Summary

- Attracting new clients to your accounting firm comes down to one thing: building trust

- Specializing in a market niche will help you scale and focus your marketing efforts

- Asking for referrals is one of the most impactful ways to get new clients

- A strong online presence (including social media) will help you reach the right audiences

- Retaining clients and extending their lifetime value is crucial in securing the revenue you’ve worked hard to acquire

Would you believe that 86% say their accountant is their trusted advisor, and five out of six consider their accountant ‘a trusted advisor they can turn to for a wide range of business advice’?

Knowing the hard work you put into providing them with value, you might not be that surprised.

Attracting new clients isn’t easy—it’s not always simple and straightforward. But it’s easier when you recognize that at the heart of your efforts is the cornerstone of converting clients: building trust.

In all business, especially in small business, trust is the most important thing you can earn.

In fact, in a study by Vanguard, 94% of people stated they are likely to make a referral when they ‘highly trust’ their advisor.

All that’s left to do is market your firm to the right audiences, and generate qualified leads that convert into high-quality clients.

7 ways to get new accounting and bookkeeping clients

Here are 7 strategies to attract clients to your accounting firm:

Find your niche

Ask for referrals

Expand your reach with social media

Try paid advertising

Optimize your website and make sure you have a clear call-to-action (CTA)

Offer free resources to develop trust, build brand awareness, and generate leads

Attend networking events

1. Find your niche

Finding a specialization or niche establishes you as an industry expert. Businesses prefer to work with accountants and bookkeepers who deeply understand their industry—and they’re more likely to trust you and your advice.

For example, if your client owns a chain of cafes, they will have specific accounting rules that apply to them. Rules that are not applicable to another client, say, a plumber.

You can use your niche to source new clients. Find the industry events your clients are attending and the content they are consuming. Sponsor them, contribute to them—use these as opportunities to become a well known name within your niche.

Plus, when you specialize in an industry, you get to build deep connections and relationships with these clients. It can make work more enjoyable and fulfilling.

Real example

Protea Financial is a US-based accounting firm that specializes in winery accounting. They deeply understand the specific challenges of running a successful winery. That is their area of expertise, and everything they do—from content production to the services they offer—is specific to wineries.

Protea Financial’s website homepage

2. Ask for referrals

From existing clients

Asking for referrals may be a little daunting, but it’s a great way to find new clients. People trust people they know, and one of the fastest ways to gain someone’s confidence is through a referral or word-of-mouth.

If a potential client trusts someone who already has faith in you, then all you need is a referral to connect the dots.

In fact, a Neilsen study found that recommendations from people that clients know are two times more likely to generate action.

From other accountants in different specializations

Leveraging other, non-competing firms is another way to generate referral clients.

For example, if you run a bookkeeping firm that doesn’t offer advisory accounting services, why not refer clients to a trusted firm that does? And in turn, that advisory practice can refer clients back to you for their bookkeeping.

3. Expand your reach with social media

Social media is an inescapable part of modern business practice.

More than half of the world now uses social media (60%)—that’s 4.8 billion people. And they’re spending, on average, 2 hours and 24 minutes on social media platforms each day.

But does social media marketing really matter to your firm?

Well, 71% of consumers who have had a positive experience with a brand on social media are likely to recommend the brand to their friends and family.

Taking that into account, social media matters to your accounting firm, particularly when trying to generate new clients.

4. Try paid advertising

Ads are a great way of increasing your exposure to small business owners. But if your ads are reaching the wrong audience, the money that you’re spending (which can be considerable) will be wasted.

GoogleAds, LinkedIn Ads or Facebook Ads can be expensive but can also have a very high return on investment (ROI)—a study conducted by Google reported an average ROI of 800% for their platform.

The ability to specifically target your paid ads at segmented audiences is key in finding and attracting your ideal clients (and ensuring your ad spend is sustainable).

If you’re unfamiliar with paid advertising but want to learn more about it, you can take a free course on Google Ads from Google, or engage a marketing professional for advice before you get started.

5. Optimize your website and make sure you have a clear call-to-action (CTA)

Your website is an extension of your firm and a huge part of your digital marketing strategy.

Progressive accounting clients are looking for progressive firms. And if your website doesn’t indicate that you’re a modern firm, potential clients will move on in their search.

Your website’s CTA needs to be clear. If you want them to book a meeting with you, make sure they know exactly how to do that. There should be no barriers between target clients becoming actual clients. CTAs should be simple, short, and only communicate one message at a time.

