring gaps and limitations:

1. There is no way to send your client automatic reminders

The client chase is real. Accounting firms spend hours each week chasing their clients for information.

Auto-reminders sent via email significantly reduce this time spent. But Asana doesn’t offer any way to automatically chase clients for outstanding information.

A weekly payroll processing workflow often kicks off with your client providing the week’s updated timesheets, and if you use Asana, you’re going to need to manually request this information until your clients provide it.

2. No direct email integration

Say your client finally provides their weekly timesheet information after a few prompts from you. Trouble is, it’s siloed away from your project in Asana.

You’ll need to constantly navigate between your inbox, Asana and your payroll processing software.

More broadly, a lack of email integration in Asana is a significant downside:

No visibility into what emails have been sent to and from your clients in relation to a specific workflow.

No single source of truth for all communication related to any given client.

Constant context switching between your inbox, CRM and Asana.

3. Lack of CRM capabilities

Wouldn’t it be valuable to automatically and directly link this weekly payroll processing workflow to your client, so you can view all their relevant information and work at a glance?

There’s no such capability in Asana. You’d need to refer to a separate CRM solution and your email inbox just to find information like:

Client details (name, address, etc.)

Email and communication history

All client work: previous, current and completed

Associated documents

Because of Asana’s lack of CRM functionality, your firm’s efficiency will likely drop compared to other practice management solutions.

4. No direct time tracking or time budgeting information

To plan your team’s capacity, you need to know time allocation for your workflows.

In the weekly payroll processing workflow example, the time budget is 1 hour for your payroll specialist. Pretty straightforward. But for more complicated workflows that cross multiple team members, like onboarding new clients, it’s difficult to see your team’s time expenditure. This makes it difficult to capacity plan.

And if you’re billing against time, you’ll need to integrate a separate solution to track time if you’re using Asana.

5. Lack of direct integration with accounting software

While its integrations library is extensive, another indicator that Asana isn’t specific enough to handle accounting and bookkeeping workflows is the lack of direct integration with the tools you use every day.

Asana offers no integrations with GLs like Xero and QuickBooks, proposal software like Ignition or GoProposal, or other accounting ecosystem apps like Dext. Instead, you’ll need to use Zapier to set up these basic integrations.

6. No client portal

A lack of client portal is another reason why Asana isn’t the best solution for accounting and bookkeeping firms. It means you don’t have a place to securely share information with your clients and communicate with ease.

Again, you’ll be context-switching to retrieve and send siloed client information.

7. Customer support isn’t specific to accounting and bookkeeping firms’ priorities and nuances

Because Asana focuses on appealing to many small businesses across a wide variety of industries, it’s not realistic to expect their customer support team to understand the nuances of accounting workflows.

So unfortunately, if you use Asana and have questions about making it work to your very specific needs, you’re unlikely to find someone on their customer service team with specific accounting knowledge.

Asana alternatives for accounting and bookkeeping firms

Here’s a compilation of alternatives to Asana that are specific to accounting and bookkeeping firms.

Karbon

Karbon is practice management for accounting and bookkeeping firms. By focusing on you, your industry, your clients, and all your unique requirements, Karbon is built specifically for you.

It enables intuitive communication and seamless workflows so you know who is doing what, when, why, and how.

And as a practice management solution, project and task management is only one aspect of the wider Karbon offering.