But it goes beyond that.

Your website needs to be discoverable in the first place. Google services over 4 billion users every day, with 100,000 searches per second. That’s where Search Engine Optimization (SEO) comes in.

Every search resulting in your firm’s website being accessed, or an article you wrote being read, is another opportunity to bring in a new client. So you need to ensure your website’s SEO and local SEO are competitive.

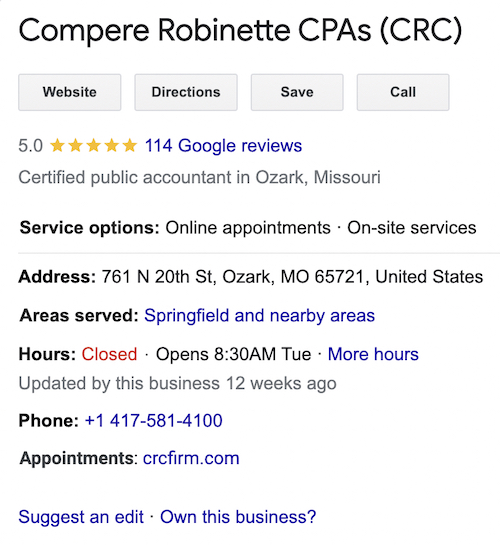

Real example

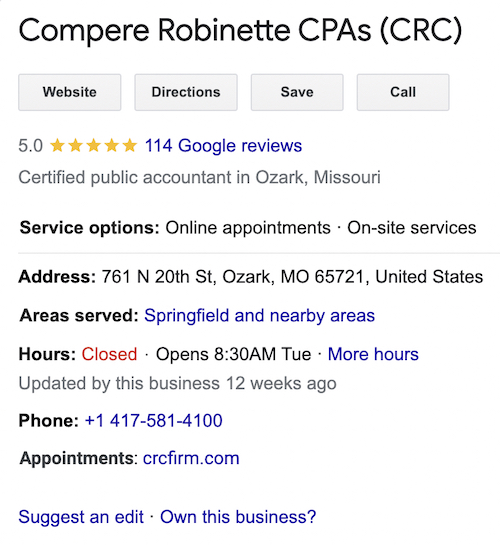

Compere Robinette CPAs (CRC) is an accounting firm based out of Ozark, Missouri. Their local Google Business profile is a great example for accounting firms. It includes clear and useful information, including the firm name, location, open hours, service options, etc.

CRC’s Google Business profile is a great example for accounting firms

This kind of information is exactly what a prospective client needs to take the next step and make contact.

6. Offer free lead generation resources to build trust and brand awareness

Your firm’s mission, at the end of the day, is to help your clients achieve success. And sometimes, that success doesn't have to always come from your typical engagement. Instead, it’s small pieces of advice that you can provide through free resources, like articles, newsletters, videos, and webinars.

Producing and sending genuinely useful content helps to build trust and establish your reputation as an industry thought leader.

Real example

An example of this is Karbon’s Practice Excellence Weekly newsletter, packed full of tips and tools to help run an efficient accounting firm.

A regular newsletter or email will keep your firm top-of-mind. Consistency is key—choose a cadence and stick to it. Avoid spamming potential clients, and ensure all your communications have a clear CTA (even if that CTA is to simply read an article or watch a video).

There are certain pieces of content, however, that have a more direct impact on finding new clients: lead generation content. Lead generation content is typically a piece of content—an ebook or a work template, for example—that is designed to engage and convert your target audience. And sometimes, that content is provided in exchange for a lead’s email address.

Lead generation content should be impactful, on-brand and demonstrate your knowledge of a problem and how you can solve it.

💡 Pro tip: If you’re struggling to build your content marketing strategy, consider asking ChatGPT to help you get started. It’s one of the ways you can use generative AI as an accountant to spark your creativity.

7. Attend networking events

As the saying goes, it isn’t about what you know, it’s who you know. When it comes to attracting clients, getting out into the community, meeting people, and building connections is a fantastic way to find new clients.

Real example

Justin Mastores, Managing Partner at Australian accounting firm Rees Group, hosts annual Property Briefing breakfast events and invites other professional services leaders to make presentations.

By combining forces with the networks of investment groups, mortgage brokers, and other professional services businesses, Justin is expanding his firm’s reach, all while providing genuinely valuable content and insights.