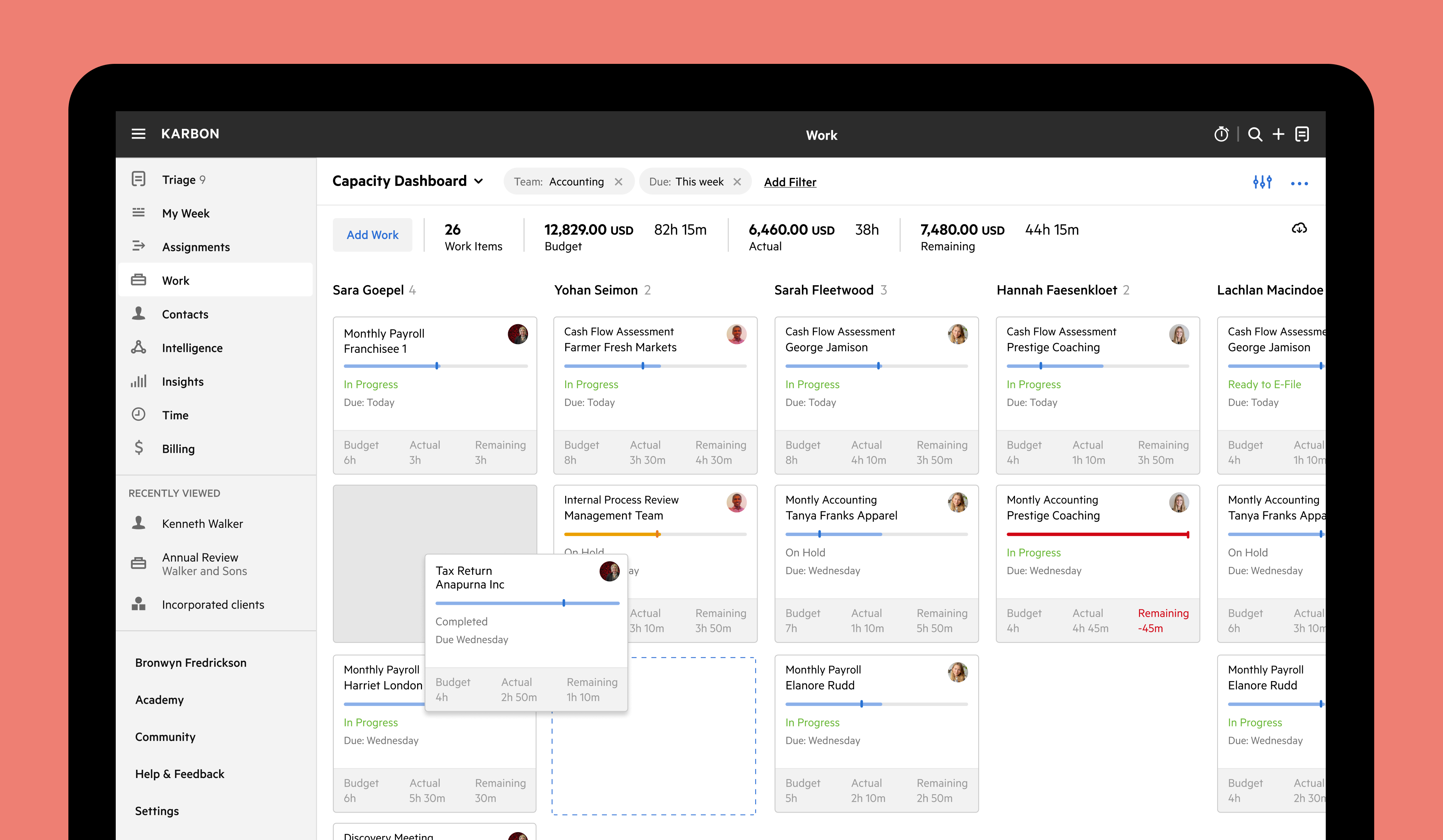

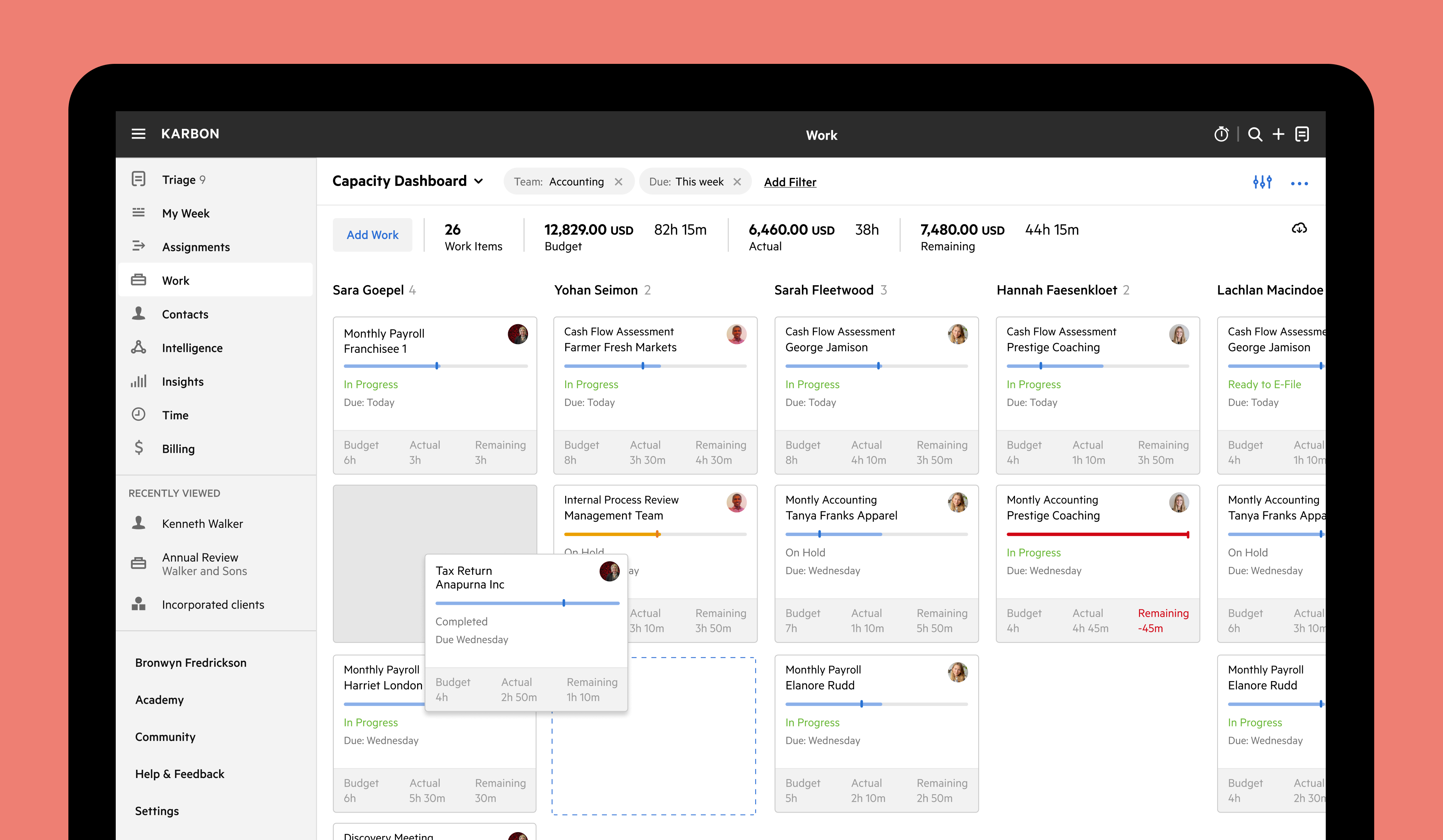

Karbon’s capacity management dashboard

Benefits of Karbon

Direct email integration (Gmail, Microsoft Outlook and Microsoft Exchange)

Built-in CRM

Automatic client reminders and client tasks

Client portal

Collaborate in context with @mentions

Accounting template library with 280+ accounting-specific templates

Time and budget tracking

Document management integration (Dropbox and OneDrive with SuiteFiles coming soon)

Invoicing and payment processing

Karbon AI: GPT-powered artificial intelligence built into email and workflows (currently in beta)

User community with 3,000+ members

Integrations that make sense for you (i.e. other leading accounting software)

Limitations of Karbon

More expensive than generic solutions like Asana

Requires more time setting up and implementing, because it is a more robust solution

Functionality is geared towards teams, so may not be suitable for sole practitioners or teams of 2-3 staff

Learn how Karbon can give you the practice management confidence you need. Book a demo.

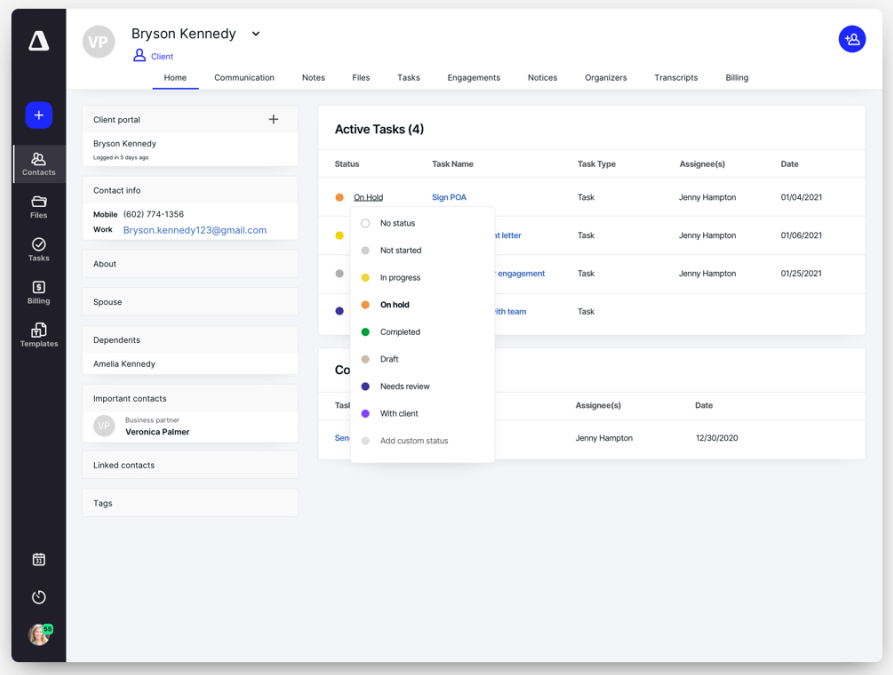

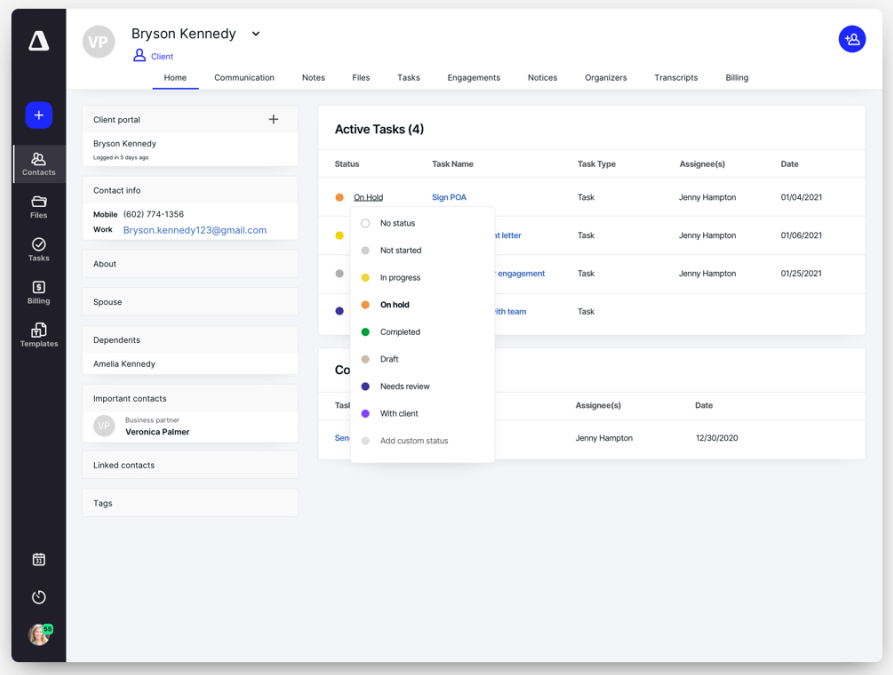

Canopy

Like Karbon, Canopy is a practice management tool for accounting and bookkeeping firms.