Converting leads into accounting clients

Finding potential clients is only one part of the mission. Converting those clients at the dotted line is the most important part of the process.

You can measure your success through a lead conversion rate, calculated by measuring converted clients versus the amount of visitors to your website or the amount of people that inquired via your website.

So if you generate 200 leads in a month and close 6 new deals, your conversion rate is 3%.

It’s important to note that the term ‘conversion’ means different things in different contexts of the buyer’s journey. Broadly, a ‘conversion’ is the result of someone completing a certain action. But a conversion might be:

A new website visitor filling in your contact form

A social media follower clicking through to your website

Someone downloading your ebook or signing up for your newsletter

It’s important that you define what ‘conversion’ means at your firm and at what stages. To keep things simple, you may consider a blanket definition as:

4 tips for improving conversion rates

1. Qualify your leads

Qualifying your leads helps you identify and prioritize the prospects that are most likely to convert to clients. This process helps you determine a potential client’s fit and if they’re ready to make a purchase.

Here are three categories into which you can group your leads:

Information qualified leads (IQLs)

Marketing qualified leads (MQLs)

Sales qualified leads (SQLs)

Information qualified leads (IQLs) are at the top of the sales funnel, they’re the people or businesses that have a question and are interested in information that helps answer it.

Marketing qualified leads (MQLs) know your brand and engage with the different marketing initiatives you put out. They’re in the middle of the sales funnel.

Sales qualified leads (SQLs) are at the bottom of the sales funnel. These are the businesses that have shown an active interest in your firm, and are primed to be converted into paying clients.

The nature of the funnel and the sales lifecycle is that as you progress with your marketing techniques, your clients should move further down the funnel, turning them from IQLs to MQLs to SQLs until finally, they’re your clients.

Finding CRM software or practice management software with CRM capabilities will help you manage that process. On your client’s record or profile, you’ll be able to see where they are in the sales lifecycle, plus all the correspondence your firm has had with them. It'll prevent you from sending them the wrong communications or trying to sell something they’ve already said yes (or no) to.

2. Show that you understand their pain points and that you have the solutions

Providing prospective clients with the information they need shows you are the right firm to help. Reiterating clients’ pain points back to them shows you understand and empathize.

If a client needs a solution and you have it, you need to be perfectly clear about how you will solve their problem. Clarity and communication are key elements to closing a new client.

3. Remember to follow up

Follow-ups are crucial. In fact, they’re arguably the most crucial aspect of turning leads into clients. Following up with emails or phone calls keeps leads thinking about your firm. Statistics show that 80% of people need 5 or more follow-ups before they convert to a sale.