Client view in Canopy

Benefits of Canopy

Tax resolution cases and integration with IRS (paid add-on)

Flexible document and file management functionality (paid add-on)

Time, billing and invoicing capabilities

Limitations of Canopy

Key product features are only available at additional costs (e.g. workflow management and document management)

Complicated and expensive pricing (pay per client, per add-on module, per user)

Limited workflow templates

Compare Karbon and Canopy

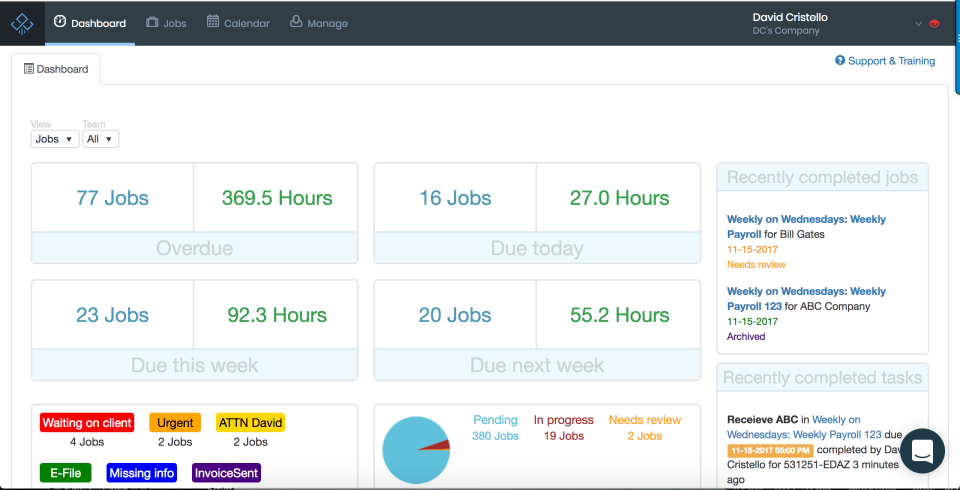

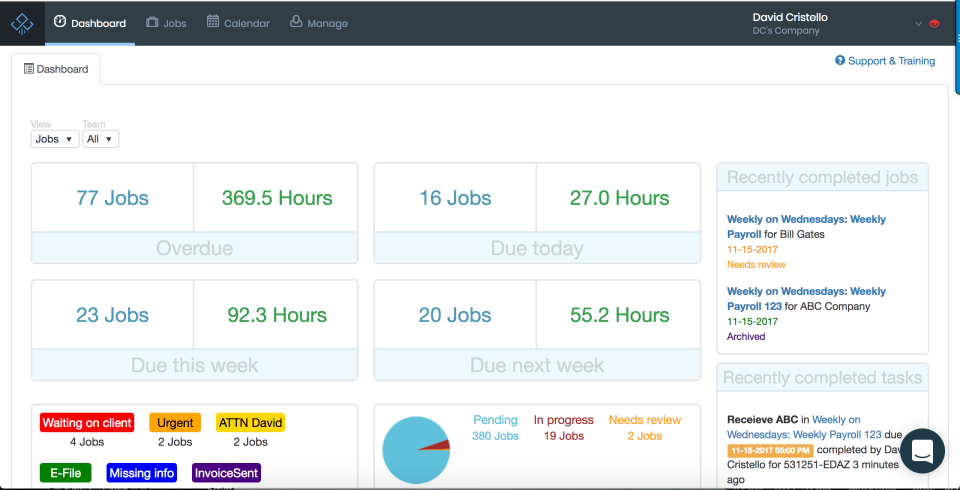

Jetpack Workflow

As its name suggests, Jetpack Workflow provides workflow management for accounting firms. So it’s important to note that Jetpack Workflow is not a practice management solution.

Jetpack Workflow dashboard view

Benefits of Jetpack Workflow

Affordable pricing for simple workflow management

Time tracking capabilities

Useful dashboard with a high-level overview of work and your firm

Limitations of Jetpack Workflow

No email integration

Limited automation

No client portal

Compare Karbon and Jetpack Workflow

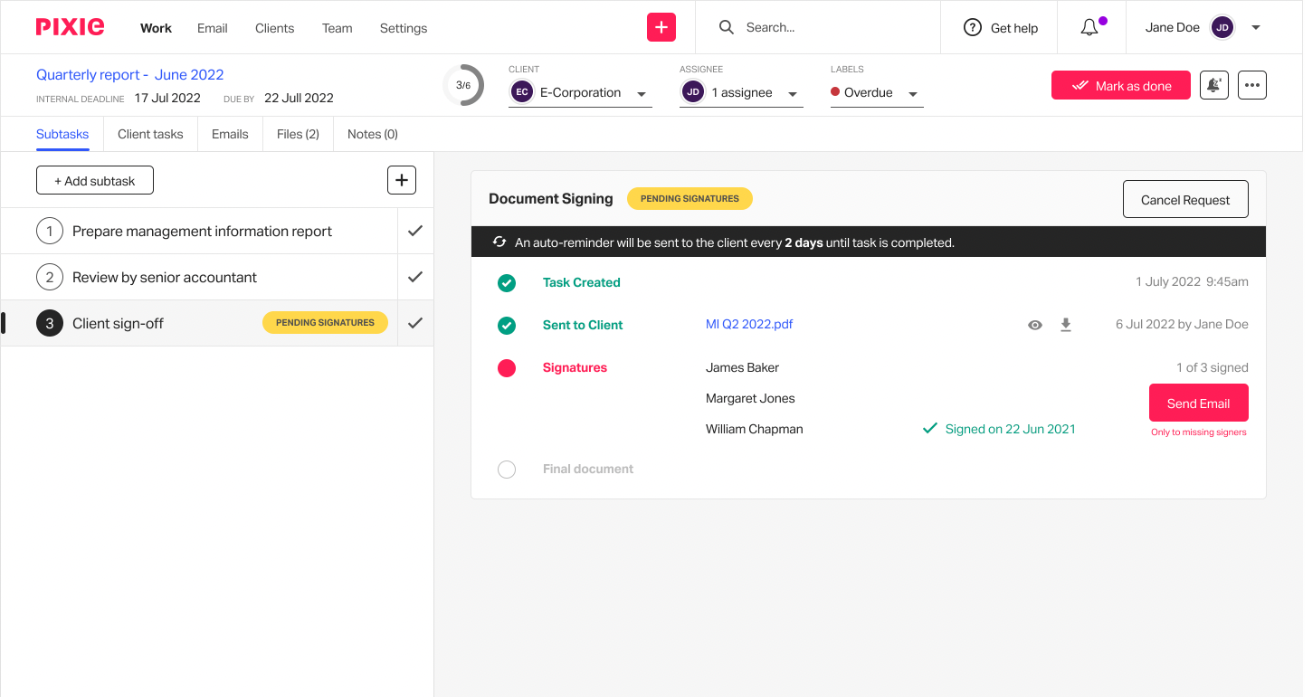

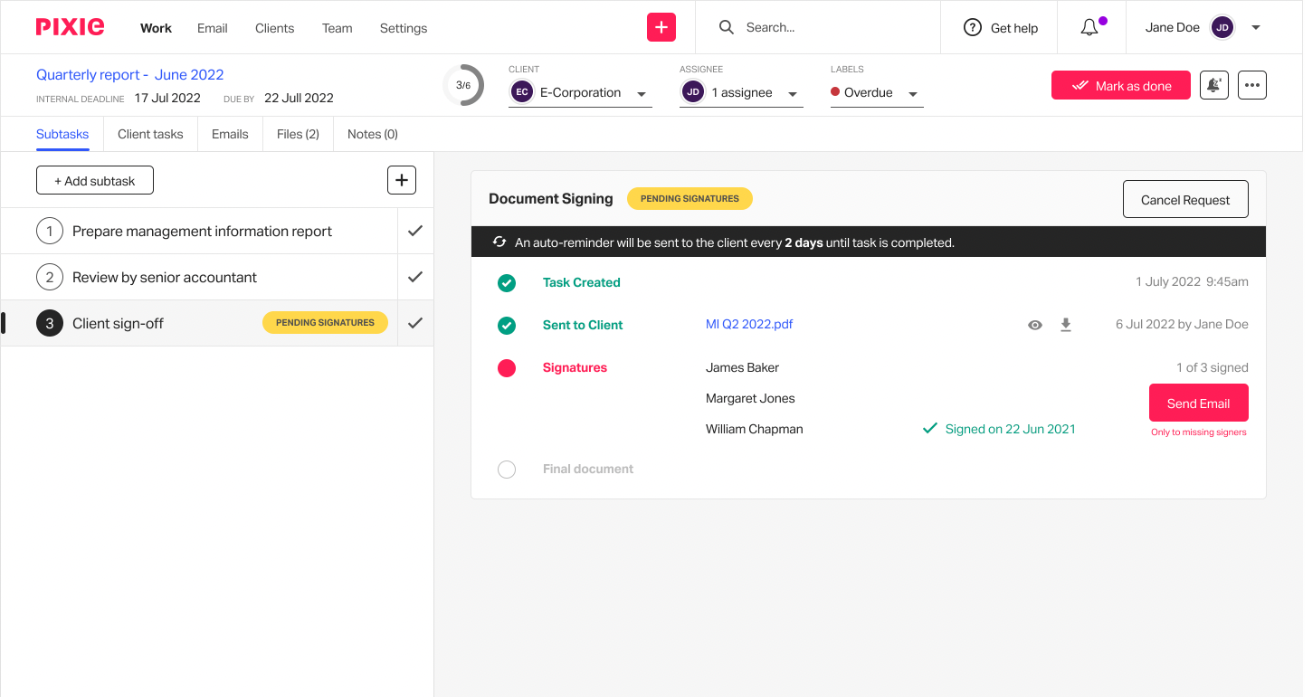

Pixie

Pixie is a practice management solution that primarily focuses on smaller firms across the UK.

Work view in Pixie

Benefits of Pixie

Affordable solution, especially for small firms with 1-3 employees

Flexible recurring work functionality

Best-practice template library

Limitations of Pixie

Limited collaboration functionality (unable to tag colleagues in comments or notes, making teamwork difficult)