4. Use a lead management template

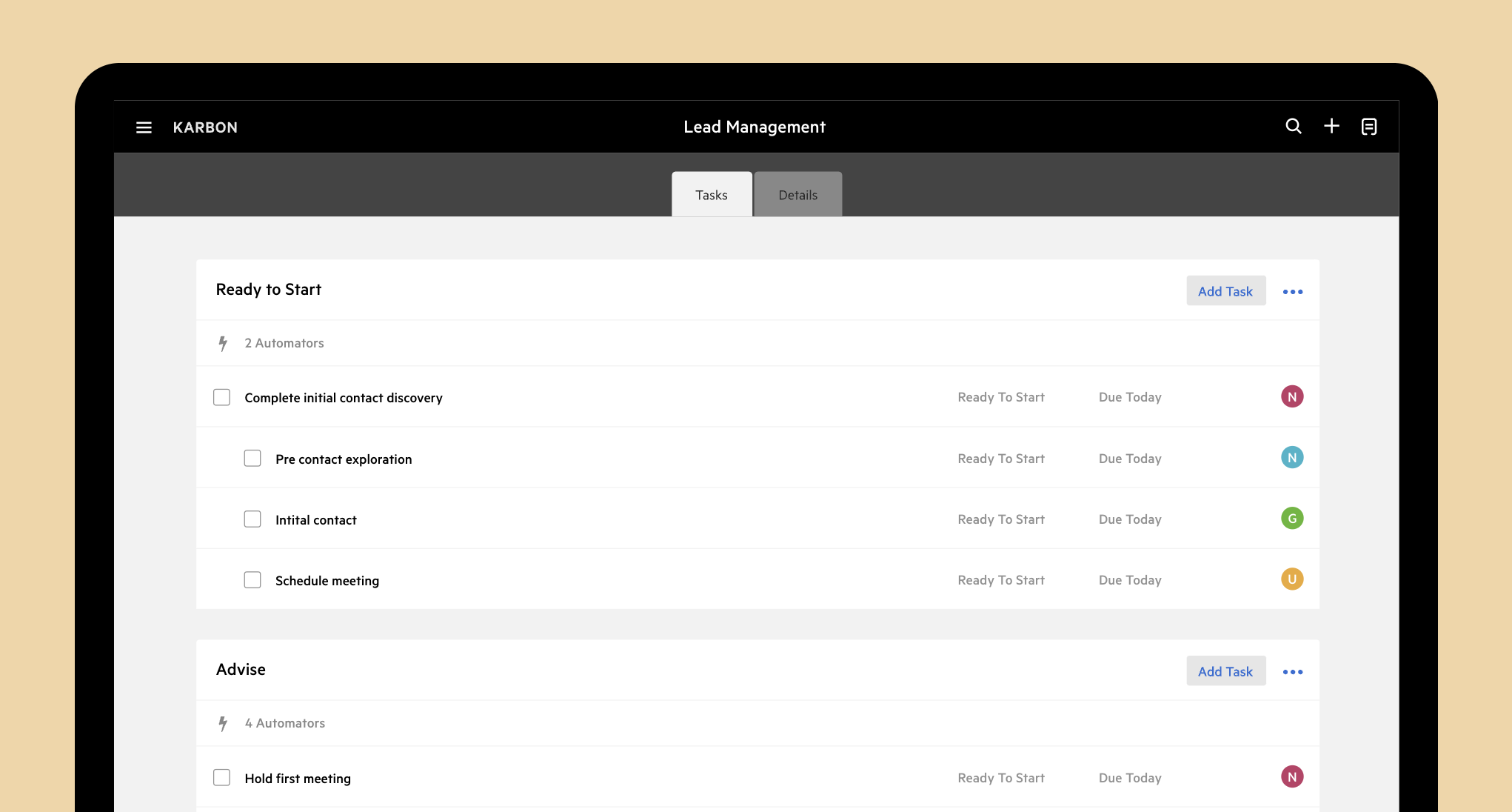

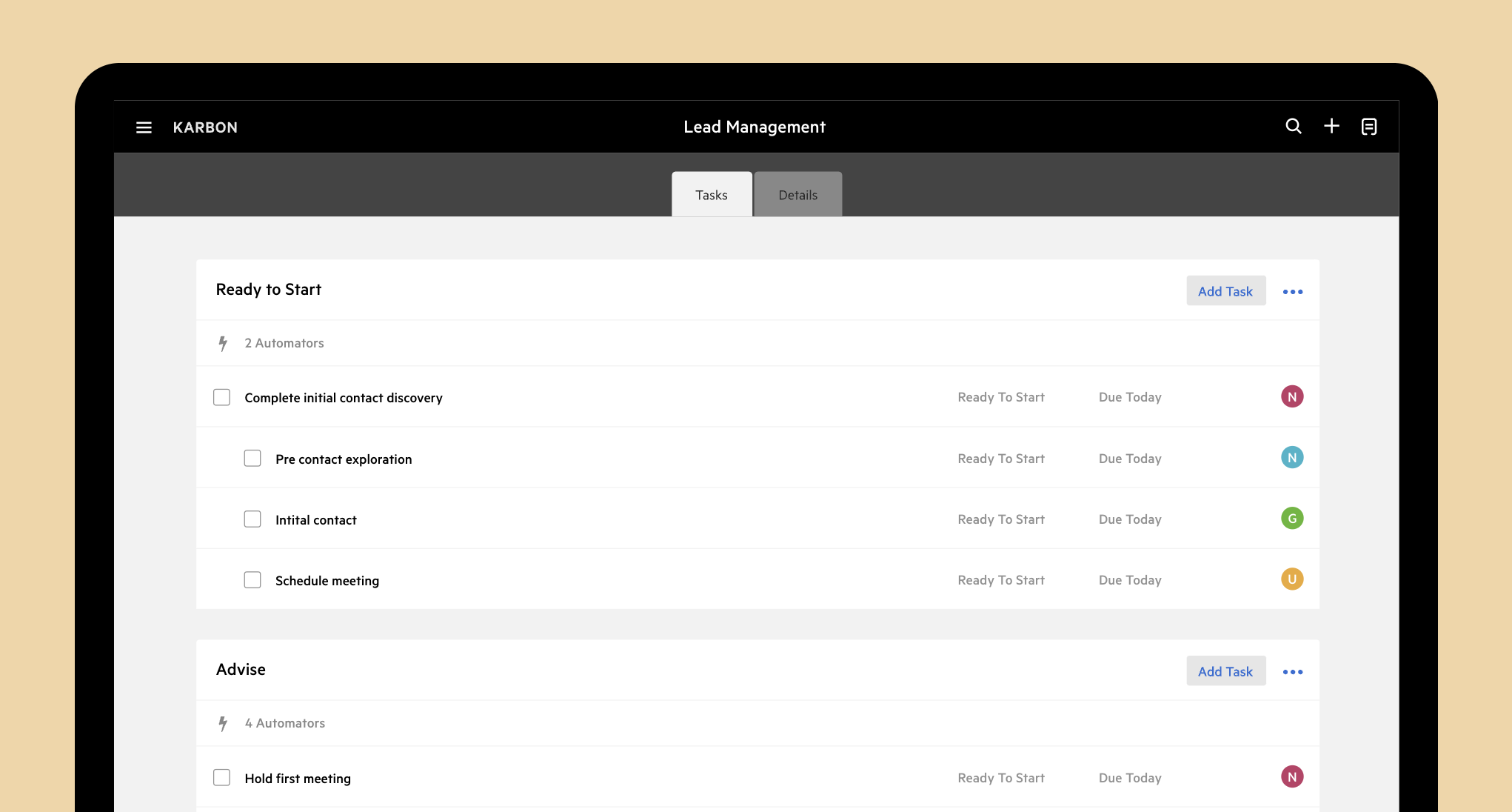

Karbon’s Lead Management Template, created by UK firm Ask The Boss, is designed to maximize your lead-to-client conversion.

A well-planned process to manage your prospective clients is the best way to maximize the conversions of leads and turning them into clients

Some steps in this process are specific to UK accounting requirements, and the systems used at BOSS. However, this is a great example of a detailed and effective onboarding process that involves several team members. It's a perfect foundation that your firm can adapt to suit your own systems and local regulations.

Download the Lead Management template.

How to retain clients to maximize revenue

Mission accomplished: you’ve reached leads, nurtured them through the sales funnel and signed them to your firm. The next step is one that will come more naturally, but is equally important: retaining clients.

There are some key metrics you can track to calculate your firm's return on investment, with one of the most important being LTV (lifetime value of a client).

Retaining your clients and extending their LTV is crucial in securing the revenue you’ve worked hard to acquire.

4 strategies for retaining your clients and extending their LTV

1. Keep communicating (even when there isn’t much to say)

Communicate clearly, early, often, and in the right places. You’ll ease client anxiety, strengthen client relationships, and create avenues to upsell.

2. Ask them if they’re happy

Happy clients are much more likely to stay with your practice long-term, and they’re also likely to provide you with referrals—one of your best methods of client acquisition.

This makes knowing how happy they are pivotal for retaining them and gaining new clients. Measuring their satisfaction with NPS will help you understand how likely they are to churn or refer.