Limited automation

No time and budget tracking

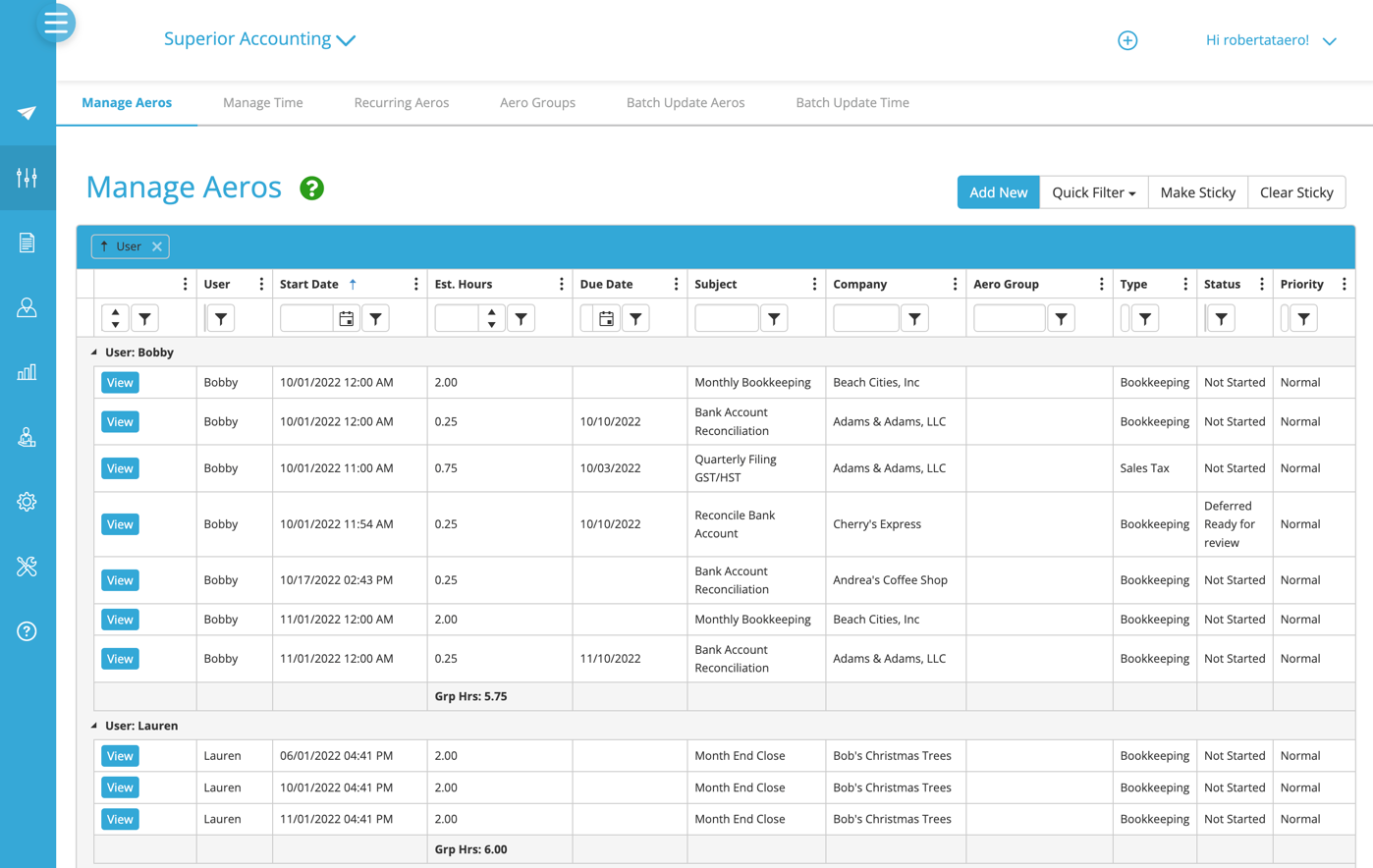

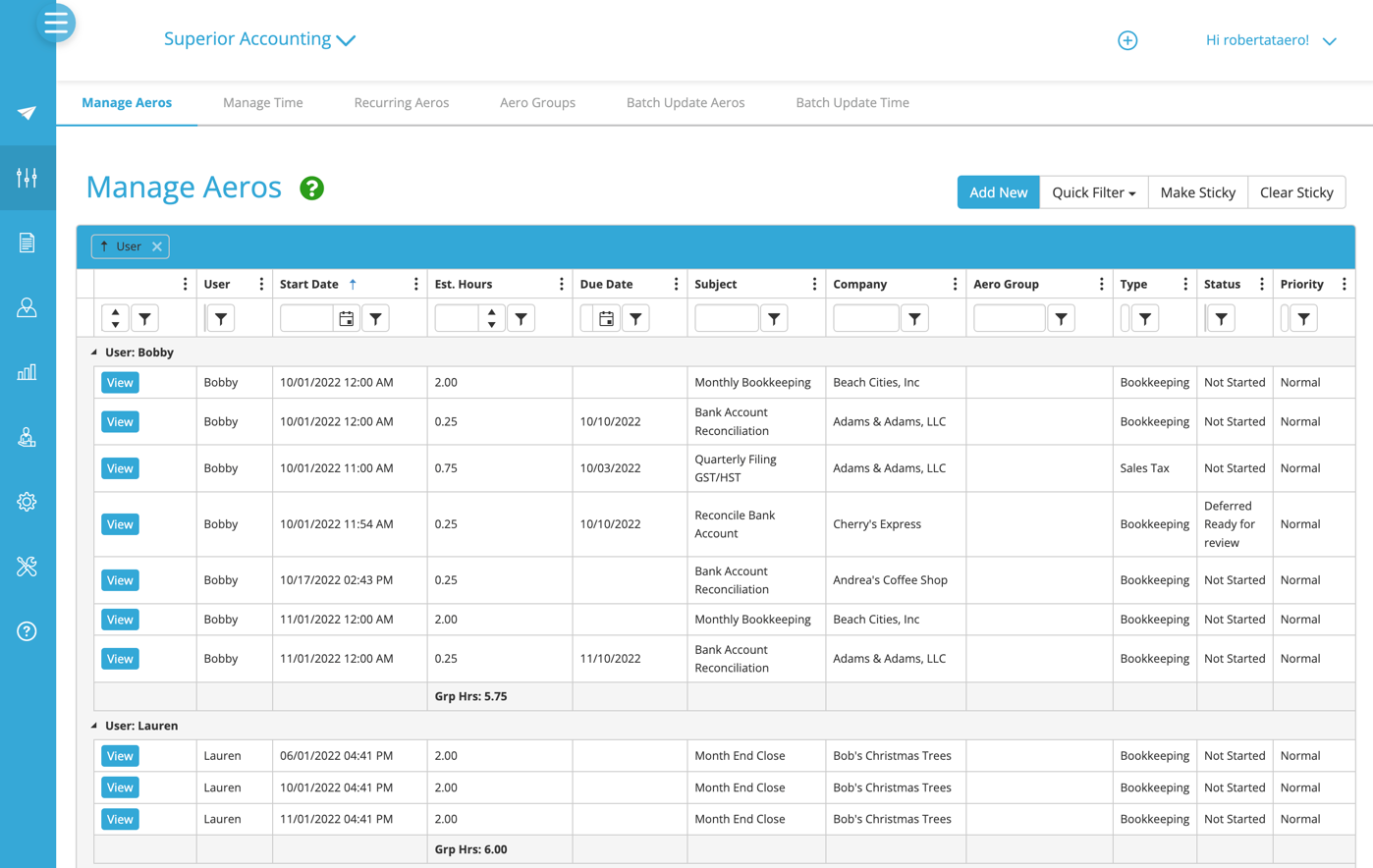

Aero Workflow

Aero Workflow is another solution that provides workflow management capabilities for accounting firms. Again, it’s important to note that Aero Workflow is not a practice management solution, so it does lack in areas you need to manage your firm.

Team capacity view in Aero Workflow

Benefits of Aero Workflow

Limitations of Aero Workflow

Not a practice management solution

Lack of direct integrations

Limited automation

Not suitable for firms with 3 or more staff

Is Asana right for accounting firms?

Here’s the important question: Is Asana right for accounting firms?

For small accounting firms just getting started, Asana is a solution to consider. But as a firm grows, it will quickly outgrow Asana. This is because it’s not designed specifically for accounting firms, which means it doesn’t prioritize the needs of modern accounting firms.

When you have a solution that is built specifically for you and what you do, it just makes sense.

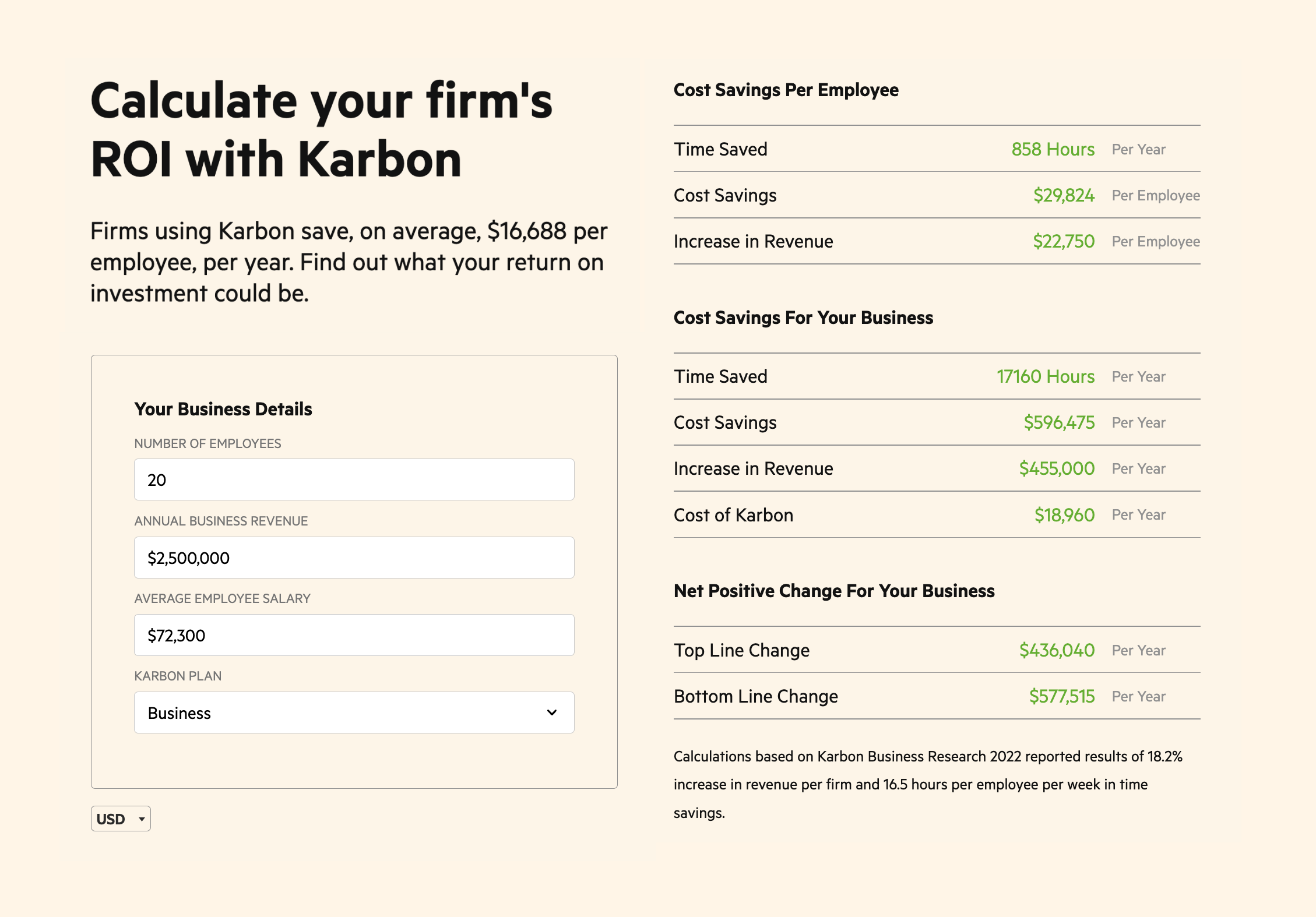

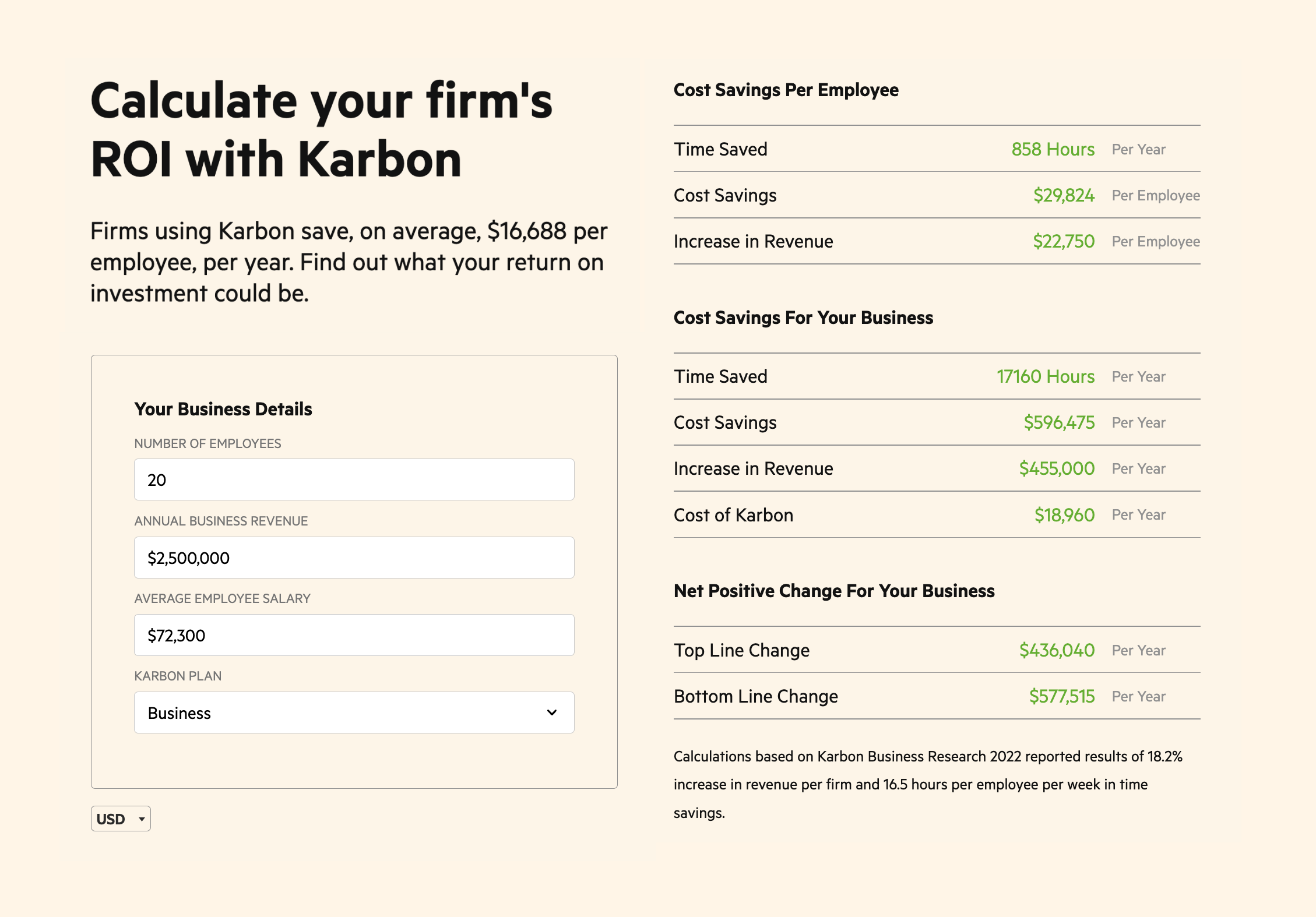

Take Karbon, for example. Accounting firms using Karbon save an average of 16.5 hours per employee each week.

Average time and money savings for firms using Karbon

To better understand the benefits of using a practice management tool like Karbon, you can calculate your firm’s ROI using Karbon’s ROI calculator.

For example, if your firm has 20 employees, you would:

Save 858 hours per year, per employee

Save $29,824 USD per employee

Increase revenue by $455,000 USD per year

Karbon’s ROI calculator

For a more in-depth understanding of how Karbon can impact your firm’s profitability, book a demo.

Selecting the right tool for your accounting firm has the potential to be one of the most important decisions you can make. It’ll either set your firm up for scalable growth, or simply add to the problems you already have.

To ensure the former, start with a practice management tool that makes sense to you, your team, your firm, and your vision.

To help you make that decision, here's a buyer's guide to accounting practice management software.