3. Collect detailed and regular feedback

You need to understand how you’re performing, and the best way to do that is by asking your clients. Consider creating an annual client survey that asks for feedback across several key areas of your firm, such as:

Your client service

The quality of work you provide

Your communication methods and frequency

How happy they are with their business performance and outcomes

4. Use accounting software to streamline and automate

By using accounting technology that automates and streamlines your workflow and communication, you’ll have more time to focus on retaining current clients and attracting new ones.

Consider an accounting practice management tool with workflow automation, client management features, work templates, business analytics, and robust integrations.

Book a demo or a free trial with Karbon and see how you can save 16.5 hours per employee every week.

Referrals are (still) the best way to grow your firm

Referrals are a huge part of modern client acquisition strategy. And like always, it circles back to trust. Clients trust those who stand to gain nothing from the sale—their peers or friends. So don’t be afraid to ask for referrals or testimonials.

According to a study by Texas Tech University, 83% of clients are willing to refer after a positive experience, but only 29% actually do. This is mostly due to people being hesitant in asking for them.

Implementing a clear referral strategy can result in exciting growth in the future.

Complement that with a solid online presence, networking efforts within your niche, and genuinely useful content, and you’ll set yourself up to attract high-quality clients to your accounting firm.

And the sooner you get serious and strategize about client conversion and retention, the sooner you’ll see meaningful growth across your client base and your bottom line.